The Nippon India Arbitrage Fund is a conservative arbitrage fund that invests in debt securities and money market instruments in addition to seeking to profit from pricing mismatches in securities between the cash and derivatives segments and between the derivatives and cash segments. Complete hedging is used in the fund portfolio, which simultaneously takes positions in opposing markets. The arbitrage fund has no particular equity risk and employs a market-neutral strategy. Nippon India Arbitrage Fund may invest in money market securities or short-term debt if there are insufficient arbitrage possibilities.

Review of the Nippon India Arbitrage Fund

Nippon India Arbitrage Fund is an open-ended scheme that focuses on exploiting arbitrage opportunities. The objective is to generate income by taking advantage of price discrepancies between the cash and derivatives markets, as well as within the derivatives segment. Nippon India Arbitrage Fund also invests in debt securities and money market instruments.

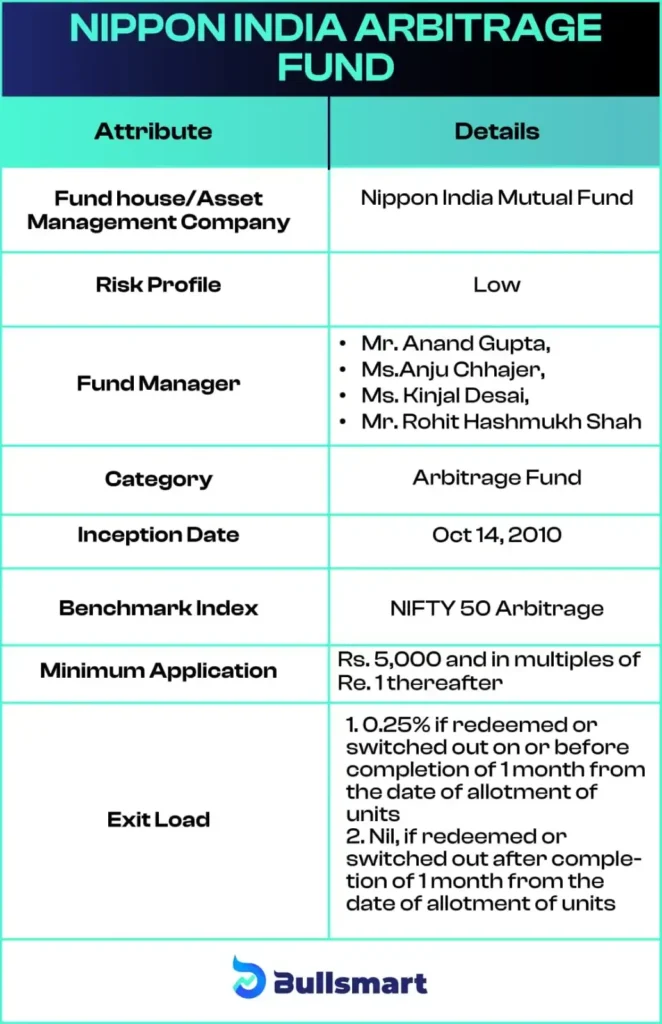

Here are the basic details of Nippon India Arbitrage Fund :

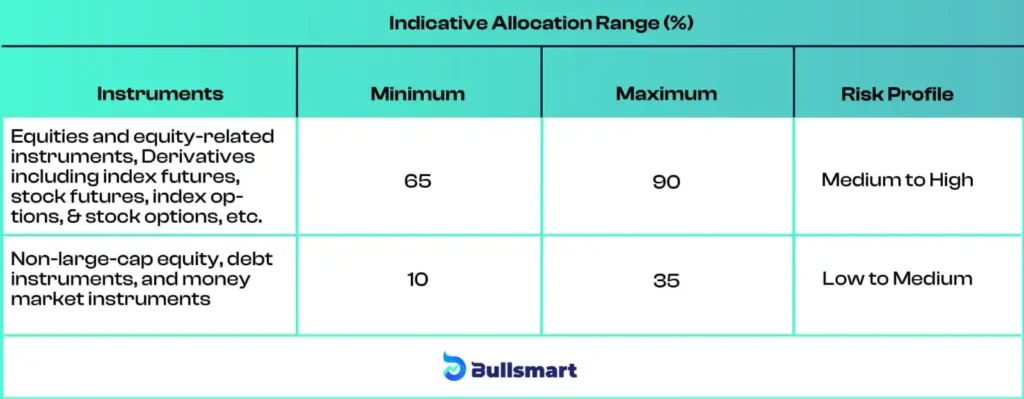

Portfolio Allocation

Under normal circumstances, the anticipated asset allocation would be:

