The proliferation of index funds has led to a substantial rise in the total Assets under Management (AUM) of these funds, across both equity and debt categories. The AUM of index funds has recorded a staggering 25x increase, from about ₹8,000 crore in March 2020 to ₹2,13,500 crore as of March 2024.

One such NFO is the Tata Nifty Capital Markets Index Fund, which aims to give investors exposure to the rapidly growing capital markets sector in India.

This significant growth underscores the growing popularity of index funds among investors seeking low-cost, passive investment strategies.

With the increasing demand, many index funds are being launched as new fund offers (NFOs), providing investors with more options to diversify their portfolios.

Let’s explore if Tata Nifty Capital Markets Index Fund NFO aligns with your investment goals.

Tata Nifty Capital Markets Index Fund Key Performance

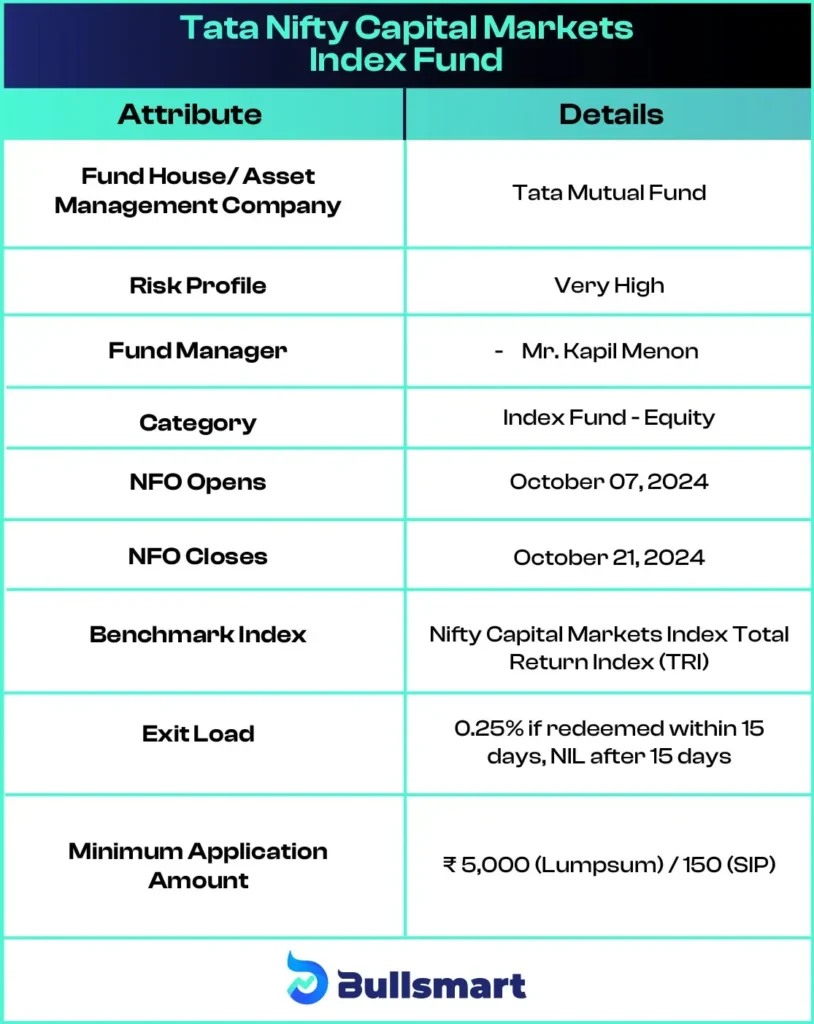

The Tata Nifty Capital Markets Index Fund NFO is an open-ended equity scheme that seeks to replicate the performance of the Nifty Capital Markets Index (TRI). The index tracks companies in the capital markets segment, including broking services, wealth management, and asset management firms.

With the growing importance of financial markets in India’s economic development, this fund provides a unique opportunity to invest in a niche sector of the economy.

Investment Objective of the Fund

TATA Nifty Capital Markets Index Fund NFO investment objective is to provide returns, before expenses, that are in line with the performance of the Nifty Capital Markets Index (TRI), subject to tracking errors. While the fund does not assure or guarantee returns, it aims to capture the growth potential of companies in the Indian capital markets sector.

