Achieving substantial returns from mutual funds requires careful planning, perseverance, and time. One such strategy is the 15:15:15 rule in Mutual Fund, which promises to turn you into a “Crorepati” in 15 years.

But how does this strategy work? Let’s break it down and explore the benefits.

What Is the 15x15x15 Rule in Mutual Fund?

The 15:15:15 rule in Mutual Fund refers to:

- Investment: Invest INR 15,000 every month.

- Tenure: Continue investing for 15 years.

- Returns: Assume an annual return rate of 15%.

By the end of this 15-year period, your investment of INR 27 lakh (15,000 x 12 months x 15 years) could grow into a corpus of INR 1,00,26,601/- through the power of compounding.

Understanding Compounding Interest

The 15:15:15 rule in Mutual Fund works because of compounding—a process where you earn interest on both your principal and previous interest. Over time, this snowball effect turns small investments into a large corpus. To maximize compounding, it’s best to start investing early and be consistent with your monthly contributions.

Example of Compounding

Let’s say you invest ₹10,000 in a mutual fund that offers an annual return of 10%. Here’s how your money grows through compounding:

- Year 1: ₹10,000 grows by 10%, giving you returns of ₹1,000. Now you have ₹11,000.

- Year 2: The ₹11,000 grows by 10%, giving you returns of ₹1,100. Now you have ₹12,100.

- Year 3: The ₹12,100 grows by 10%, giving you returns of ₹1,210. Now you have ₹13,310.

How does the 15:15:15 rule in Mutual Fund works?

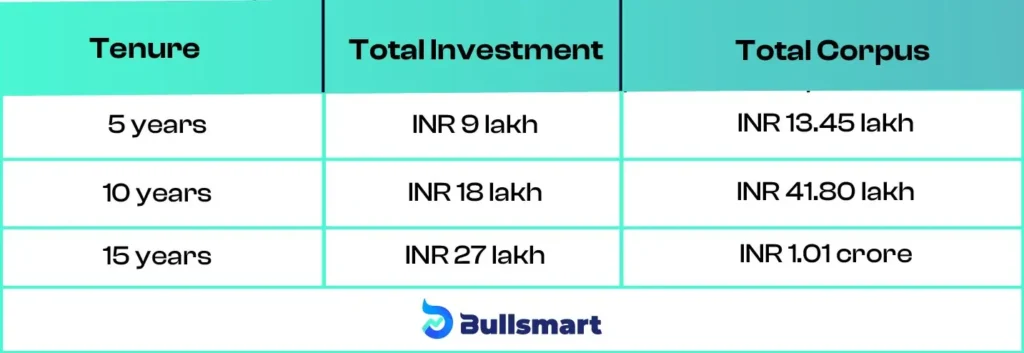

Let’s say you invest INR 15,000 monthly at an annual return of 15%. Here’s how your investment could grow:

With only INR 27 lakh invested over 15 years, you could accumulate over INR 1 crore. But, if you extend your investment to 20 years, your corpus could grow to INR 2.28 crore!

Advantages of the 15x15x15 Rule

- Disciplined Investing: This strategy promotes a systematic approach to wealth creation, encouraging you to invest regularly without reacting impulsively to market fluctuations.

- Clear Goals: With fixed amounts and returns, it helps set specific financial goals, making it easier to monitor your progress.

- Power of Compounding: Consistent investment and reinvestment over 15 years allows you to benefit from compounding, helping you achieve significant growth.

- Long-Term Perspective: By focusing on the long-term, you avoid the temptation to make decisions based on short-term market movements.

Tips for Success with the 15:15:15 Rule in Mutual Fund

- The earlier you begin, the more time compounding works in your favor.

- Reduce risk by investing in a mix of mutual funds.

- Stick to your monthly investments, even during market downturns.

- Periodically rebalance your portfolio to align with your goals.

- Stay invested in the long term to reap the full benefits.

Conclusion

The 15:15:15 rule in Mutual Fund offers a simple yet effective way to build a substantial corpus over 15 years through disciplined investing. While this strategy is not without risks, particularly in the equity markets, it highlights the importance of patience and the power of compounding in wealth creation.

If you’re unsure about how to implement this strategy, it’s advisable to consult a financial advisor who can tailor it to your specific goals and circumstances.

Suggested Read – The 8-4-3 Rule of Compounding in Mutual Funds SIP

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.