It’s not just that India’s healthcare system is growing; it’s skyrocketing! The world healthcare market is huge with $8.5 trillion, however, India’s sector is on fire, set to hit $372 billion by 2027. That’s an out-of-this-world growth rate of 22%! And savings? Heart surgeries in India cost around $3,000 as opposed to jaw-dropping sum of $90,000 in the USA. So no wonder why many people come to India each year for medical treatments!

But there is still a shortage of doctors however which makes it possible for improvement; one doctor for every 1,456 people. For this fast-growing sector, the SBI Healthcare Opportunities Fund enters here. Are you curious about how this fund intends to utilize India’s healthcare revolution?

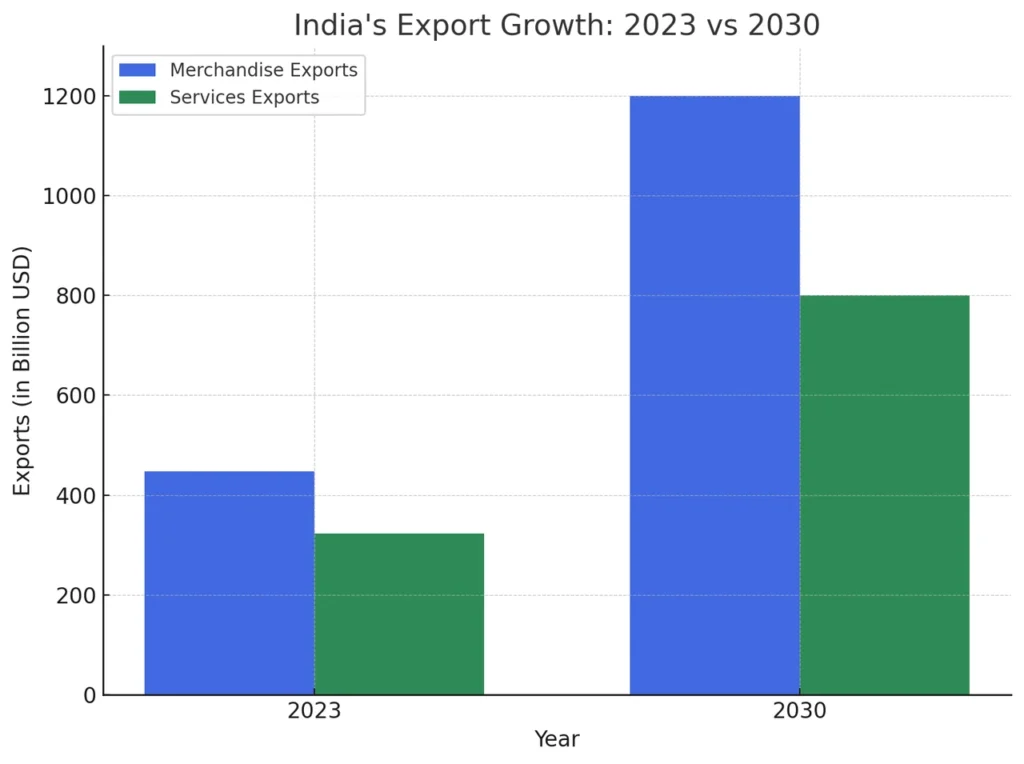

India is also more than saving money; it has become a global pharmaceutical giant supplying more than 50% of the world’s vaccines and 40% of generic drugs used in the US. Moreover, India is leading digital health with the telemedicine market likely hitting $5.5 billion by 2025.

