With the growing dominance of technology in our daily lives, the digital revolution is reshaping industries across the globe. India is witnessing rapid digitization, creating vast opportunities in technology, telecom, media, entertainment, and related sectors.

For investors looking to tap into this digital wave, the Motilal Oswal Digital India Fund NFO offers an exciting new investment avenue.

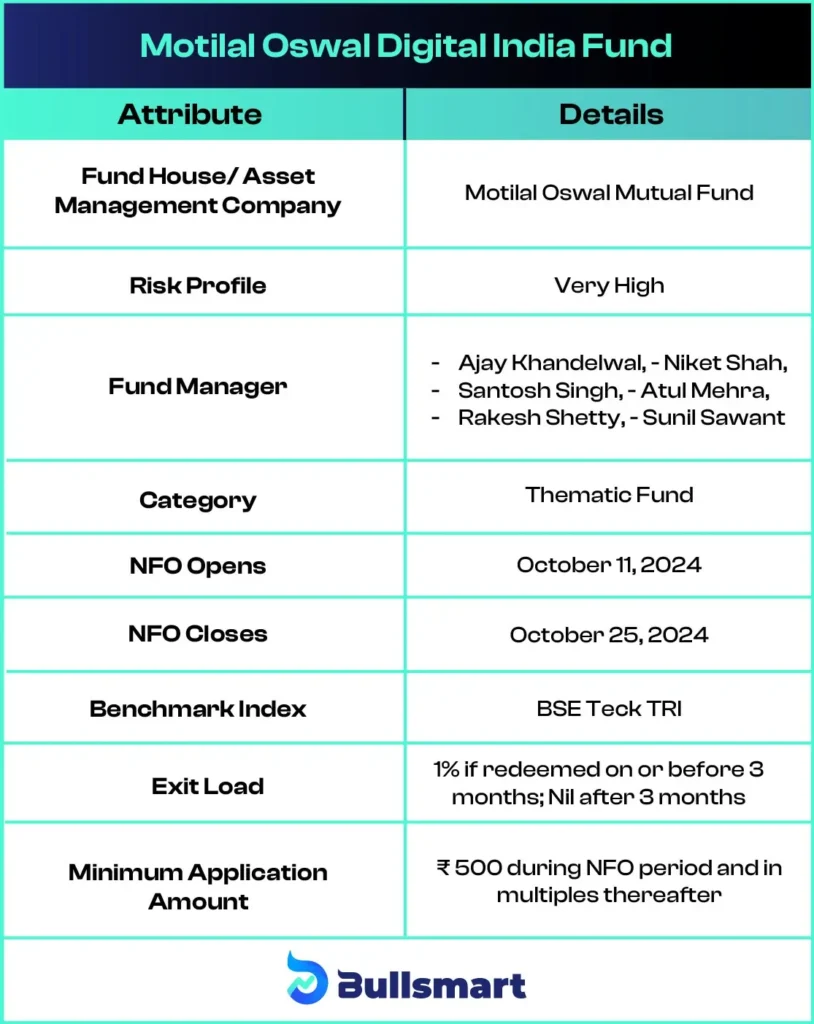

The NFO (New Fund Offer) opens on October 11, 2024, and closes on October 25, 2024.

Motilal Oswal Digital India Fund NFO a thematic fund focuses on companies driving digitization in sectors such as technology, telecom, media, entertainment, e-commerce, and more. The fund aims to deliver long-term capital growth by investing in businesses benefiting from digital transformation.

Let’s explore the details of this fund and explore why it might be a good addition to your portfolio.

Invest in Motilal Oswal Digital India Fund NFO

The Motilal Oswal Digital India Fund is an open-ended equity scheme that invests in companies across sectors benefiting from the digital economy. The fund focuses on technology-driven companies, including those engaged in hardware, software, telecom, media, e-commerce, and other related industries.

Investment Strategy of Motilal Oswal Digital India Fund

The primary objective of this scheme is to generate long-term capital growth by predominantly investing in companies leveraging digitisation across various sectors. This includes companies engaged in technology, telecom, media, entertainment, and internet-based services.

