Large and midcap mutual funds provide exposure to both established large-cap companies and high-growth midcap companies, offering investors a balanced blend of stability and growth.

One such fund that aims to replicate this index is the Mirae Asset Nifty LargeMidcap 250 Index Fund, which is currently in its NFO (New Fund Offer) period.

In the past three years and even the last year (as of April 12, 2024), less than half of actively managed schemes have been able to outperform the Nifty LargeMidcap 250 Index (NLM). This index has a unique structure that’s designed to generate solid long-term returns.

It gives equal weight to both large-cap and midcap stocks, which means it provides a good balance between stability and growth. The top 100 large-cap stocks make up 50% of the index, while the other 50% is made up of 150 midcap stocks.

This balanced approach ensures that the index truly represents both large-cap and mid-cap segments of the market. The index is rebalanced every quarter to stay up to date with the market.

Let’s take a closer look at how this fund works and why it could be a good addition to your investment portfolio.

Investment Insights Mirae Asset Nifty LargeMidcap 250 Index Fund

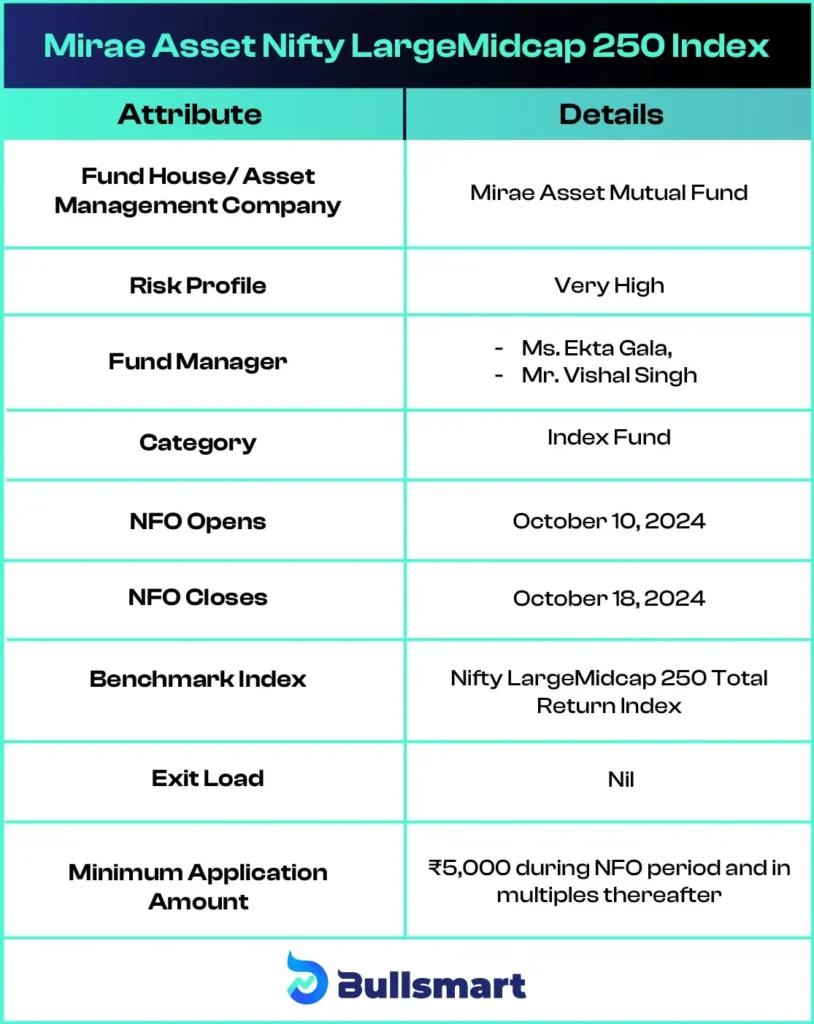

The Mirae Asset Nifty LargeMidcap 250 Index Fund NFO is an open-ended equity index fund designed to replicate or track the performance of the Nifty LargeMidcap 250 Total Return Index.

By doing so, the fund provides diversified exposure to large-cap and midcap companies, balancing stability with growth opportunities. Mirae Asset Nifty LargeMidcap 250 Index Fund NFO will invest primarily in equity securities covered by the index, with a small portion reserved for liquidity.

Fund’s Investment Objective and Strategy

The primary objective of the Mirae Asset Nifty LargeMidcap 250 Index Fund NFO is to generate returns, before expenses, that align with the performance of the Nifty LargeMidcap 250 Total Return Index, subject to tracking error. However, there is no guarantee that the objective will be achieved.

