Private bank funds focus on investing in shares of private sector banks. These banks are privately owned, operate without government control, and are the key aspects of the Indian banking system.

The UTI Nifty Private Bank Index Fund NFO is designed to track the performance of the Nifty Private Bank Index, which includes the top private banks in India. The ongoing NFO offers an opportunity to invest in this sector-focused index fund, allowing for exposure to private banking giants.

In recent years, private sector banks have seen robust growth, driven by their ability to adapt to digital advancements and their focus on profitability. As of 2024, private banks in India have maintained an impressive market share, contributing nearly 35-40% of total banking assets.

Understanding UTI Nifty Private Bank Index Fund

The UTI Nifty Private Bank Index Fund is an open-ended equity index scheme replicating/tracking the Nifty Private Bank TRI. This fund is designed for investors looking for long-term capital appreciation by investing in the leading private sector banks in India.

The benchmark of this fund is the Nifty Private Bank TRI.

Investment Objective of the Fund

The UTI Nifty Private Bank Index Fund NFO scheme aims to provide returns that, before expenses, correspond to the total return of securities represented by the underlying index, i.e., the Nifty Private Bank TRI, subject to tracking error. However, there is no guarantee that the investment objective will be achieved.

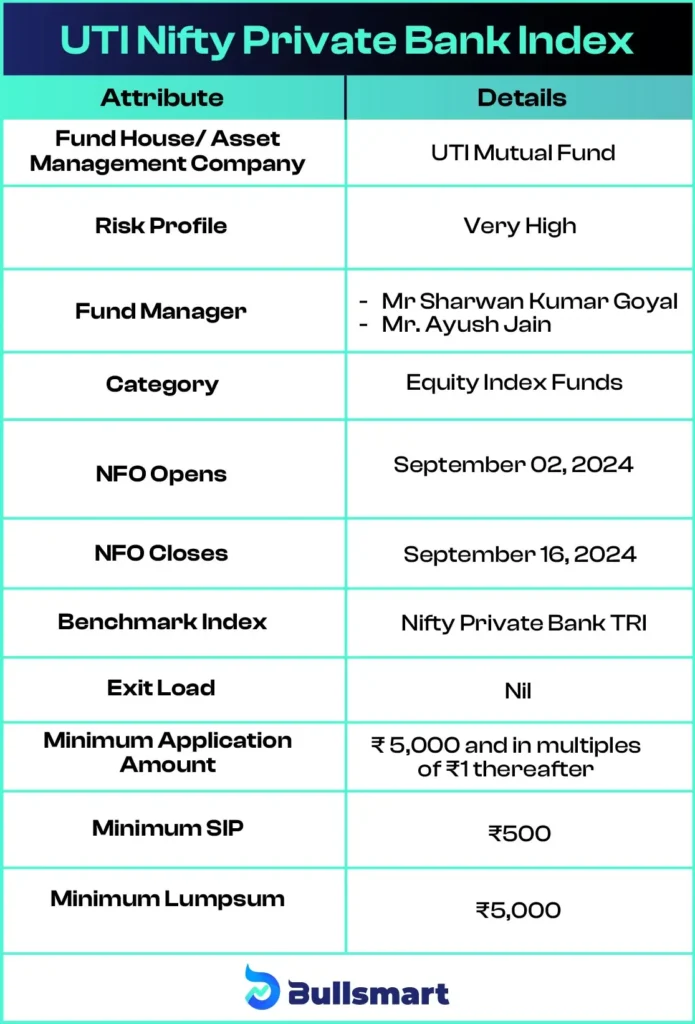

Let’s take a quick look at the key basic details of the fund:

Portfolio Analysis

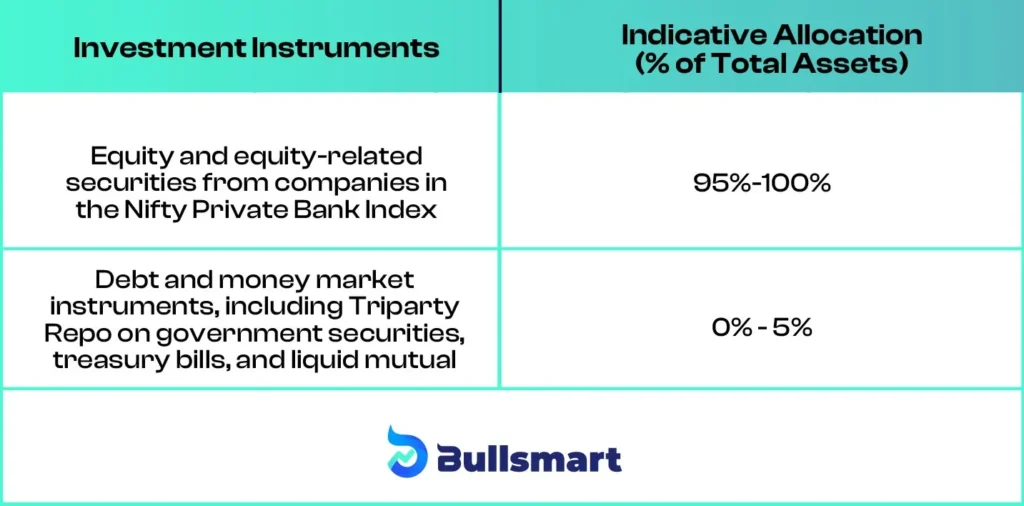

The asset allocation of the UTI Nifty Private Bank Index Fund NFO is as follows:

Understanding Risks and Returns

The UTI Nifty Private Bank Index Fund carries a very high-risk profile due to its exposure to equities, specifically in the private banking sector. However, the UTI Nifty Private Bank Index Fund aims to replicate the performance of the Nifty Private Bank TRI, which has historically delivered returns of 9.94%, 11.33%, and 11.40% in the last 1 year, 3 years, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Suggested Read – UTI Infrastructure Fund

About UTI Mutual Fund

Mutual funds were first introduced in India in 1963 with the launch of the Unit Trust of India (UTI). In 2003, UTI was split into two separate entities: SUUTI and UTI Mutual Fund (UTI MF), which was registered with SEBI on February 1, 2003.

Initially created in 1963 under an act of Parliament and regulated by the RBI, UTI Mutual Fund played a key role in shaping India’s mutual fund industry. Until 1993, the industry was mainly dominated by public-sector companies.

Today, UTI Mutual Fund is one of the most recognized mutual fund companies in India, with nearly 11 million investors and over 250 active schemes. It works with around 50,000 financial advisors certified by AMFI and NSFM to guide investors.

As of June 30, 2024, UTI Mutual Fund manages assets worth around ₹ 325,512.45 crore

Introducing the Fund Management Experts

The fund is managed by experienced fund managers:

Mr. Sharwan Kumar Goyal

With 18 years of experience in risk and fund management, Mr. Goyal oversees a diverse portfolio including prominent funds like UTI Nifty 50 ETF and UTI Nifty200 Momentum 30 Index Fund. His role as Equity Fund Manager and Head of Passive, Arbitrage & Quant Strategies highlights his extensive expertise in managing large-scale equity investments.

Mr. Ayush Jain

As an Assistant Fund Manager with over 6 years in equity fund management, Mr. Jain contributes significantly to key schemes such as UTI Nifty 50 Index Fund and UTI Nifty Bank ETF. His background as a Chartered Accountant enhances his proficiency in equity research and portfolio management.

Who should invest in this NFO?

The UTI Nifty Private Bank Index Fund may be suitable for investors who are:

- Looking for long-term wealth creation

- Interested in a focused and disciplined approach to investing in private-sector banks

- Comfortable with high-risk investments, as this is a sector-specific index fund

- Looking for returns commensurate with the performance of the Nifty Private Bank Index

The NFO is ideal for investors who believe in the potential of private banks and are looking for a passive investment strategy that mirrors the performance of this sector. As always, it is important to consult with a financial advisor to ensure this fund aligns with your overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.