Key Benefits of SBI Healthcare Opportunities Fund

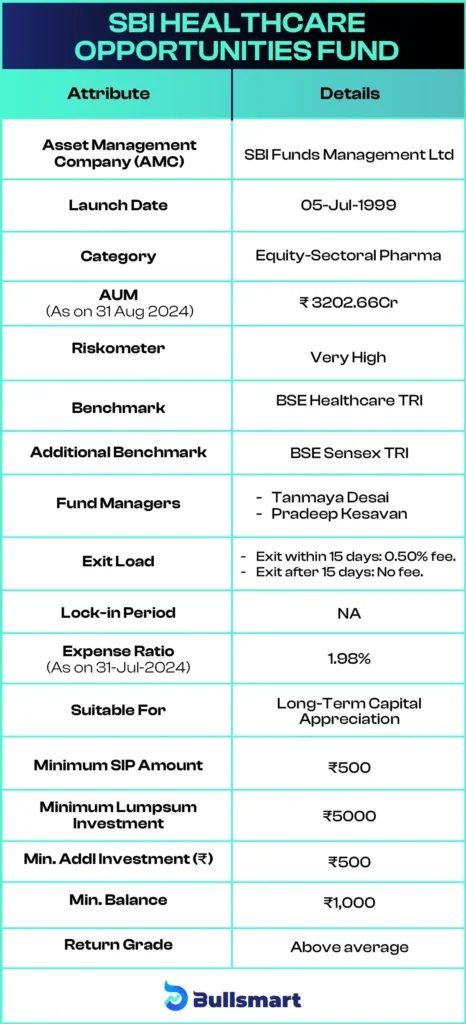

The SBI Healthcare Opportunities Fund is an open-ended scheme with a wide range of features to offer. An introduction to the SBI Healthcare Opportunities Fund is never complete without stating what this fund offers. Ever since its inception back in 1999, this fund has been about “Futuring” and the healthcare and pharmaceutical sectors.

What’s the goal? It’s rather easy. The fund will increase the capital invested over time by benefiting from the growth of the healthcare industry. The label describes a “general heartbeat” emphasis on growth-oriented. These trends are already developmental for the funds outside of Indian financial institutions.

Let’s peek at the deets:

Data updated as of 09.09.24

SBI Healthcare Opportunities Fund has an expense ratio of 1.98% for its regular plan. This is the annual fee the fund charges to manage your investment, which is slightly lower than the category average, which is around 2.08%, makes it a cost effective choice. In general, such sector-specific funds are more expensive as they target a specific area.

Suggested Read – SBI Innovative Opportunities Fund Review

About SBI Mutual Fund AMC

Imagine the offspring of the Earth’s biggest bank, State Bank of India (SBI), and the largest asset manager in Europe, Amundi, becoming a financial force to be reckoned with. This is SBI Mutual Funds Management Ltd. (SBIMF), which took flight in 1987 as India’s first bank-sponsored asset management company to launch a mutual fund in India. Over the course of its existence, SBIMF has transformed, demonstrating its emphasis on novel technologies, an investor-centric mindset, and a firm ethical footing. The collaboration with Amundi, which began in 2011, was already a huge win in terms of multinational-level expertise which further empowered SBIMF.

SBIMF, in its endeavor to grab hold of burgeoning opportunities, rolled out the SBI Healthcare Opportunities Fund to capture the robust development of India’s healthcare and pharmaceutical sector. This fund is a living testimony to SBI Mutual Fund’s approach of bringing the market-skewed investment solutions well in line with surrounding industry trends.

Some of the treasured inclusions in SBIMF’s portfolio are:

- SBI Bluechip Fund – A bond fund that invests in well-established, large companies known for their robustness and reliability.

- SBI Small Cap Fund – An exciting mover and one of the top performers in the segment. The dynamic growth strategy of the fund consists of investing in start-ups in their early stages and companies that are anticipating rapid growth in the industry.

- SBI Equity Hybrid Fund – A mixed fund that acquires the benefits of both the equity and debt sides of the investment for an all-rounded method.

SBI Mutual Fund is a story of vision, advances, and zest for life. It has designed asset portfolios that are in resonance with the transforming world.

