Multinational companies (MNCs) have played an important role in shaping the global economy, with their extensive presence in multiple countries. In India, the MNC sector has shown impressive growth, driven by increasing consumer demand, innovation, and advanced technologies.

With its focus on globally competitive companies, Kotak MNC Fund NFO provides a unique opportunity to capitalize on this growth by investing in MNCs that dominate their respective sectors.

The Nifty MNC Index has consistently outperformed broader indices, delivering strong returns over the past decade. From FY14 to FY24, the MNC sector recorded an average annual growth rate of around 15%, with key industries like consumer goods, pharmaceuticals, and automobiles benefiting from this expansion.

Let’s know in detail about this fund and how it aims to utilize the potential of multinational corporations.

Comprehensive Overview of Kotak MNC Fund

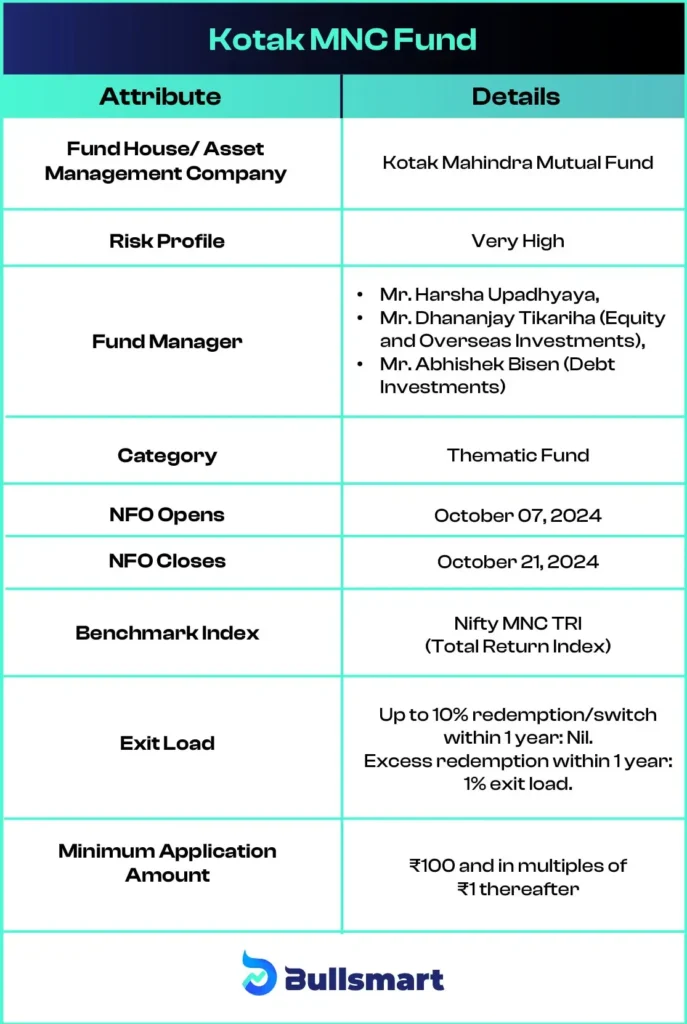

The Kotak MNC Fund is an open-ended equity scheme focusing on multinational companies. It is designed to capture growth opportunities by investing in firms that are incorporated or registered in India but are part of global corporations. The fund’s strategy revolves around long-term capital appreciation by targeting companies with strong business models, stable management, and fair valuations.

Objective of the Kotak MNC Fund

The primary objective of the Kotak MNC Fund is to generate long-term capital appreciation by investing in a portfolio of equity and equity-related securities of multinational companies. However, there is no guarantee that the investment objective will be achieved.

The focus is on companies that have a strong market position in India but benefit from global exposure and resources.

Here are the key details of the fund:

