Investing can often feel overwhelming, especially for those new to financial markets. However, the 8-4-3 Rule of Compounding offers a simplified approach that demonstrates how compounding can significantly grow your investments over time. By sticking to this rule, investors can see their wealth multiply in phases while staying on track for long-term success.

In this blog, we’ll break down the 8-4-3 rule of compunding, explain how it works, show you an example, and discuss ways to maximise your returns.

The Power of Compounding

Compounding is the backbone of wealth generation in long-term investments. Often referred to as the “eighth wonder of the world,” compounding means earning returns on both your initial investment and the returns it generates. Over time, this snowball effect can exponentially grow your wealth, especially if you reinvest your earnings.

For example, let’s say you invest ₹20,000 annually at a 10% interest rate. In the first year, you earn ₹2,000. The next year, your returns will be calculated on ₹22,000, and the pattern continues. The more time your investment has to grow, the more powerful compounding becomes.

What is the 8-4-3 Rule of Compounding?

The 8-4-3 rule of compounding is a simplified way of understanding how consistent investing and the power of compounding can accelerate growth. It breaks down investment growth into three phases:

- Initial Growth (Years 1-8): The first eight years see steady growth in the investment with an average return of around 12% annually.

- Accelerated Growth (Years 9-12): Over the next four years, the investment grows at a faster rate, often doubling the value from the first eight years.

- Exponential Growth (Years 13-15): In the final three years, the investment doubles again, thanks to the full power of compounding, which is most effective in the later years.

Example of the 8-4-3 Rule of Compounding

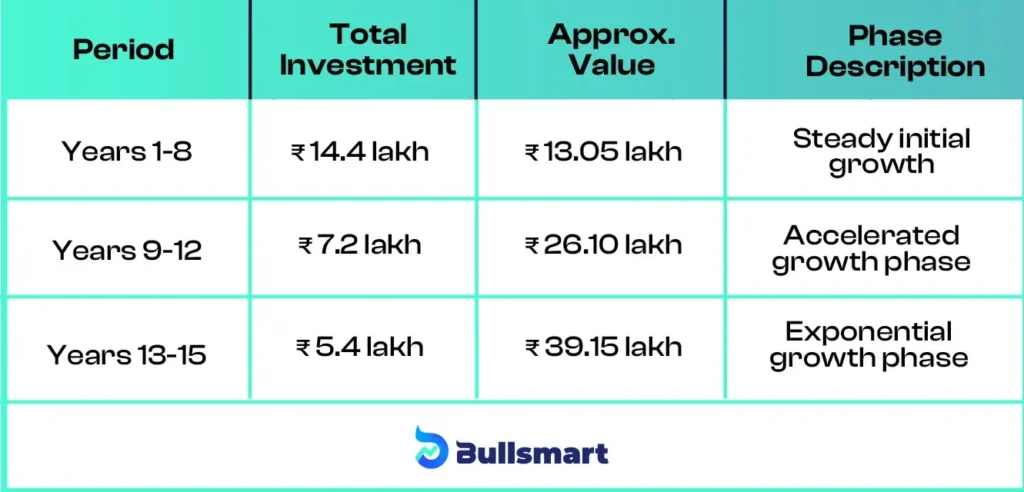

Let’s look at how the 8-4-3 Rule of Compounding works with an example of a Systematic Investment Plan (SIP) in a Mutual Fund.

- Monthly Investment: ₹15,000

- Investment Period: 15 years

- Assumed Annual Return: 12%

Investment Growth Breakdown

By the end of 15 years, the total value of your investment would be around ₹39.15 lakh, showing how the compounding effect amplifies returns over time.

Benefits of the 8-4-3 Rule of Compounding

- Long-Term Discipline: This rule encourages investors to stick to a long-term plan, helping them stay committed despite short-term market fluctuations.

- Protection Against Inflation: The average return of 12% helps investments outpace inflation, ensuring that the purchasing power of your money is preserved over time.

- Dynamic Growth: The 8-4-3 rule ensures that as time passes, compounding accelerates, leading to faster growth in the later years of your investment journey.

How to Maximize Your Returns

To fully leverage the 8-4-3 Rule of Compounding and the power of compounding, consider the following strategies:

- Start Early: The earlier you start, the more time compounding has to work its magic. Even small contributions early on can lead to substantial growth in the long run.

- Diversify: Spread your investments across different asset classes like equity, debt, and gold to minimise risk and maximise potential returns.

- Increase Contributions: As your income rises, increase your investment amounts. This will amplify the compounding effect and accelerate your wealth growth.

- Stay Invested: The key to compounding is time. Stay invested for at least 10 years or more to see the full impact of compounding.

- Reinvest Returns: Avoid withdrawing your returns or dividends. Instead, reinvest them to continue benefiting from the compounding effect.

Conclusion

The 8-4-3 rule of compounding provides a clear roadmap for long-term investment success. By following a disciplined investment plan and harnessing the power of compounding, you can turn small, regular investments into significant wealth over time with Best SIP Platform.

Start today, and let the magic of compounding work for you!

Suggested Read – Why Mutual Funds are going down?

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.