Portfolio Allocation

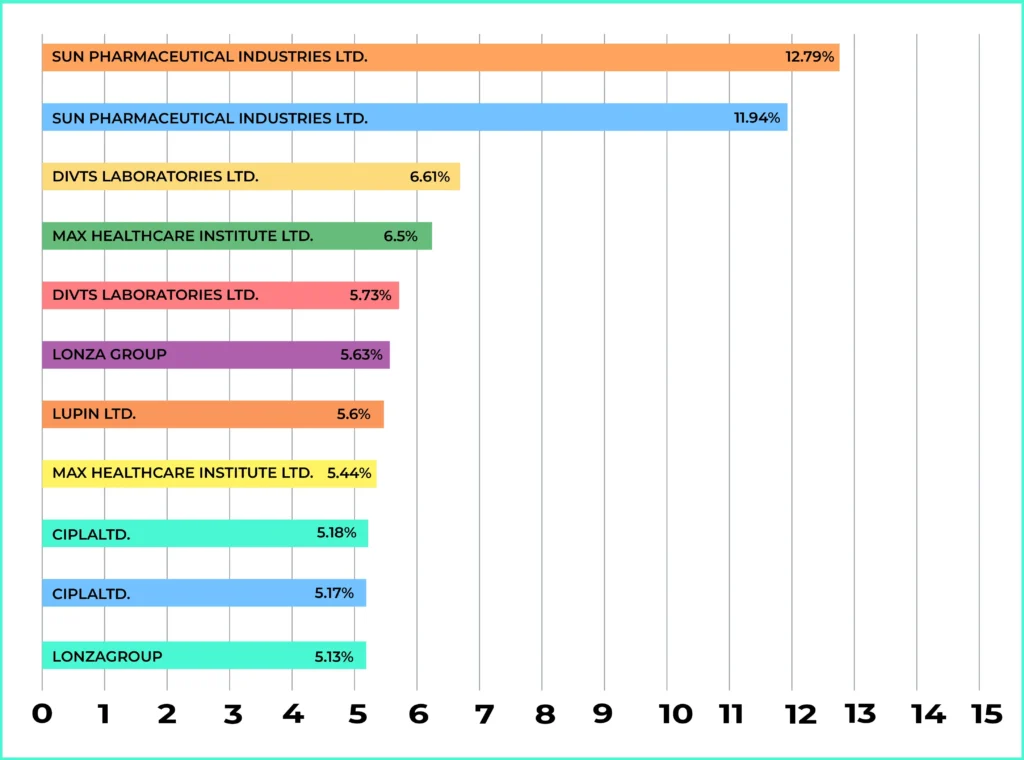

The SBI Healthcare Opportunities Fund which is a specialized equity fund focuses almost entirely on the healthcare sector, with 97.42% of its investments in this area. It is a fund which comprises 29 stocks in its portfolio and the top 10 holdings are its most important ones, with 55.29% making up the total. The fund consists of different healthcare companies of different sizes: big ones like Sun Pharmaceutical (12.70%), Divi’s Laboratories (6.61%) and Max Healthcare (6.50%) are its significant investment to name a few.

Over the last three years, this fund has awarded investors with a robust return of 20.45%, and for that reason, this gem is among the major sought-after growth funds in the healthcare sector. However, it should be noted that the label “Very High Risk” is attached to the fund because it is focused on one sector, which is the reason it is quite risky. Its performance is superior to the market in the healthcare sector, but as with other similar funds, it is risky and, therefore, it deserves the”Very High Risk” rating.

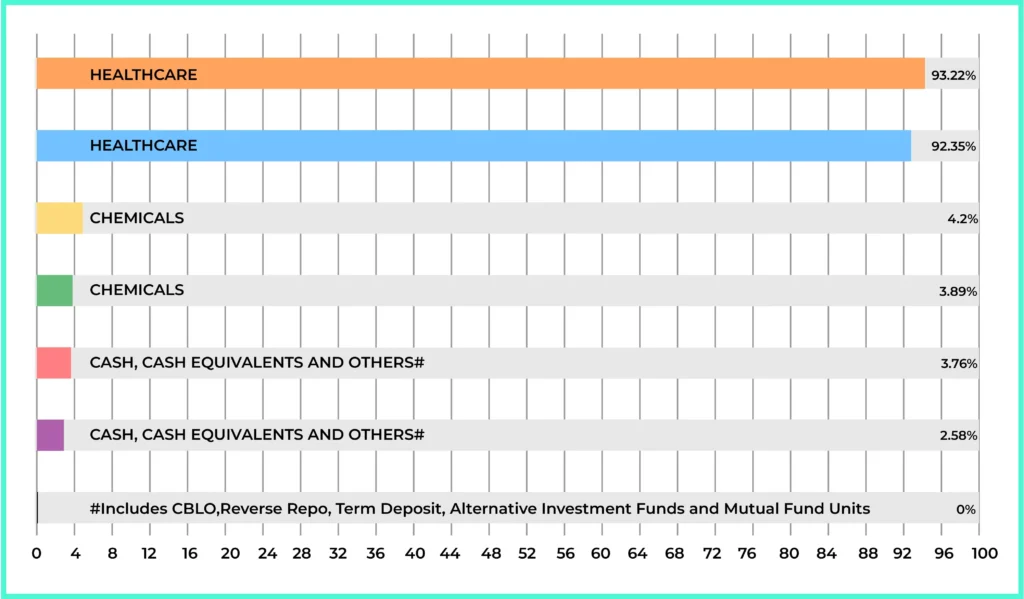

Asset Allocation

The SBI Healthcare Opportunities Fund puts a significant proportion of its corpus into healthcare stocks, with 97.42% in equities and just 2.58% in cash and equivalents. This shows how much the fund wants to profit from growth in the healthcare sector.