Here are the key details of the fund:

Portfolio Allocation

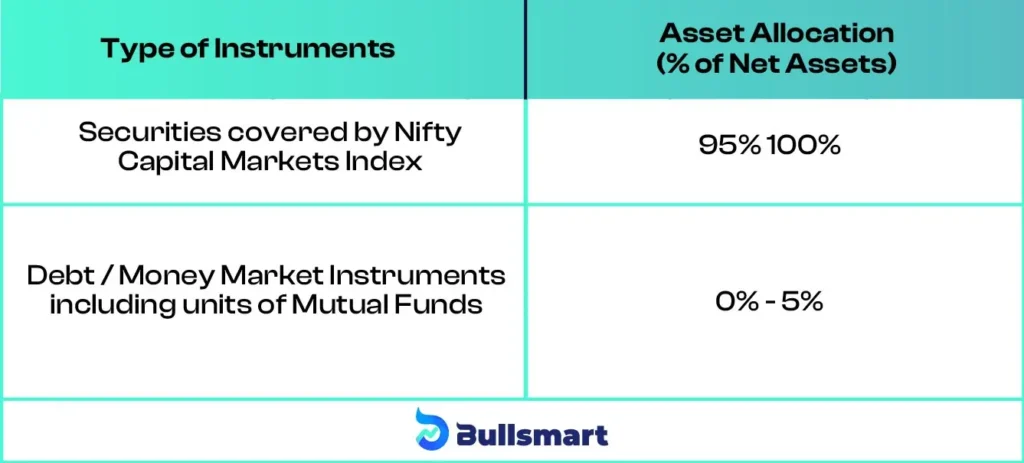

The Tata Nifty Capital Markets Index Fund NFO will invest in equity and equity-related instruments that are part of the Nifty Capital Markets Index.

This index includes companies involved in capital market-related activities, such as broking, wealth management, and financial services, providing concentrated exposure to this niche sector.

Understanding Risks and Returns

The Tata Nifty Capital Markets Index Fund has a very high risk profile due to its concentrated investments in the capital markets sector. This means that investors should be prepared for market volatility and sector-specific risks.

However, the financial services sector in India is growing, supported by increased retail investor participation, innovation in financial services, and government initiatives.

The Nifty Capital Markets Index – Total Return Index (TRI), which is the fund’s benchmark, tracks companies in the capital markets sector. It has delivered returns of 109.70%, 28.71%, and 36.11% in the last 1 year, 3 year, and 5 years respectively

Since it is the fund’s benchmark, the goal of the Tata Nifty Capital Markets Index Fund is to meet or exceed the benchmark returns, subject to tracking errors.

TATA Mutual Funds Asset Management Company

Tata Asset Management, part of the Tata Group, manages Tata Mutual Fund. Since it started in 1994, Tata AMC has created a wide variety of mutual fund schemes tailored to different investor risk profiles, financial goals, and income needs across fixed-income, equity, and hybrid categories.

With a strong focus on performance, service, and trust, Tata Mutual Fund aims to offer modern investment options for financial security.

As of March 31, 2024, Tata AMC has an impressive Assets Under Management (AUM) of INR 1,36,144.12 crores, providing around 58 schemes in various asset classes and plans.

Throughout the years, Tata Mutual Fund has received numerous accolades, including:

- Best Contra Fund at the CNBC TV 18 Mutual Fund Awards 2018

- Best Low Duration Debt Fund for Tata Treasury Advantage Fund

Renowned for its reliability, Tata Mutual Fund ranks among the top mutual fund companies in India.

Fund Manager Insights

The scheme is managed by Mr. Kapil Menon, who has significant experience in managing equity funds. He is a seasoned professional with over 17 years of experience at Tata Asset Management. He currently manages various funds, including the Tata Nifty India Tourism Index Fund and Tata Nifty Midcap 150 Momentum 50 Index Fund, and recently took on the role of Fund Manager – Equities.

Who Should Invest in this NFO?

The Tata Nifty Capital Markets Index Fund is suitable for investors who:

- Are seeking long-term capital appreciation.

- Want to gain exposure to companies in the Indian capital markets sector.

- Have a high-risk tolerance and are comfortable with market volatility in a concentrated sector.

- Want to diversify their portfolio with a sector-focused index fund.

Tata Nifty Capital Markets Index Fund NFO is ideal for those who believe in the growth potential of the financial services and capital markets industry in India. However, investors should consult with a financial advisor to ensure that this fund fits their financial objectives and risk tolerance.

Suggested Read – Tata Tourism Fund

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.