The Indian mutual fund market has seen growing interest in passive investment strategies, and index funds are at the forefront of this trend. One such fund-making wave is the SBI Nifty Next 50 Index Fund, designed to offer investors exposure to the next 50 largest companies after the Nifty 50.

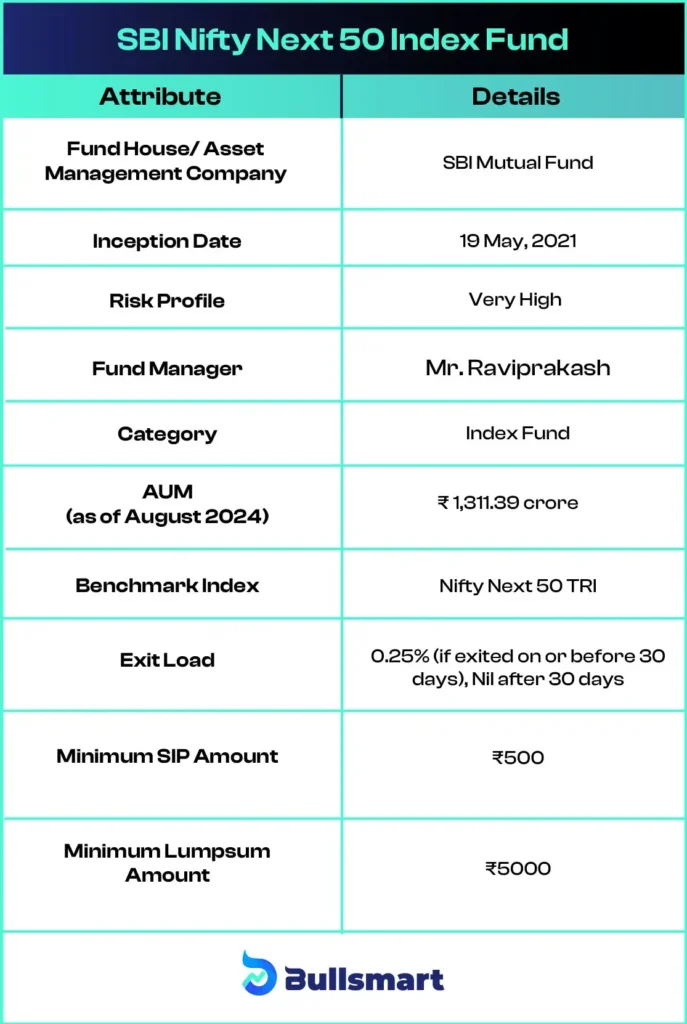

With an impressive track record since its inception in May 2021, the fund has gained traction among investors seeking long-term capital appreciation. The fund’s assets under management (AUM) stood at ₹1,311.39 crore as of August 2024.

Let’s explore the details of this fund and see how it can fit into your investment strategy.

All You Need to Know: SBI Nifty Next 50 Index Fund

SBI Nifty Next 50 Index Fund is an open-ended scheme that tracks the Nifty Next 50 Index, providing investors with a passive, cost-effective way to invest in some of the most promising companies outside of the Nifty 50. This index consists of large-cap companies that have the potential to become future leaders in their respective sectors.

What Is the Investment Objective of the SBI Nifty Next 50 Index Fund?

The primary objective of the SBI Nifty Next 50 Index Fund is to closely correspond to the total returns of the Nifty Next 50 Index, subject to tracking error. While there is no guarantee that the fund will achieve this objective, it strives to minimize the difference between the performance of the scheme and the underlying index.

Here are the key details of the fund:

Portfolio Composition

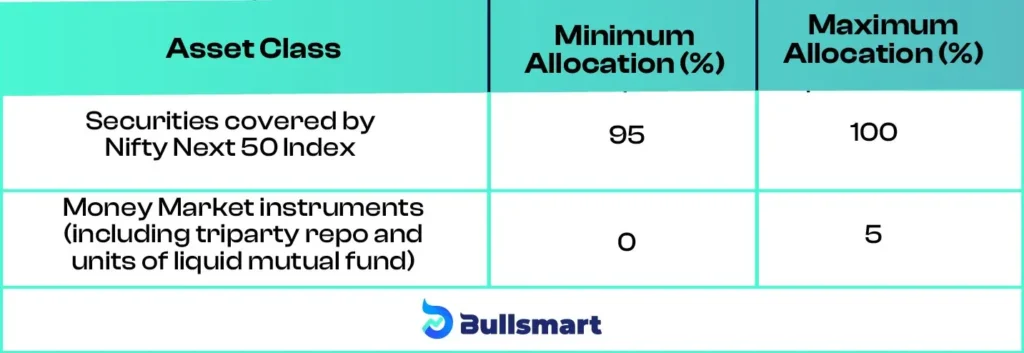

The scheme allocates its assets as follows:

Understanding the Risk-Return

Given that the fund tracks the Nifty Next 50 Index, it comes with a high-risk profile. The Nifty Next 50 Index consists of companies that are next in line to the Nifty 50, meaning these companies are large but still growing, and as a result, they may offer more volatility compared to Nifty 50 stocks. However, they also present significant growth opportunities over the long term.