Asset Allocation Strategy

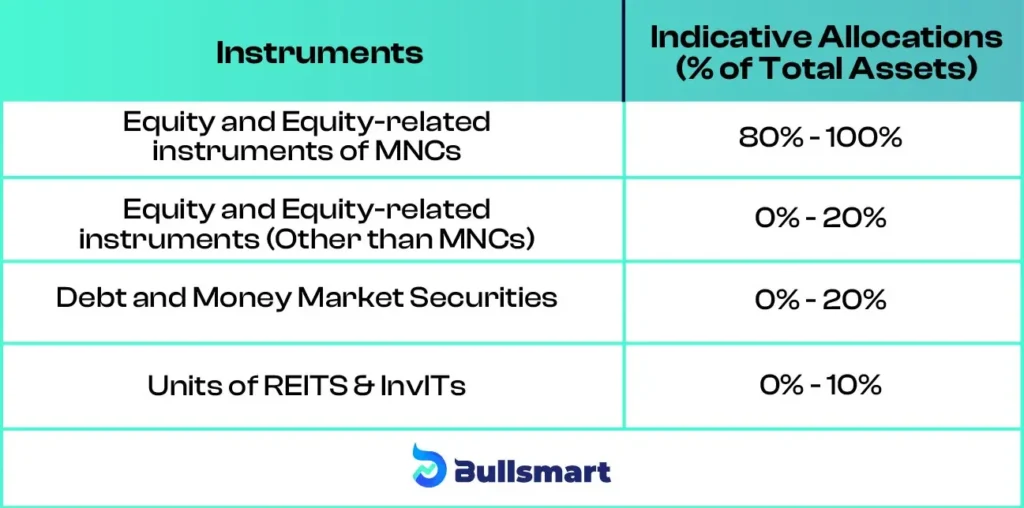

The Kotak MNC Fund is designed to provide investors with a portfolio primarily comprising equity and equity-related securities of multinational companies operating in India.

These companies, known for their global expertise and robust financial performance, are spread across sectors such as pharmaceuticals, consumer goods, and technology.

The fund follows a BMV (Business, Management & Valuation) approach combined with the GARP (Growth at a Reasonable Price) strategy, ensuring a well-diversified portfolio that aims for both stability and growth.

The scheme allocates its assets as follows:

Risk and Return Analysis

As a thematic fund, the Kotak MNC Fund NFO carries a very high-risk profile due to its concentration in multinational companies. While MNCs often provide stability due to their global presence and strong financial health, market fluctuations can still impact the performance of the fund.

Historically, the Nifty MNC Index has outperformed broader market indices, with lower debt-to-equity ratios over the years, indicating strong financial health.

The Nifty MNC TRI has delivered impressive returns of 47.10%, 19.89%, and 20.55% in the last 1 year, 3 years, and 5 years respectively.

The fund aims to match or outperform its benchmark, the Nifty MNC TRI, which has demonstrated superior returns compared to broader indices.

Kotak Mahindra Mutual Fund

Kotak Mahindra Asset Management Company Limited (KMAMC) was founded on August 2, 1994, under the Companies Act of 1956 to manage the Kotak Mahindra Mutual Fund (KMMF). Recognized as a prominent asset management firm, Kotak has significantly influenced the market with its innovative investment offerings.

It was the pioneer in launching a gilt fund, which focuses solely on government securities. As of June 30, 2024, Kotak Mutual Fund oversees assets amounting to ₹444,792.28 crores, positioning it among the largest mutual fund companies in India.

Introduction to the Fund’s Management Team

The fund is managed by experienced fund managers:

Mr. Harsha Upadhyaya

Mr. Harsha Upadhyaya brings over 20 years of experience in fund management and equity research. He has previously worked with top firms like DSP BlackRock and UTI Asset Management. He manages several notable schemes, including the Kotak Equity Opportunities Fund and the Kotak Flexi cap Fund, focusing on diverse equity strategies.

Mr. Dhananjay Tikariha

With 17 years of experience in equity research and fund management, Mr. Dhananjay Tikariha has a strong background in project finance. He previously worked at IDFC Ltd. He currently manages the Kotak Healthcare Fund, which targets investments in the healthcare sector.

Mr. Abhishek Bisen

Since joining Kotak AMC in 2006, Mr. Abhishek Bisen has specialized in managing debt schemes. His past experience includes a role at the Securities Trading Corporation of India. He oversees a range of funds, including the Kotak Multicap Fund and the Kotak Banking & Financial Services Fund, which are popular choices among investors looking for balanced equity exposure.

Ideal Investors for This NFO

The Kotak MNC Fund NFO is suitable for investors who:

- Are seeking long-term capital appreciation through exposure to multinational companies.

- Are comfortable with a high-risk profile, given the concentration in MNCs.

- Want to invest in companies that benefit from global expertise and strong financial performance.

- Are willing to stay invested for a minimum of 5 years to realize the fund’s growth potential.

As with any thematic fund, investors should consult their financial advisor to determine whether the Kotak MNC Fund aligns with their investment goals and risk tolerance.

Suggested Read – Kotak Tourism NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.