With market trends shifting rapidly, investors are constantly on the lookout for funds that can capture both quality and momentum in the stock market. The Edelweiss Nifty500 Multicap Momentum Quality 50 ETF NFO aims to provide a diversified and systematic way to invest in companies that exhibit high-quality and momentum characteristics across different market capitalizations.

The Nifty500 Multicap Momentum Quality 50 Index is designed to include stocks that not only show strong price momentum but are also selected based on high-quality metrics, ensuring a balance of growth potential and financial stability.

Let’s explore if this NFO aligns with your long-term investment strategy.

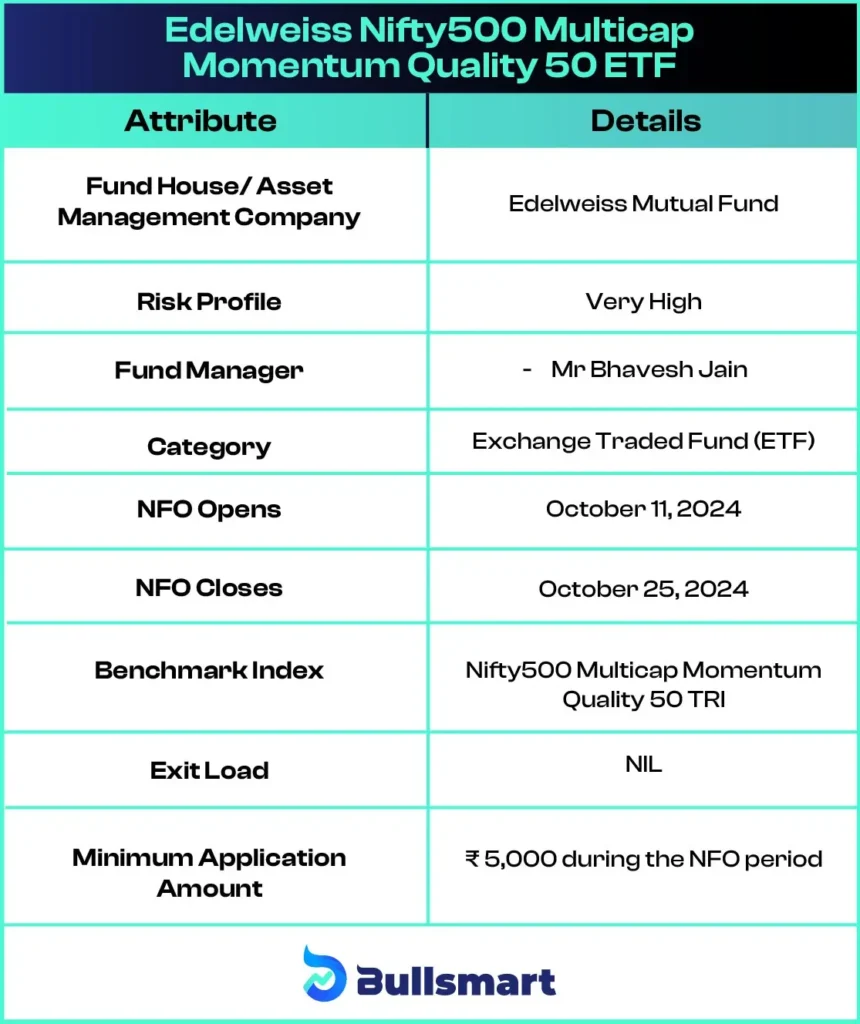

Edelweiss Nifty500 Multicap Momentum Quality 50 ETF NFO Overview

The Edelweiss Nifty500 Multicap Momentum Quality 50 ETF is an open-ended exchange-traded fund (ETF) that seeks to replicate the performance of the Nifty500 Multicap Momentum Quality 50 Total Return Index. This index tracks 50 stocks from the Nifty 500 universe, focusing on stocks with strong momentum and quality factors across large-cap, mid-cap, and small-cap segments.

Investment Focus of Multicap Quality Fund

Edelweiss Nifty500 Multicap Momentum Quality 50 ETF NFO investment objective is to generate returns in line with the performance of the Nifty500 Multicap Momentum Quality 50 Total Return Index, subject to tracking errors. While there is no guarantee of returns, the fund seeks to mirror the returns of this unique index by investing in the same basket of stocks.

