A business cycle refers to the natural rise and fall in economic activity over time. It comprises four phases namely, Expansion, Peak, Contraction, and Trough. India’s economy goes through regular business cycles, impacting various sectors differently at each stage.

Investors can benefit from identifying these phases and positioning their portfolios to take advantage of the opportunities these cycles present.

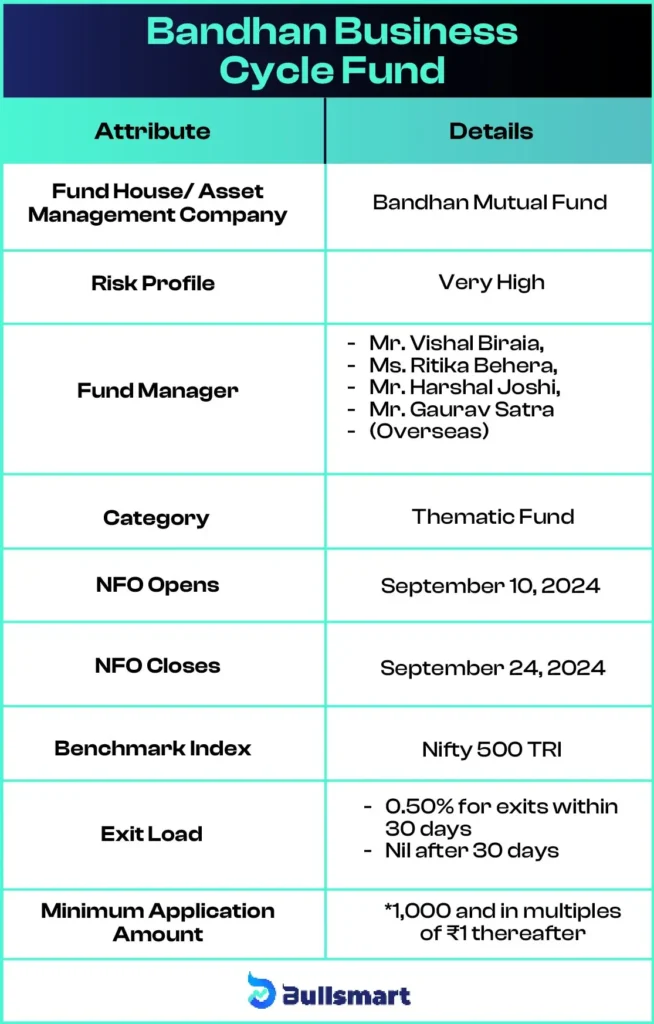

One way to do this is through the NFO launched by Bandhan Mutual Fund. The Bandhan Business Cycle Fund, which leverages the business cycle approach to dynamic sector allocation.

Let’s explore the details of this NFO to see if it aligns with your investment strategy.

Understanding Bandhan Business Cycle Fund NFO

The Bandhan Business Cycle Fund is an open-ended equity scheme designed to follow a business cycle-based investing theme. Bandhan Business Cycle Fund allows investors to dynamically allocate between sectors and stocks, depending on the stage of the economic cycle.

The fund’s benchmark is the Nifty 500 TRI, and it focuses on long-term capital appreciation by adjusting to shifts in the business cycle across various sectors.

Investment Objective of the fund

The scheme aims to generate long-term capital appreciation by investing predominantly in equity and equity-related instruments, following a business cycle-based investment approach. This dynamic allocation helps the fund capitalize on sectors and stocks best positioned for growth at different phases of the economic cycle.

Here’s a look at the key basic details of the fund:

Portfolio Allocation

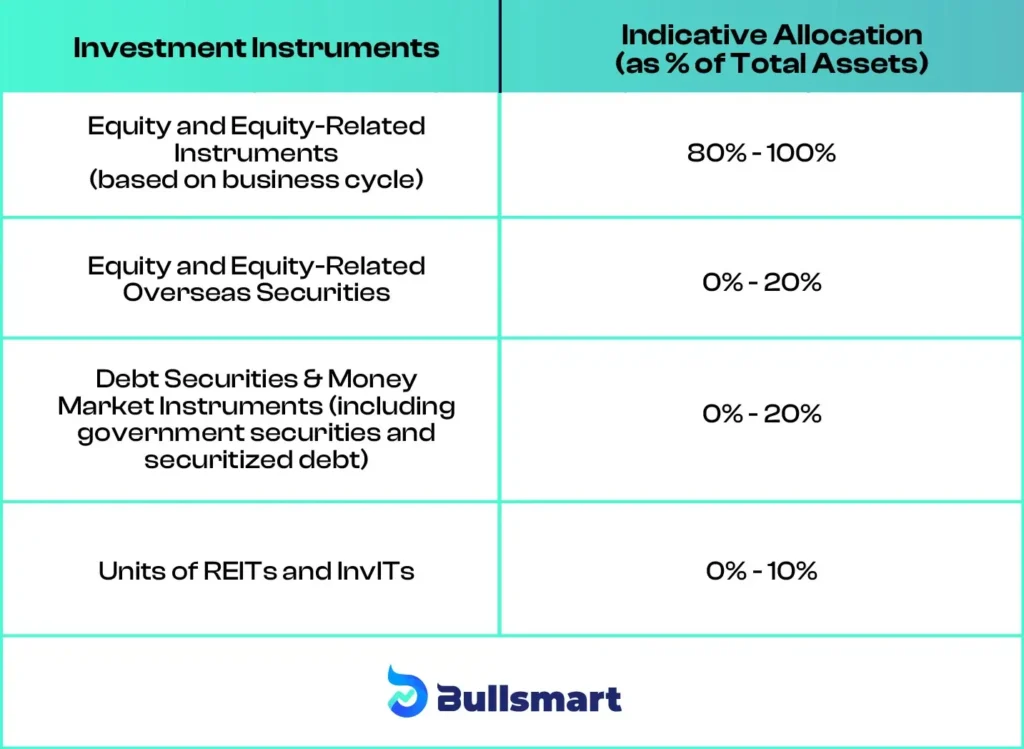

The asset allocation of the Bandhan Business Cycle Fund is as follows:

Understanding Risks and Returns

The Bandhan Business Cycle Fund carries a very high-risk profile due to its equity-heavy portfolio. However, the dynamic nature of the fund allows it to shift between sectors based on the economic cycle, potentially maximizing returns while managing risk.

Since the fund’s benchmark is the Nifty 500 TRI, its objective is to perform in line with or exceed the returns of this index, which has delivered returns of 33.13%, 17.84%, and 22.62% over the past 1 year, 3 years, and 5 years, respectively.

Bandhan Mutual Fund

Founded in 2000, Bandhan Mutual Fund is among the top 10 fund houses in India by Assets Under Management (AUM). The company has a talented investment team spread across over 60 cities, dedicated to helping people grow their savings through smart investment strategies.

Before it became Bandhan Mutual Fund, the company was known as IDFC Mutual Fund, part of IDFC Ltd. Since its establishment in 2000, IDFC Mutual Fund has been instrumental in the development of India’s mutual fund industry. As of June 30, 2024, the company’s AUM was ₹148,741.98 crore.

Some of the popular funds offered by the AMC include the Bandhan Infrastructure Fund, which has delivered the highest returns in its category within the last 10 years.

Bandhan ELSS Tax Saver Fund and Bandhan Large Cap Fund are also the top-performing funds of the AMC.

Meet the Fund Managers

The Bandhan Business Cycle Fund is handled by a team of experienced fund managers:

Mr. Vishal Biraia

Vice President of Fund Management for Equities, joined Bandhan AMC in June 2023. With a background in research and fund management from Max Life Insurance and Aviva Life Insurance, he oversees the Bandhan Balanced Advantage Fund, Bandhan Infrastructure Fund, and Bandhan Retirement Fund.

Ms. Ritika Behera

Vice President of Equities, started with Bandhan AMC on August 10, 2023. With over 13 years of experience from Ocean Dial Asset Management and Elara Securities, she manages the Bandhan US Equity Fund of Fund and other schemes that invest in overseas equities.

Mr. Harshal Joshi

Vice President of Fund Management, has been with Bandhan AMC since December 2008. With more than 14 years of mutual funds, he manages a range of funds, including the Bandhan Equity Savings Fund and Bandhan Government Securities Fund – Constant Maturity Plan.

Mr. Gaurav Satra

Assistant Manager – Equity, joined Bandhan AMC in June 2022 as an Equity Dealer. He brings over 7.5 years of experience from consultancy roles and handles the Bandhan US Equity Fund of Fund along with other schemes focused on overseas equity investments.

Suggested Read – Bandhan BSE Healthcare Index Fund NFO

Who should invest in this NFO?

The Bandhan Business Cycle Fund may be suitable for investors who are:

- Seeking long-term capital appreciation

- Comfortable with high-risk, equity-oriented investments

- Looking for exposure across different sectors based on the business cycle

- Willing to invest for a minimum of 5 years or more

This fund is designed for those who want to benefit from the shifts in the business cycle, dynamically adjusting their portfolio to capture growth opportunities in various sectors.

It’s important to remember that all investments carry some level of risk. Therefore, investors should consult their financial advisors to determine whether this fund fits their investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.