Flexi-cap funds are one of the most versatile categories of mutual funds. Unlike other equity funds, which have fixed allocations, flexi-cap funds can invest in large-cap, mid-cap, or small-cap stocks in any proportion.

One of the top-performing funds in this category is the HDFC Flexi Cap Fund.

For instance, large-cap funds must allocate at least 80% of their investments to large-cap stocks, while mid-cap and small-cap funds need to invest a minimum of 65% in their respective categories. This flexibility allows fund managers to adjust their portfolios based on market conditions, making these funds popular among investors.

Let’s explore how HDFC Flexi Cap Fund has performed and what makes it a strong choice for investors.

Details of HDFC Flexi Cap Fund

The HDFC Flexi Cap Fund is an open-ended dynamic equity scheme that invests across large-cap, mid-cap, and small-cap stocks. As a flexible investment option, it allows investors to benefit from a diversified portfolio while adjusting to market opportunities.

Investment Objective of the HDFC Flexi Cap Fund

The primary objective of the HDFC Flexi Cap Fund is to generate capital appreciation and income by investing in a diversified portfolio of equity and equity-related instruments.

While there is no guarantee that the fund’s investment goals will be achieved, its dynamic allocation approach aims to capture market opportunities across different capitalizations, making it suitable for long-term investors.

Here is a basic overview of HDFC Flexi Cap Fund:

Portfolio Construction

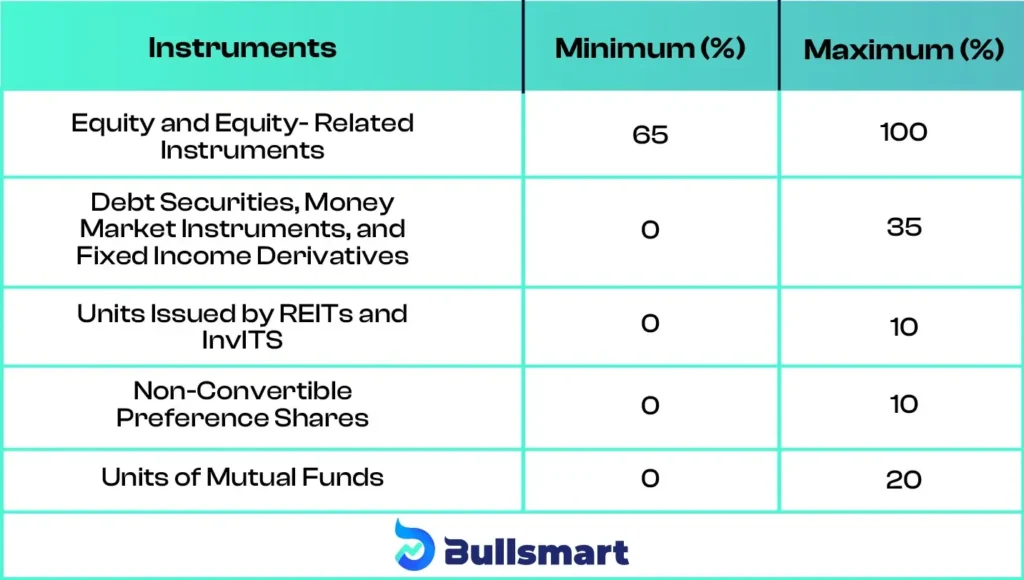

The fund allocates its assets as follows:

