India’s tourism sector has seen a significant surge post-pandemic. According to the India Travel Trends Reports, travel bookings in 2023 have surpassed 2019 levels, marking a 50% increase in domestic travel.

Additionally, India has become a popular destination, with a 43.5% increase in foreign travelers visiting for leisure and recreation. This rising trend in travel makes the Kotak Nifty India Tourism Index Fund NFO a timely and relevant investment opportunity for those looking to tap into the expanding tourism sector.

Post-COVID, the travel industry is seeing a significant surge, with 25% more people taking 3 or more trips a year. A growing trend among Millennials and Gen Z shows that 75% of them prefer spending on experiences like travelling over material goods.

Let’s explore the Kotak Nifty India Tourism Index Fund to help you decide if it aligns with your investment goals.

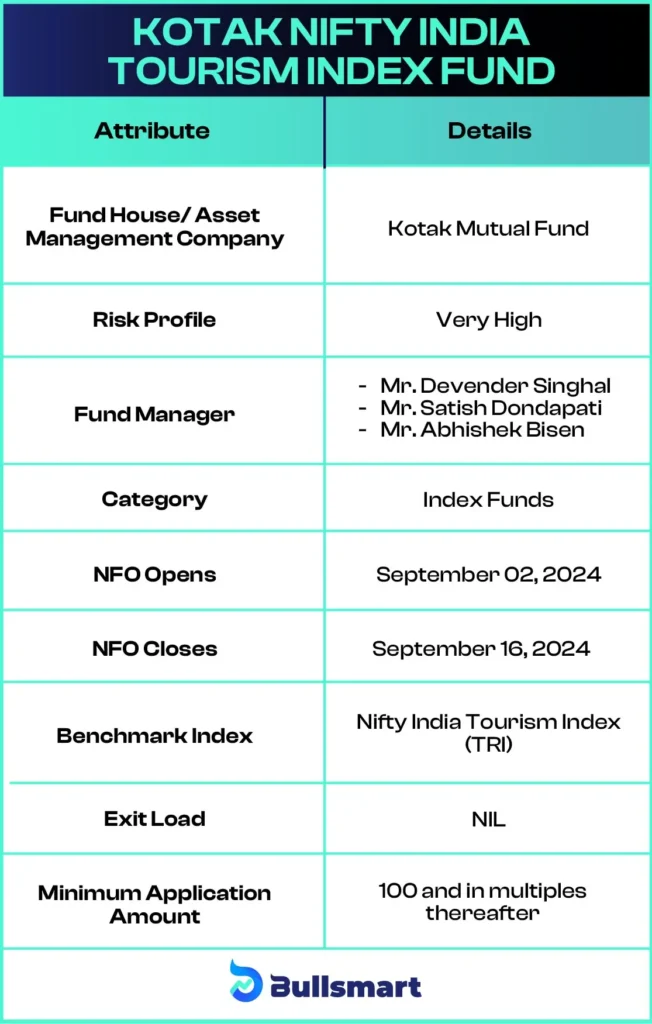

Key Information : Kotak Nifty India Tourism Index Fund NFO

The Kotak Nifty India Tourism Index Fund is an open-ended scheme that replicates/tracks the Nifty India Tourism Index. It’s designed for investors who want exposure to companies benefiting from the rise of tourism in India.

The fund aims to provide returns that correspond to the total returns of the Nifty India Tourism Index, subject to tracking errors.

Investing Strategy of the fund

The primary goal of the scheme is to generate returns that closely mirror the performance of the securities in the Nifty India Tourism Index, before expenses.

