The Indian equity market offers a variety of mutual funds that cater to different themes and sectors. One such fund is the Aditya Birla Sun Life PSU Equity Fund, which focuses on investing in Public Sector Undertakings (PSUs). PSUs are government-owned corporations known for their strategic importance, which often leads to strong market positions in their respective sectors.

The Aditya Birla Sun Life PSU Equity Fund seeks to provide long-term capital appreciation by investing in equity and equity-related instruments of PSUs. Over time, the fund has established itself as a thematic offering for those who wish to capitalise on the growth potential of public sector enterprises.

Let’s explore this fund to help you decide if it aligns with your investment objectives.

Detailed Review of Aditya Birla Sun Life PSU Equity Fund

The Aditya Birla Sun Life PSU Equity Fund is an open-ended equity scheme following the PSU theme. Its primary goal is to generate long-term capital growth by investing in well-established public-sector companies.

Understanding the Investment Objective of the Fund

The scheme aims to provide long-term capital appreciation by focusing on the growth of PSUs across various sectors. This fund does not offer guaranteed returns, but it is structured to take advantage of the robust fundamentals and growth potential of government-owned corporations.

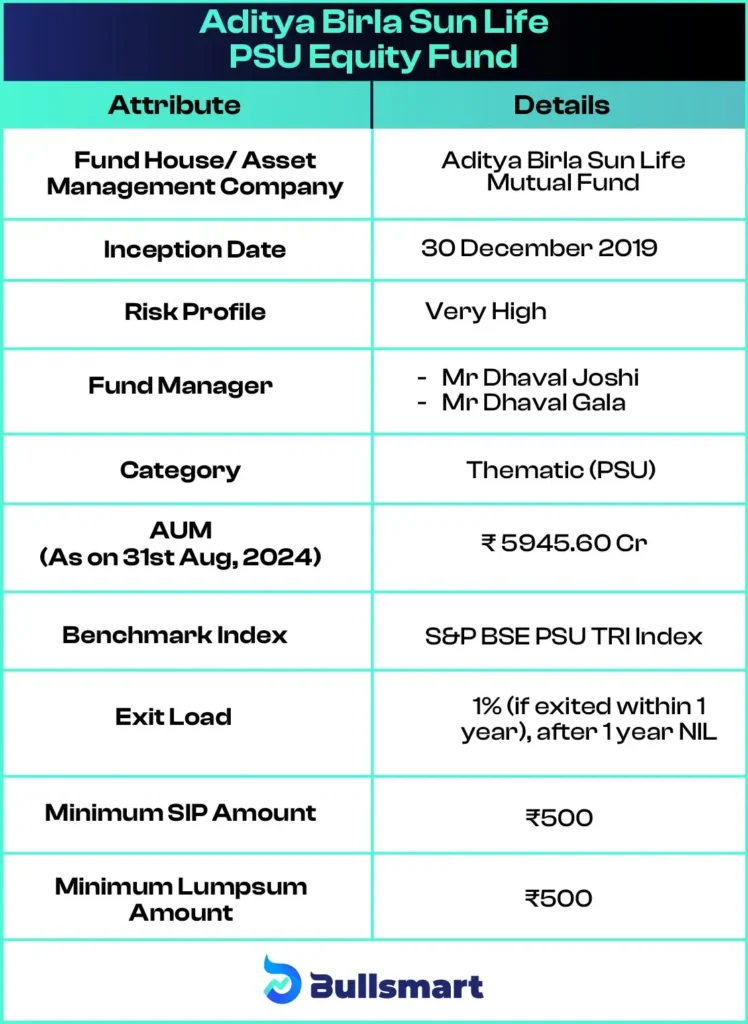

Let’s take a quick look at the key basic details of the fund:

Exploring the Portfolio Construction Strategy

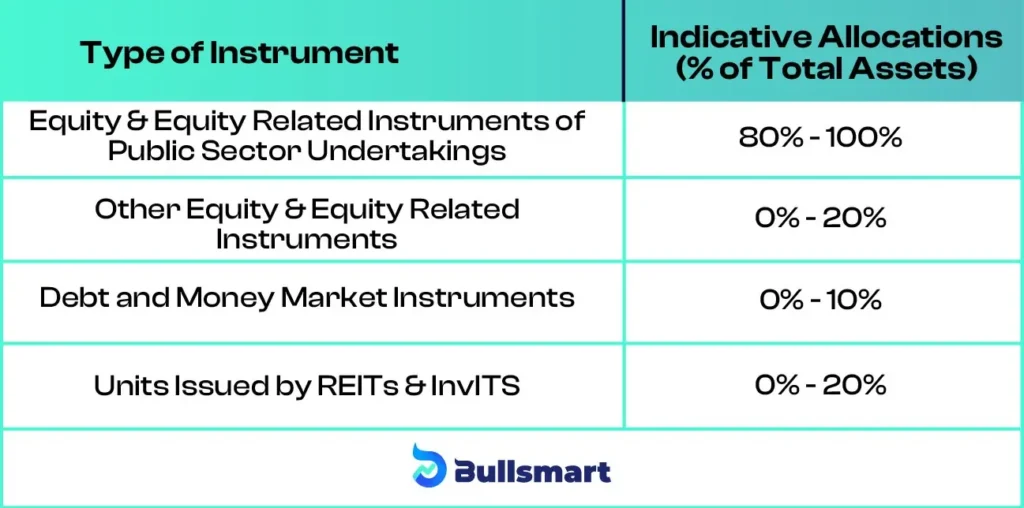

The fund allocates its assets as follows:

Balancing Risks and Returns in the Fund

The Aditya Birla Sun Life PSU Equity Fund carries a very high-risk profile due to its focus on equities, particularly within a specific sector (PSUs). However, PSUs tend to offer strong fundamentals, with the backing of government ownership, which can provide more stability during volatile market periods.

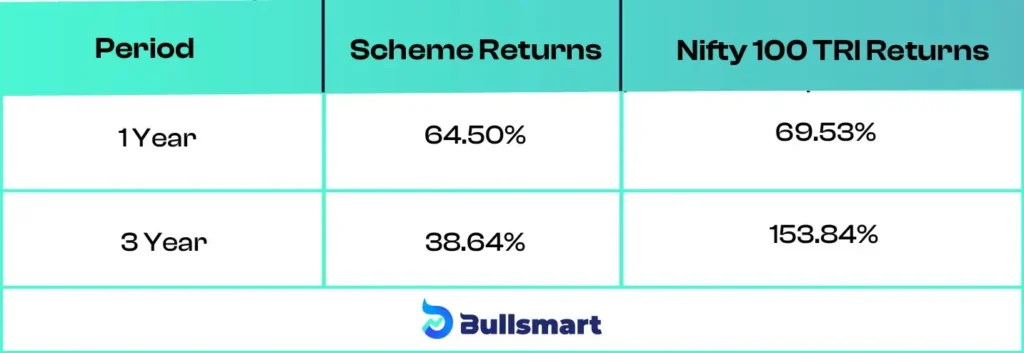

Here’s a comparison of the scheme with its benchmark scheme

Suggested Read – Aditya Birla Defence Index Fund

ABSL Mutual Fund

Aditya Birla Sun Life Mutual Fund (ABSLMF) is a collaboration between Aditya Birla Capital Limited of India and Sun Life AMC Investments, Inc. of Canada. Established in 1994, the company was initially known as Birla Sun Life Asset Management Company Limited. With over 25 years in the Indian financial sector, ABSL Mutual Fund has established a significant presence.

As of 30th June 2024, ABSLMF oversees assets valued at around ₹360,520.88 crore, positioning it as one of India’s largest asset management firms.

The Experts Behind the Fund

The fund is managed by experienced fund managers:

Mr. Dhaval Gala

Dhaval Gala has over 18 years of experience in financial markets, with 9 years focused on investment research and analysis. At Aditya Birla Sun Life Mutual Fund, he manages the Aditya Birla Sun Life Dividend Yield Fund and the Aditya Birla Sun Life Dynamic Bond Fund.

Mr. Dhaval Joshi

Dhaval Joshi, with over 17 years in equity research and investments, manages the Aditya Birla Sun Life Asset Allocator FoF and the Aditya Birla Sun Life Banking and Financial Services Fund.

Is Aditya Birla Sun Life PSU Equity Fund Right for You?

The Aditya Birla Sun Life PSU Equity Fund is suitable for investors who:

- Are looking for long-term capital appreciation.

- Want to participate in the growth of public sector undertakings.

- Have a high-risk tolerance and are willing to face market volatility for the potential of long-term gains.

- Seek inflation-beating returns over a period of 3 to 5 years.

Aditya Birla Sun Life PSU Equity Fund is ideal for those who believe in the long-term potential of government-owned enterprises and are willing to hold their investments through market ups and downs.

However, it is always advisable to consult a financial advisor before investing to ensure this fund aligns with your financial goals and risk tolerance.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.