The ongoing economic situation in the China equity market has had a significant impact on Indian markets and investors, with ripple effects seen across both stock markets and investment strategies. China’s recent stimulus measures, though initially promising, have started to lose momentum as traders reassess the government’s commitment to long-term economic support.

This development has created both opportunities and challenges for investors, particularly those focused on emerging markets like India.

China’s Economic Slowdown and Its Impact on Indian Markets

The China equity market surged in early October following the government’s announcement of stimulus plans aimed at boosting consumption and stabilizing the real estate and equity markets. However, this rally fizzled as traders began to question whether Beijing would implement the necessary fiscal policies to sustain this momentum.

While some investors have increased their exposure to Chinese equities, others remain sceptical, waiting for more concrete actions from the Chinese government.

The result of this uncertainty has been a noticeable shift in investment patterns. For example, foreign institutional investors (FIIs) withdrew over Rs 40,500 crore from Indian stocks last week, contributing to a 4.5% decline in the Nifty index.

A significant portion of this liquidity has moved to Chinese markets, where valuations appear more attractive after a period of underperformance.

Comparison of India and China Equity Market

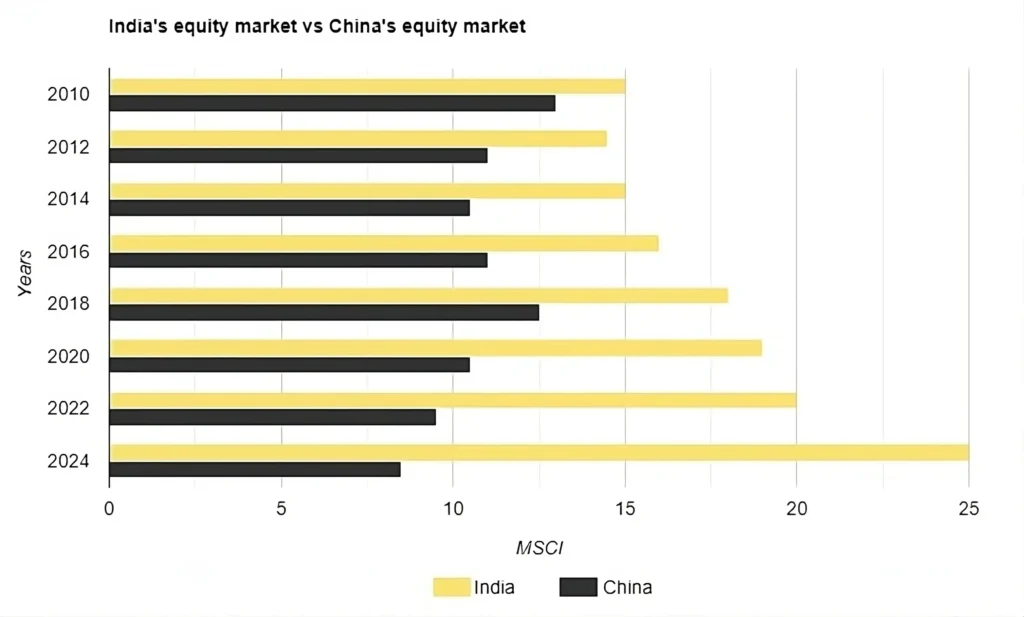

Investments in India and China Equity Market have grown significantly over the years, making both countries attractive to global investors.

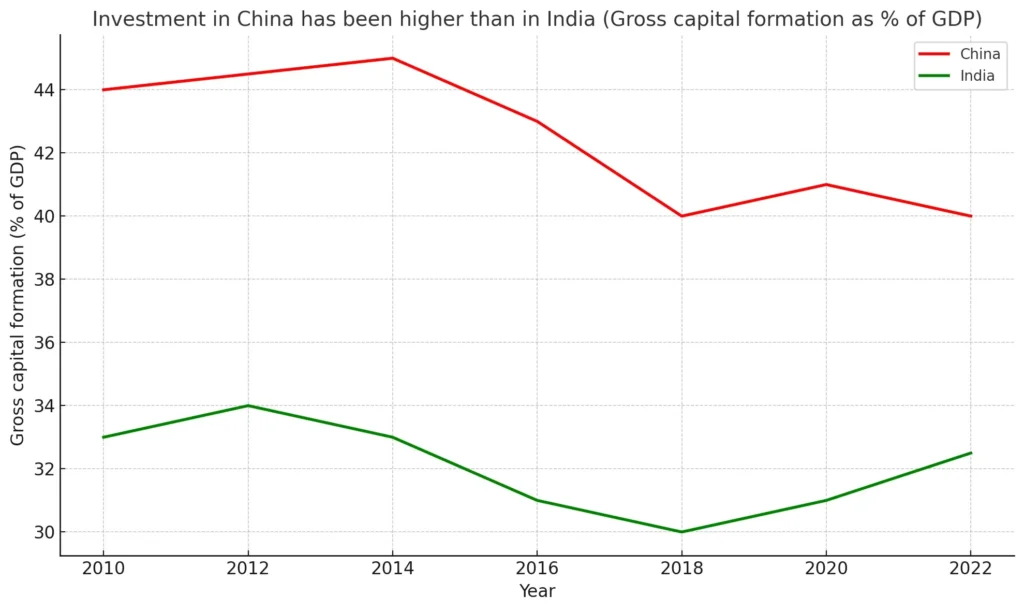

Historically, India’s stock market has outperformed China’s, despite the latter’s larger economy. Since the global financial crisis of 2008, Indian stocks have consistently delivered better returns than their Chinese counterparts, with Indian equities growing four times faster than Chinese ones over the past decade.

This is largely due to China’s over-reliance on stimulus and investment-driven growth, which has led to inefficiencies and excess capacity across industries.

In contrast, India has maintained a more disciplined approach to capital allocation, resulting in higher returns on investment.

Here’s a brief comparison for you:

However, the resurgence of China’s market has drawn investor attention back to its potential, particularly in sectors like technology, electric vehicles, and real estate. The renewed interest in China is starting to divert funds away from Indian markets, posing a challenge to Indian investors and companies.

Key Concerns for Indian Investors

For Indian investors, the situation in China presents both risks and opportunities. The liquidity shift towards Chinese markets could lead to short-term volatility in Indian equities.

Moreover, rising oil prices, the surge in new IPOs, and the appetite of retail investors in India have contributed to concerns about overstretched valuations in the Indian market.

Nevertheless, India’s long-term growth story remains strong. Global investors continue to see India as the most scalable emerging market, offering opportunities for sustained growth.

While China’s economic recovery has garnered attention, many experts caution against short-term trading in the China equity market due to volatility.

What Should Indian Investors Do?

For Indian investors, it is important to maintain a balanced and diversified portfolio. While the China equity market may offer attractive valuations and growth potential, India’s stable economic fundamentals and disciplined capital management still provide a compelling investment case.

Investors may consider exposure to both markets through Mutual Funds and ETFs to capitalize on growth opportunities while mitigating risks.

The economic situation in China will continue to influence global markets, including India’s, but strategic diversification and long-term thinking will help investors go through these volatile times.

Suggested Read – SEBI approved Jio Financial Services and Blackrock collaboration

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.