Here are the key details of the fund:

Portfolio Allocation

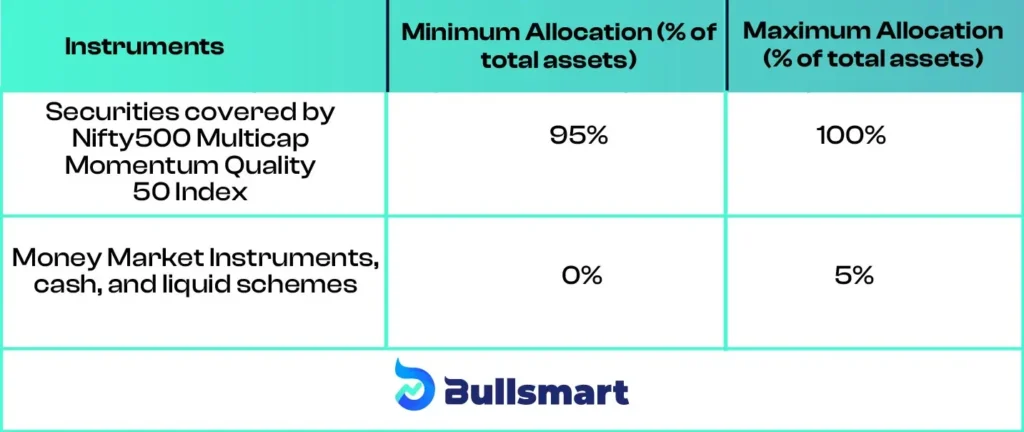

The asset allocation pattern for the Edelweiss Nifty500 Multicap Momentum Quality 50 ETF is structured to maintain a majority in stocks from the Nifty500 Multicap Momentum Quality 50 Index, with a minor portion allocated to cash and money market instruments for liquidity.

This allocation allows Edelweiss Nifty500 Multicap Momentum Quality 50 ETF NFO to closely track its benchmark while maintaining some liquidity to manage short-term requirements and tracking errors.

Investment Risk and Return Analysis

The Edelweiss Nifty500 Multicap Momentum Quality 50 ETF has a very high-risk profile, meaning it is subject to market volatility and price fluctuations due to its focus on momentum and quality stocks.

However, this strategy could lead to substantial gains when the market conditions favour momentum-driven stocks.

This ETF tracks the Nifty500 Multicap Momentum Quality 50 Index, which includes stocks from different market caps. The index leverages both momentum (stocks with strong price trends) and quality (stocks with strong financial metrics like low debt and high profitability), offering a balanced yet aggressive investment approach.

The Nifty500 Multicap Momentum Quality 50 Index has delivered results of 57.76%, 22.15%, and 30.66% in the past 1 year, 3 years, and 5 years respectively.

Since the index has demonstrated solid performance, the goal of this fund is to match or outperform its benchmark.

Edelweiss Mutual Fund

Edelweiss Mutual Fund, operated by Edelweiss Asset Management Limited, is one of the most innovative mutual fund houses in India. Established in 2009, it rapidly expanded by acquiring Forefront Capital, India’s first domestic hedge fund, in 2014.

The company continued its growth in 2016 with the acquisition of JP Morgan AMC’s India operations, significantly boosting its scale. In 2019, Edelweiss launched Bharat Bond, India’s first corporate bond ETF, as part of a government initiative.

In 2020, it became the first asset management company to introduce MSCI, a leading global index provider, to the Indian market. As of June 2024, Edelweiss Mutual Fund manages assets totaling around Rs 1,36,130.04 crores.

Fund Manager Strategies

The scheme is managed by Bhavesh Jain. Mr Bhavesh Jain is 38 years old and holds a Master’s in Management Studies (Finance) from Mumbai University. With over 16 years of experience in the equity market, he currently co-heads hybrid and solution funds at the AMC and manages schemes such as the Edelweiss Aggressive Hybrid Fund and the Edelweiss Equity Savings Fund.

Who Should Invest in This Fund?

The Edelweiss Nifty500 Multicap Momentum Quality 50 ETF is suitable for investors who:

- Are seeking long-term capital appreciation.

- Want to invest in a diversified portfolio of stocks with strong momentum and financial quality.

- Have a high-risk tolerance and are willing to endure market volatility for potentially high returns.

- Prefer a low-cost, passive investment strategy through an ETF.

If you believe in the long-term growth potential of momentum-driven stocks with solid fundamentals, this ETF could be a good fit for your portfolio. However, it is always advisable to consult with a financial advisor to ensure that this fund aligns with your investment goals and risk profile.

Suggested Read – HSBC Export Opportunities Fund NFO Review

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.