Here are the key details of the fund:

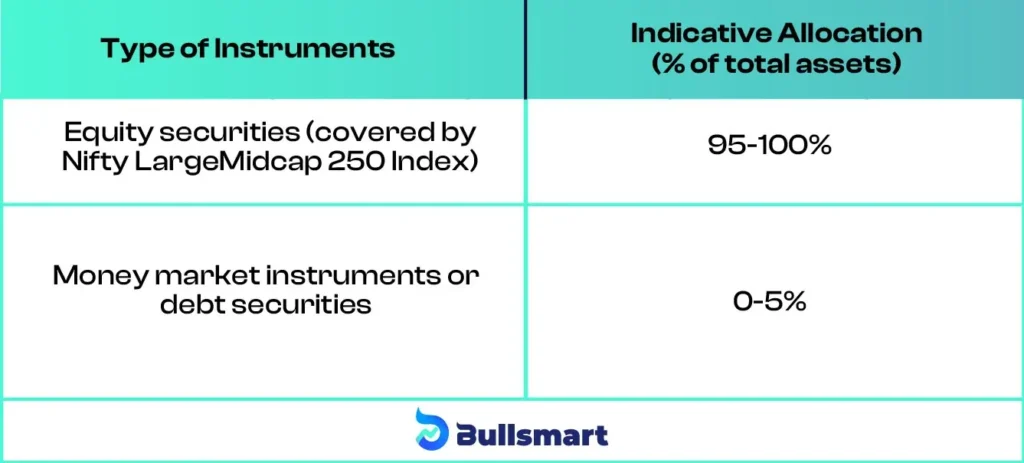

Detailed Portfolio Allocation of the Fund

The Mirae Asset Nifty LargeMidcap 250 Index Fund is structured to invest primarily in equity securities that are part of the Nifty LargeMidcap 250 Total Return Index. This approach ensures exposure to both large-cap and midcap companies, offering a balance of stability and growth in the portfolio.

A minor portion of the portfolio will be allocated to money market instruments or debt securities to manage liquidity and short-term market fluctuations.

This allocation ensures that the fund stays true to its objective of tracking the Nifty LargeMidcap 250 Total Return Index, while maintaining some flexibility to navigate short-term market changes.

How the Fund Balances Risk and Returns?

The Mirae Asset Nifty LargeMidcap 250 Index Fund is designed for investors with a very high-risk tolerance, as it primarily invests in large-cap and midcap stocks. While large-cap stocks provide stability, midcap stocks offer high-growth potential, which makes the fund suitable for investors seeking a mix of both.

The Nifty LargeMidcap 250 Total Return Index, which the fund tracks, has delivered returns of 39.64%, 18.83%, and 25.54% in the past 1 year, 3 years, and 5 years respectively.

While the goal is to replicate the index’s performance, there may be tracking errors that could lead to slight deviations in returns.

Investors should be prepared for potential short-term market fluctuations and volatility, but the fund aims to generate long-term growth. It is ideal for those with an investment horizon of 3-5 years or more, who are comfortable with market ups and downs.

Overview of the Mirae Asset Mutual Fund AMC

The AMC began in 1997 during the Asian financial crisis, initially focusing on Korea. It expanded internationally with a Hong Kong office in 2003 and now operates in countries like India, Australia, and the USA.

In 1998, Mirae Asset Mutual Fund became the first asset management company to offer mutual funds to retail investors in Korea. It launched the Mirae Asset Retirement Pension Fund in 2005 and entered the Indian market in 2007.

Mirae Asset Global Investments (India) Pvt. Ltd. was established in 2007, becoming one of India’s fastest-growing Mutual Fund companies with 54 schemes. As of June 30, 2024, its Assets Under Management (AUM) reached INR ₹1,87,899 Cr.

Meet the Experienced Fund Managers

Mirae Asset Nifty LargeMidcap 250 Index Fund is managed by experienced fund managers:

Ms. Ekta Gala

Ms Ekta Gala, 31, has over 6 years of experience as a dealer, previously working with ICICI Prudential Asset Management Company Ltd. She currently manages several schemes, including the Mirae Asset Nifty 100 ESG Sector Leaders Fund of Fund and the Mirae Asset NYSE FANG+ ETF Fund of Fund.

Mr. Vishal Singh

Mr. Vishal Singh, 30, brings over 5 years of experience in financial services, having previously worked with NSE Indices Limited. He oversees various schemes, including the Mirae Asset Nifty India Manufacturing ETF Fund of Fund and the Mirae Asset S&P 500 Top 50 ETF Fund of Fund.

Who Should Invest in This NFO?

The Mirae Asset Nifty LargeMidcap 250 Index Fund is ideal for:

- Investors seeking long-term capital growth through a blend of large-cap and midcap stocks.

- Individuals with an investment horizon of at least 3-5 years.

- Investors looking for passive investment opportunities that track a reliable market index.

- Those comfortable with high market volatility in the short term but aiming for steady returns over the long term.

Mirae Asset Nifty LargeMidcap 250 Index Fund NFO is a suitable option for building a core equity portfolio that benefits from both the stability of large-cap stocks and the high-growth potential of midcap stocks.

By investing in the Mirae Asset Nifty LargeMidcap 250 Index Fund, investors can take advantage of a diversified portfolio that tracks a well-established index, offering balanced exposure to India’s leading large and midcap companies.

Suggested Read – Mirae Large and Midcap Fund Review

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.