When you invest in Mirae Asset Large & Midcap Fund, your investments are directed towards India’s top blue chip stocks, which are working on India’s major projects, along with emerging companies in the mid-cap segment. Intriguing, don’t you think? It is more like investing in a playlist where every song is a hit–some are classic tracks that have been released by A-List musicians while others are fiery songs which were done by up-and-coming artists.

And amid all these jingles comes the Mirae Asset Large & Mid-Cap fund–this is your one-stop shop for dishing out that traditional big-cap safety with some mid-cap spotlight overtones. The fund used to be called “Mirae Asset Emerging Bluechip Fund” until December 15th, 2023 when it was renamed.

Feeling curious to uncover what makes Mirae Asset Large & Midcap Fund so elite? Let’s spill the tea on all the deets!

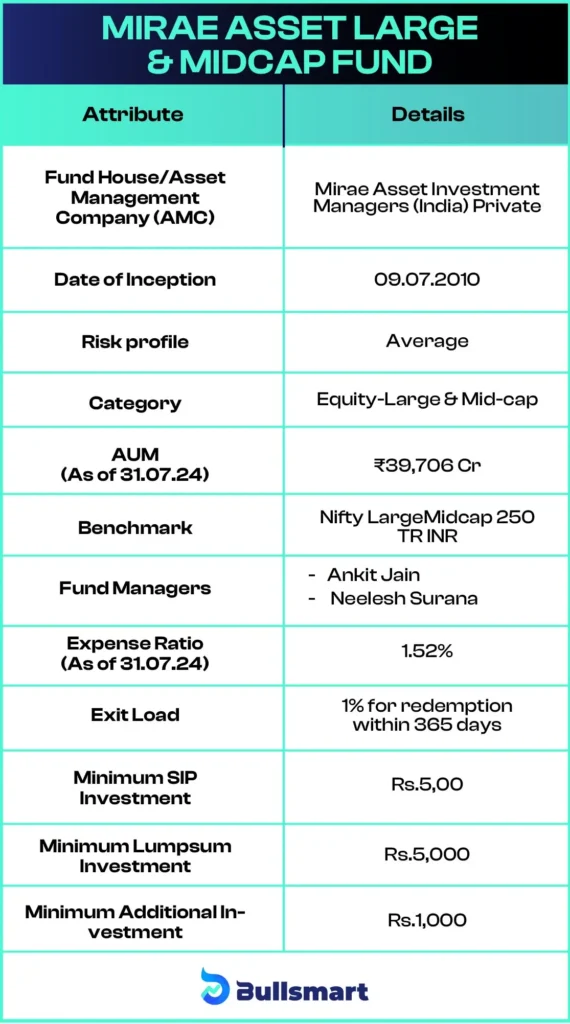

Details of Mirae Asset Large & Midcap Fund

Mirae Asset’s Large & Midcap Fund (formerly known as Mirae Asset Emerging Bluechip Fund) invests in India’s large-cap (35-65%) and midcap(35-65%) companies with an equity orientation. Its strategy is to provide investors with both capital appreciation and income through diversified investments in these firms. For long-term investment purposes, Mirae Asset Large & Midcap Fund aims at providing returns that are higher than inflation rate as well as better than fixed-income securities for five years or longer periods.

Here are some details about it:

Portfolio Analysis

The Mirae Asset Large & Midcap fund is tailored for investing in large-cap and mid-cap companies alike in a bid to emphasize financial services(24.99%) and industrials(14.2%).

Overall, the fund currently invests 65.78% in large-cap, 31.25% in midcap and 02.97% in small-cap stocks, hinting it’s tendency to avoid entering murky waters and establishing a sense of stability by investing maximum corpus in large and midcap stocks.

The major investments made here include well-known institutions such as HDFC Bank accounting for about 5.38% share in its total portfolio, Axis Bank (3.64%), L& T (3.18%) among other significant players like Reliance Industries Limited at (2.24%). By doing so, this mix tries to tap into both the stability associated with old large corporations as well as new dynamic growth potentials from smaller ones.