Risks and Returns Explained

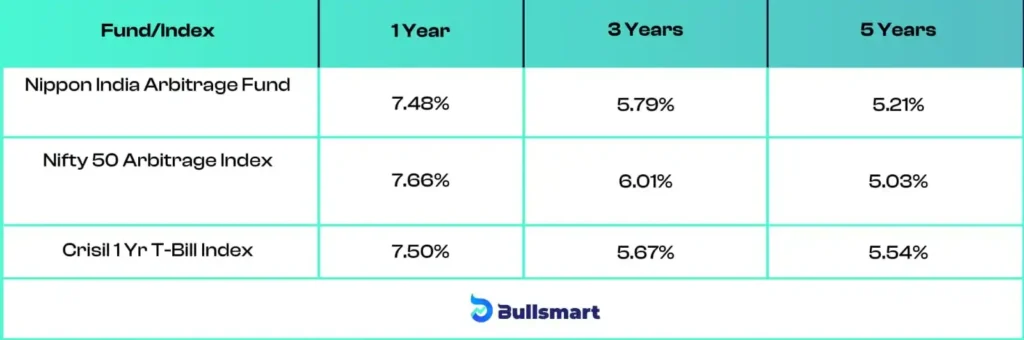

The Nippon India Arbitrage Fund follows NIFTY 50 Arbitrage as its benchmark scheme and the Crisil 1 Yr T-Bill Index as its additional benchmark. Here is a comparison of how the fund has been performing against its benchmark fund:

Meet the Fund Managers

Mr. Anand Gupta

With over 31 years of experience, Mr. Anand Gupta is the Vice President of Equity & ETFs at NAM India. He has held significant roles in equity trading and has been managing the Nippon India Equity Savings Fund since September 2018. Other schemes he oversees include the Nippon India Capital Protection Oriented Fund II – Plan A and the Nippon India Equity Savings Fund.

Ms. Anju Chhajer

Ms. Anju Chhajer is a Senior Fund Manager for Debt at NAM India, bringing over 27 years of experience to her role. Since February 2020, she has managed various debt schemes, including the Nippon India Low Duration Fund and the Nippon India Liquid Fund.

Ms. Kinjal Desai

As the Fund Manager for Overseas Investments, Ms. Kinjal Desai has a decade of experience and has been with NAM India since May 2018. She manages overseas investments, including the Nippon India US Equity Opportunities Fund and the Nippon India Multi Asset Fund.

Mr. Rohit Hashmukh Shah

Mr. Rohit Shah, with over 13 years of experience, is a Dealer and Co-Fund Manager at NAM India since April 2024. He focuses on equity and derivative trades and manages schemes such as the Nippon India Floating Rate Fund and the Nippon India Money Market Fund.

About the Asset Management Company

Reliance Capital and Japan’s Nippon Life Insurance Company partnered to create Nippon India Mutual Fund (NIMF), formerly known as Reliance Mutual Fund, in June 1995. Nippon Life purchased Reliance’s shares in October 2019, which led to the rebranding of Nippon India Mutual Fund. NIMF made history in 2017 by being the first asset management company (AMC) to debut on Indian stock exchanges.

Asset management for NIMF is handled by Nippon Life India Asset Management Limited (NAM India). Together, Reliance Capital Limited and Nippon Life Insurance Company are the company’s two largest shareholders, owning 75.93% of its issued and paid-up equity share capital.

As of June 30, 2024, Nippon India Mutual Fund managed assets totaling ₹ 516,267.80 crore across various categories, including mutual funds, alternative investments, pension funds, and offshore funds.

Who should invest in this Scheme?

- Investors who prioritize income over short-term gains.

- Investing through prospects for arbitrage in the derivatives segment as well as in the cash and derivatives markets.

- Individuals looking for diversification in their portfolio through arbitrage opportunities.

- Conservative investors wanting exposure to both equity and debt markets.

Suggested Read – Nippon India Nifty 500 Momentum 50 Index Fund

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.