The fund puts most of its cash into big and medium-sized companies, with 37.36% in large-cap and 26.86% in mid-cap stocks. It also has 16.53% in small-cap stocks, which is a bit more than usual for this type of fund. The top 10 investments make up 55.29% of the whole portfolio, which means the fund bets big on a few stocks. The average size of companies it invests in is ₹64,967 crore less than the typical ₹81,541 crore for similar funds. This hints that the fund looks for smaller companies that could grow a lot.

Risk and Returns Explained

The SBI Healthcare Opportunities Fund carries a high-risk high-reward profile because it zeroes in on the healthcare sector. In the short run, the fund has produced impressive returns beating its sector benchmark. Over extended periods, it has kept up a solid performance staying on par with or ahead of its benchmark.

Yet, SBI Healthcare Opportunities Fund’s laser focus on healthcare means its returns link to the unique ups and downs of the sector. This narrow focus brings a “Very High Risk” label making the fund a better fit for investors who don’t mind higher risks and want to grow their money in this field over time.

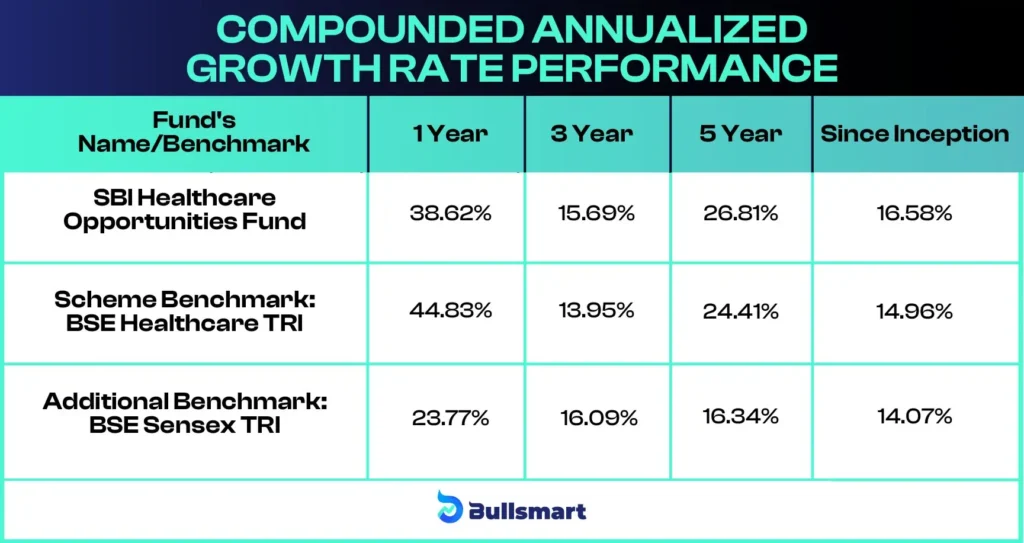

A better insight can be derived by glancing over returns:

Data updated as of 09.09.24

Meet the Fund Managers

Tanmaya Desai

- Has worked for over 18 years, with more than 11 years in capital markets.

- Started at SBI Funds Management in 2008 as a research analyst; now handles fund management.

- Earned an Engineering degree in Electronics and a Master’s in Finance from Narsee Monjee Institute of Management Studies.

- Holds a CFA Charter from the CFA Institute, USA.

- Worked as a Software Engineer at Patni Computer Systems.

- Taught as a lecturer in the Electronics Department at D J Sanghvi College of Engineering Mumbai, for two years.

- Has managed the SBI Healthcare Opportunities Fund since June 2011.

Pradeep Kesavan

- Joined SBI Mutual Fund in July 2021 with more than 18 years of experience in the financial services industry.

- Previously worked at Elara Securities Private Limited (Sep 2017 – Apr 2021) managing equity strategy from the top down.

- At Accenture Solutions Private Limited (Oct 2013 – Aug 2017) was dealing with consulting on strategies.

- Skill sets in corporate finance strategies were developed while working at Morgan Stanley India Private Limited (Mar 2005 – Sep 2013).

Is SBI Healthcare Opportunities Fund Right for You?

SBI Healthcare Opportunities Fund is right for investors who want to penetrate into the rising healthcare industry in India and are willing to accept some calculated risks for possibly high rewards. SBI Healthcare Opportunities Fund offers a more concentrated chance to ride the wave as the Indian healthcare market is growing more rapidly and about to grow immensely.

Considering it specializes in healthcare investment, it is suitable for those who know what it means when someone says that sector-specific investments are speculative and should be looked upon with a long-term view. If you are an audacious investor, growth oriented and ready to pay out higher risks for attractive returns, this might be your best option if you desire entering one of India’s most lively industries.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.