Let’s have a quick look at the key basic details of the fund:

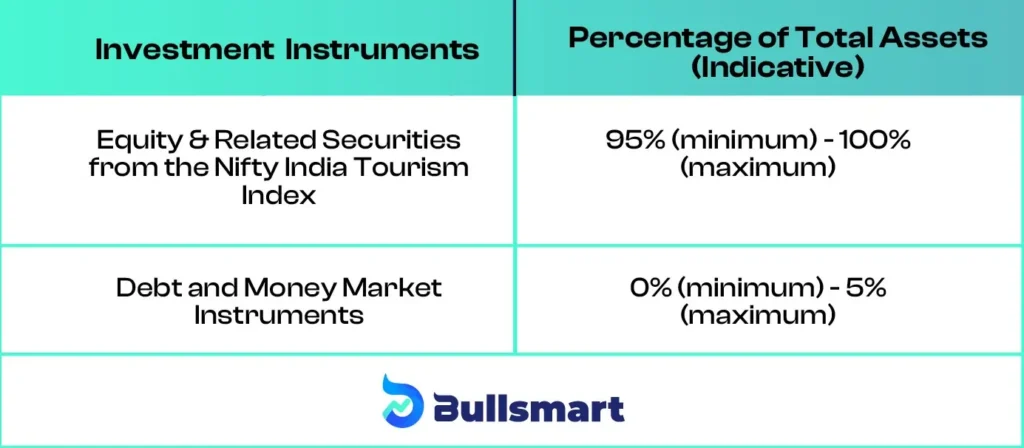

Portfolio Allocation

The asset allocation of Kotak Nifty India Tourism Index Fund NFO is as follows:

Understanding Risks and Returns

The Kotak Nifty India Tourism Index Fund carries a very high-risk profile, given its reliance on equity markets. The fund’s performance depends heavily on the tourism sector, which can be volatile but offers high growth potential in the long term.

The Nifty India Tourism Index (TRI) has delivered 42.75% and 25.19% returns over the past 1 year and 5 years, respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Suggested Read – kotak special opportunities fund

Kotak Mahindra Mutual Fund

Kotak Mahindra Asset Management Company Limited (KMAMC) was founded on August 2, 1994, under the Companies Act of 1956 to manage Kotak Mahindra Mutual Fund (KMMF). As a well-known asset management firm, Kotak has made a significant impact on the market with various innovative investment schemes.

It was the first to introduce a gilt fund, which invests solely in government securities. As of June 30, 2024, Kotak Mutual Fund manages assets worth ₹ 444,792.28 crores, making it one of the top mutual fund companies in India.

Introducing the Fund Managers

The Kotak Nifty India Tourism Index Fund is managed by a team of experienced fund managers:

Mr. Devender Singhal

With over 22 years of experience in fund management and equity research, Mr. Singhal has been managing Kotak AMC’s equity funds since 2015, focusing on multicap and hybrid strategies.

Key Funds Managed: Kotak Multicap Fund, Kotak Consumption Fund, Kotak Multi Asset Allocation Fund.

Mr. Satish Dondapati

Mr. Dondapati has over 16 years of expertise in managing ETFs and joined Kotak AMC in 2008. His background includes working with Centurion Bank of Punjab.

Key Funds Managed: Kotak Nifty 50 ETF, Kotak Nifty 200 Momentum 30 Index Fund, Kotak Nifty Financial Services Ex-Bank Index Fund.

Mr. Abhishek Bisen

Mr. Bisen has been with Kotak AMC since 2006, specializing in debt fund management. He previously worked with Securities Trading Corporation of India in fixed income sales and trading.

Key Funds Managed: Kotak Bond Short Term Fund, Kotak Gilt Fund, Kotak Banking and PSU Debt Fund.

Ideal Investors for This Fund

The Kotak Nifty India Tourism Index Fund NFO may be suitable for investors who are:

- Looking for long-term capital appreciation

- Comfortable with high-risk investments

- Seeking exposure to the growing tourism sector

- Willing to invest for at least 5 years or more

This fund is designed for those who want to benefit from the rapid growth of India’s tourism industry, which has become a critical component of the country’s economy.

However, as with all investments, there are risks involved, and it is recommended to consult with a financial advisor to ensure this fund fits your overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.