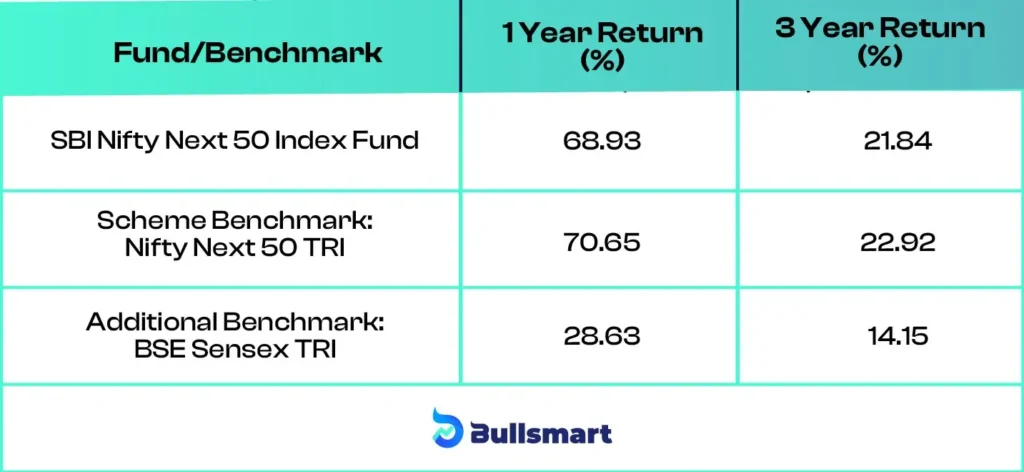

The fund has delivered a 24.11% return since inception (as of August 2024), closely matching the Nifty Next 50 TRI’s returns of 25.23% over the same period.

Here’s a brief comparison of the schemes’ performance:

The fund’s focus on long-term capital appreciation makes it suitable for investors with a long-term horizon and a higher risk appetite.

Insight into the SBI Mutual Fund

SBI Mutual Fund (SBIMF) is a major asset management company in India, formed as a partnership between the State Bank of India and the French firm Amundi. As of June 30, 2024, it manages assets totaling ₹ 1,039,785.49 crore.

Founded on June 29, 1987, SBI Mutual Fund has a long history of helping Indian investors grow their wealth. It started as a trust under the Trust Act of 1882 and was officially incorporated on February 7, 1992. In 2004, SBI sold 37% of its stake and partnered with Amundi to enhance its operations.

Fund Manager Overview

The fund is managed by Mr. Raviprakash Sharma.

Mr. Raviprakash Sharma is a Fund Manager with over 21 years of experience in Indian capital markets, currently managing the SBI Nifty Next 50 Index Fund and SBI S&P BSE Sensex ETF.

He has been with the firm since May 2021 and has previously managed schemes such as the SBI Gold Fund, SBI Equity Minimum Variance Fund and SBI Nifty Index Fund, along with several other equity-focused funds.

Is This Fund Suitable for Your Financial Goals?

The SBI Nifty Next 50 Index Fund is ideal for investors who:

- Seek long-term capital appreciation.

- Want exposure to large companies with growth potential, particularly those not included in the Nifty 50.

- Have a higher risk tolerance and are prepared for market volatility.

- Prefer a passive investment approach with lower management fees.

- Are looking for a cost-effective way to invest in a diversified portfolio of large-cap companies.

Investors should note that while index funds typically come with lower costs and require less active management, they are still subject to market risks.

This fund is suitable for investors who are willing to hold their investments for a longer period to ride out short-term market fluctuations.

The SBI Nifty Next 50 Index Fund offers an excellent opportunity for investors looking to invest in the next big companies poised for growth. By tracking the Nifty Next 50 Index, the fund gives investors exposure to a diversified portfolio of large-cap stocks with significant growth potential.

Suggested Read – SBI Nifty 500 Index Fund NFO

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.