Understanding Risks and Returns

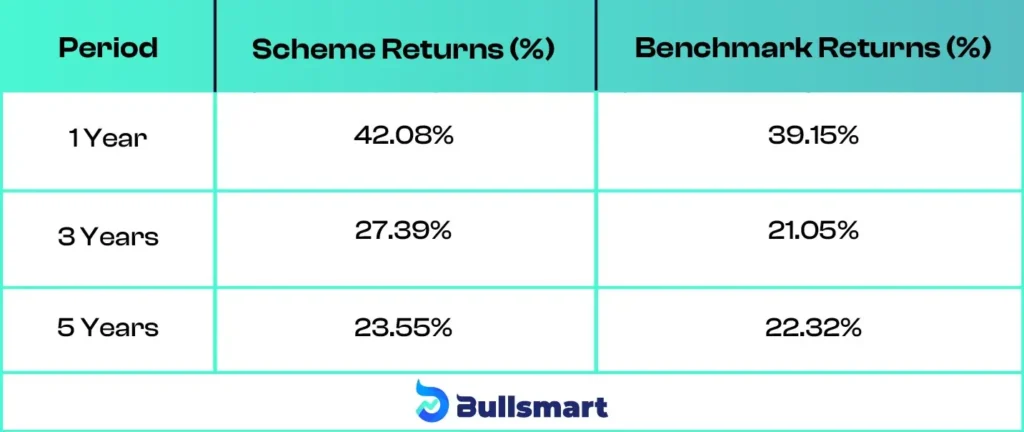

Since its inception, the HDFC Flexi Cap Fund has consistently provided solid returns, with the following performance metrics:

The fund has delivered strong performance across different time horizons, outperforming its benchmark, the NIFTY 500 TRI, particularly over the 1-year, 3-year, and 5-year periods.

With a very high-risk profile, the fund is designed for investors with a long-term outlook and the capacity to tolerate short-term volatility.

HDFC Mutual Fund

HDFC Mutual Fund, backed by India’s largest private bank, is one of the top asset management companies in the country, managing assets worth ₹ 715,750.38 crores as of June 30, 2024.

Established in 1999 through a partnership between HDFC and ABRDN Investment Management Limited, the company became publicly traded in 2018. With nearly 28 years of experience and a strong track record of profitability, HDFC Mutual Fund offers a wide variety of investment products across different asset classes to help investors generate income and build wealth.

The fund is well-regarded for its strong performance and has a large network of millions of active investors along with thousands of distribution partners, including mutual fund distributors and banks.

Suggested Read – HDFC Nifty 500 Multicap Fund NFO

Meet the Fund Managers

The fund is managed by experienced fund managers.

Roshi Jain

Roshi Jain, 46 years old, has been managing the scheme for 1 year and 8 months. She holds qualifications including a CA from ICAI, a CFA from the CFA Institute, and a PGDM from IIM Ahmedabad. With over 19 years of experience in equity research and fund management, she brings extensive expertise to her role.

She manages the HDFC Focused 30 Fund, which aims for long-term capital appreciation through a concentrated portfolio, and the HDFC ELSS Tax Saver, a tax-saving scheme that invests primarily in equities while offering tax benefits under Section 80C.

Dhruv Muchhal (Overseas Manager)

Dhruv Muchhal is 36 years old and has been managing the scheme for 11 months. He is a CFA charter holder, a Chartered Accountant, and holds a B.Com from the University of Mumbai. With over 13 years of experience in equity research, he specializes in analyzing market trends.

Dhruv co-manages the HDFC Arbitrage Fund, which seeks returns by exploiting price differences in the stock market, and the HDFC Balanced Advantage Fund, which dynamically adjusts equity and debt allocations based on market conditions.

He is also involved in the HDFC Banking & Financial Services Fund, which focuses on investing in companies within the banking and financial sector.

Who should invest in HDFC Flexi Cap Fund?

The HDFC Flexi Cap Fund is best suited for investors who are looking for:

- Long-term capital appreciation and income.

- Exposure to a diversified portfolio across large, mid, and small-cap stocks.

- Willingness to tolerate a high level of risk. This fund is ideal for individuals with a long-term horizon of three years and above, as it aims to capitalize on market opportunities across different sectors and capitalisations.

Hence, as per this overview of HDFC Flexi Cap Fund we can conclude that it might be best option for the above listed investors. However, one should also carefully assess their investment goals and risk appetite in order to see if it aligns your financial objective.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.