Key Details of the Fund

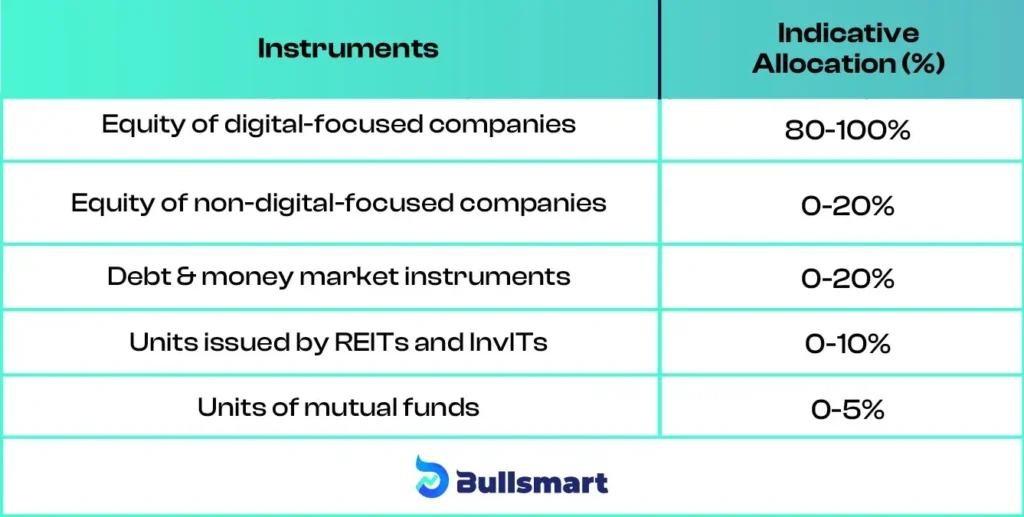

Asset Allocation Strategy of Motilal Oswal Digital India Fund NFO

The Motilal Oswal Digital India Fund will invest predominantly in equity and equity-related instruments of companies that are driving or benefiting from digitization.

This includes sectors like technology, telecom, media, entertainment, and e-commerce. A minor portion of the portfolio may be allocated to debt and money market instruments to manage liquidity.

Balancing Risk and Return Strategy

The Motilal Oswal Digital India Fund NFO carries a very high-risk profile, as it primarily invests in companies linked to the digital sector, which can be volatile but offer high-growth potential.

Motilal Oswal Digital India Fund’s benchmark, BSE Teck TRI, reflects the performance of companies in the technology and telecom sectors, providing an ideal comparison for investors.

It has delivered returns of 32.2%, 7.8%, and 21.6% in the last 1-year, 3-year, and 5-year.

As the fund tracks the BSE Teck TRI index, its goal is to match or exceed the returns of this benchmark, which has historically performed well in the technology sector.

While the fund aims to generate significant long-term growth, investors should be prepared for short-term market fluctuations. This fund is suitable for those with a high-risk appetite and an investment horizon of 3-5 years or more.

Asset Management Company

Motilal Oswal Asset Management Company (MOAMC) is a portfolio manager registered with SEBI and operates the Motilal Oswal Mutual Fund (MOMF). It is backed by Motilal Oswal Financial Services Limited (MOFSL), which is listed on the BSE and NSE. MOAMC received its SEBI registration in 2009.

Besides managing assets, MOAMC provides advisory services for offshore funds, including portfolio management, business consulting, and research.

As of June 30, 2024, Motilal Oswal Mutual Fund manages over ₹66,452.27 crore in assets and offers more than 40 Mutual Funds scheme.

Fund Management Team Insights

The fund is managed by experienced fund managers:

Ajay Khandelwal

Ajay Khandelwal, 44, has 13 years of experience in fund management and research. He manages funds such as the Motilal Oswal Small Cap Fund and the Motilal Oswal Large Cap Fund, having previously worked at Canara Robeco Asset Management.

Niket Shah

Niket Shah, 37, also has 13 years of experience in the financial sector. He manages several funds, including the Motilal Oswal Midcap Fund and the Motilal Oswal Flexi Cap Fund, and has held various roles in research at Motilal Oswal and other firms.

Santosh Singh

Santosh Singh, 44, has over 15 years of experience in finance. He oversees the Motilal Oswal Balanced Advantage Fund and the Motilal Oswal Focused Fund, having previously led research at Haitong International Securities.

Atul Mehra

Atul Mehra, 35, brings over 15 years of experience and is currently a Senior Vice President at Motilal Oswal. He manages the Motilal Oswal Large Cap Fund and the Motilal Oswal Multi Cap Fund, having worked as a research analyst at Edelweiss Capital.

Rakesh Shetty

Rakesh Shetty, 42, has more than 14 years of experience in trading and fund management. He manages the Motilal Oswal Ultra Short Term Fund and the Motilal Oswal Liquid Fund, with a background in managing equity and debt ETFs.

Sunil Sawant

Sunil Sawant, 37, holds a Master’s in Commerce and has been with Motilal Oswal since 2018. He manages the Motilal Oswal S&P 500 Index Fund and the Motilal Oswal Multi Asset Fund, bringing extensive experience from previous roles at Sharekhan and Aditya Birla.

Suggested Read – Motilal Oswal Manufacturing Fund NFO Review

Why Invest in the Motilal Oswal Digital India NFO?

- Motilal Oswal Digital India Fund NFO allows investors to participate in India’s ongoing digital transformation, which is reshaping the economy across various sectors.

- The fund provides exposure to multiple industries benefiting from digitization, including technology, telecom, media, entertainment, and e-commerce.

- The digital sector is expected to experience robust growth over the next decade, offering significant opportunities for capital appreciation.

- The fund is managed by seasoned professionals with extensive experience in equity fund management, ensuring sound investment decisions.

The Motilal Oswal Digital India Fund is an ideal investment option for those looking to tap into India’s fast-growing digital economy.

With exposure to various sectors benefiting from the digital transformation, this fund offers long-term growth potential for investors with a high-risk appetite. Consider adding this thematic fund to your portfolio for diversified exposure to the technology-driven future. Invest now with the Best SIP platform in India.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.