The Bandhan Nifty 500 Value 50 Index Fund NFO is a great choice for those looking to invest in undervalued stocks with strong growth potential. This fund follows the Nifty 500 Value 50 Index, which selects 50 companies from the Nifty 500 that are priced lower compared to their actual worth.

This strategy has been successful over the years, with value stocks often outperforming other types of stocks in the long run.

For example, over the past decade, value-based investing has shown better returns during periods of market recovery.

As of recent data, value stocks have grown by around 12-15% annually, depending on market conditions. This makes value investing a smart option for investors seeking steady long-term growth.

Let’s dive into the details of Bandhan Nifty 500 Value 50 Index Fund NFO and explore how it aligns with your investment goals.

Overview of Bandhan Nifty 500 Value 50 Index Fund

The Bandhan Nifty 500 Value 50 Index Fund is designed for investors seeking long-term wealth creation through investments in equity and equity-related instruments of companies in the Nifty 500 Value 50 Index. This fund follows a passive investment approach, replicating the index to its exact weightage.

The emphasis on value stocks offers a strategic edge for those looking for undervalued companies with high growth potential.

Why Invest in Bandhan Nifty 500 Value 50 Index Fund?

The investment objective of Bandhan Nifty 500 Value 50 Index Fund is simple: to replicate the Nifty 500 Value 50 Index by investing in its securities in the same proportion and weightage. The goal is to provide returns before expenses that align with the total return of the Nifty 500 Value 50 Index, subject to tracking errors.

However, like all investments, there is no guarantee of achieving the investment objective or assured returns.

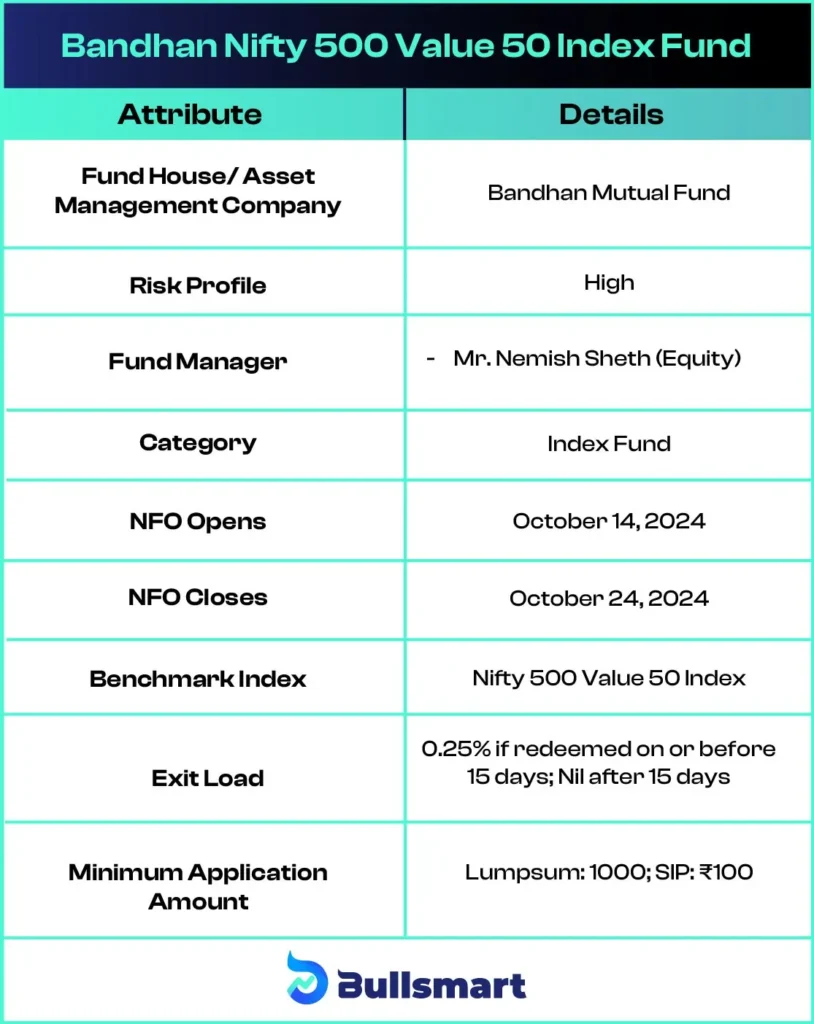

Key Details of Bandhan Nifty 500 Value 50 Index Fund NFO:

Portfolio Analysis

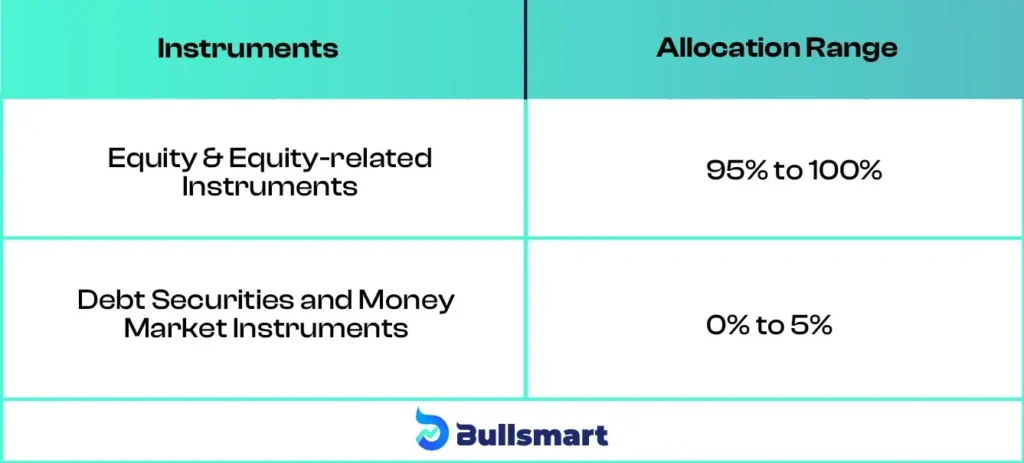

The portfolio of the Bandhan Nifty 500 Value 50 Index Fund NFO will largely reflect the constituents of the Nifty 500 Value 50 Index. The fund invests in 50 high-value stocks selected based on factors such as low price-to-earnings ratio, low price-to-book ratio, and attractive dividend yield, ensuring a focus on value-driven companies.

The table below highlights the general allocation:

This allocation strategy aims to deliver market-like returns in the long term, with the added benefit of value-based stock selection.

Risks and Returns of Bandhan Nifty 500 Value 50 Index Fund

As an index fund, the Bandhan Nifty 500 Value 50 Index Fund comes with a high-risk profile, making it suitable for investors with a higher risk tolerance and a long-term investment horizon. Value investing can sometimes underperform growth stocks in the short term, but it has historically rewarded patient investors with significant returns over time.

It follows the Nifty 500 Value 50 Index as its benchmark, which has delivered returns of 69.80%, 35.99%, and 37.46% in the past 1 year, 3 years, and 5 years respectively.

Investors should be mindful of tracking errors, which can impact returns, though these are generally minimised through the fund’s strategy of mirroring the Nifty 500 Value 50 Index.

Bandhan Asset Management

Founded in 2000, Bandhan Mutual Fund has become one of the top 10 fund houses in India based on Assets Under Management (AUM). With a skilled investment team operating in over 60 cities, Bandhan Mutual Fund aims to help people grow their savings through effective investment strategies.

Originally known as IDFC Mutual Fund, under its parent company IDFC Ltd., it has played a key role in shaping India’s mutual fund industry. As of June 30, 2024, the company’s AUM stood at ₹148,741.98 crore.

Fund Managers

Bandhan Nifty 500 Value 50 Index Fund NFO will be managed by Mr. Nemish Sheth, who has extensive experience in equity management. At 37 years old, he serves as an Associate Vice President in Equity at Bandhan AMC, having joined the team in November 2021. With 12 years of experience, he manages various funds, including the Bandhan Nifty 100 Index Fund and the Bandhan Arbitrage Fund. Prior to this, he worked at Nippon Life India Asset Management and ICICI Prudential.

Who Should Invest in This Fund?

The Bandhan Nifty 500 Value 50 Index Fund is best suited for:

- Investors looking for long-term capital appreciation through value investing.

- Individuals who believe in the power of passive investing and want to mirror the returns of a specific index.

- Those who are comfortable with market volatility and can stay invested for a period of 5 years or more.

- Investors seeking exposure to undervalued companies with strong fundamentals.

Bandhan Nifty 500 Value 50 Index Fund offers an opportunity to benefit from the market’s best-value companies, making it a compelling choice for investors who prefer a hands-off, systematic approach to wealth creation.

In conclusion, the Bandhan Nifty 500 Value 50 Index Fund NFO provides a straightforward path for investors looking to leverage the growth potential of value-driven stocks. By tracking the Nifty 500 Value 50 Index, the fund ensures that investors can access a diversified portfolio of well-chosen companies with strong value metrics.

Suggested Read – Bandhan Nifty 500 Momentum 50 Index Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.