Clearly, with almost no cash at all—Mirae Asset Large & Midcap Fund is highly leveraged since only 0.8% of it’s corpus is comprised in cash. This strategy enables it to maintain stability while at the same time pursuing growth, a combination that enhances diversification and ultimately leads to impressive returns. Balancing the two extremes—excitement of new investments versus the reliability of big players—is what this arrangement is all about.

Risks and Returns of Mirae Asset Large and Midcap Fund

Risks Metrics

Moderate to high-risk actions are packed in the Mirae Asset Large & Midcap Fund. It balances large caps that are more stable with mid caps which have greater potential for growth but a rollercoaster ride. Higher returns may be seen from that mixture although it equally exposes investors to higher volatility, especially when the market is volatile. Likewise, this focus on mid-caps brings about liquidity risk where buying or selling cannot happen without disturbing stock prices.

Mirae Asset Large & Midcap Fund’s risk largely depends on its degree of diversification across investments. Its coverage includes both large and mid-cap stocks however excessive concentration in one sector such as finance or industry can amplify its risks. Additionally, factors such as changing interest rates and prevailing market sentiments could adversely affect its performance.

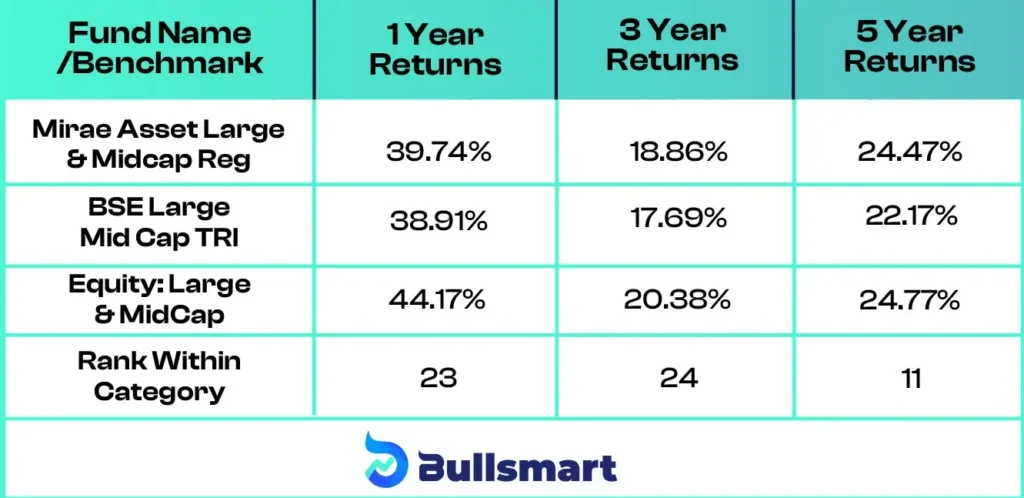

SIP Returns

The Mirae Asset Large & Midcap Fund has been holding its fort quite well, though it is not always the center of attraction. In the short term, it presents slightly below its benchmark as well as the average for its category. However, on longer stretches like five years, it flaunts itself competing with other market trends – beating benchmarks and even outpacing category averages themselves sometimes. Its rank changes from lower spots in the short run to better positions over a longer period of time, while shining brightly at positions two and one during past seven & ten years respectively.

A look at this table would help you understand these numbers more simply:

Update date: 04 September 2024

So, if you’re thinking of a long game, this fund could be worth the ride.

Meet the Fund Managers

Ankit Jain

- More than 7 years’ worth experience in the field of investment analysis & fund management.

- In 2015 September, he joined Mirae Asset Mutual Fund AMC as a Research Analyst.

- He had also worked for companies like Equirus Securities Pvt Ltd & Infosys Ltd.

- Known for insightful analyses as well as successful portfolio management.

Neelesh Surana

- Almost 24 years of expertise in the financial arena, facilitating wealth operations.

- Custodian of distributed schemes with a profound strategic perspective.

- Former top portfolio holder at ASK Investment Managers Pvt. Ltd.

- Commanded both inland and overseas portfolios with adeptness exhibiting comprehensive cognizance and technique.

Suggested Read – ITI Large and Midcap Fund NFO Review

Who should invest in the Fund?

Mirae Asset Large & Midcap Fund is perfect for investors who want a combination of stability and growth because it earns the reliability in large-cap stocks together with the hope that exists in mid-cap. Hence, if you can handle some volatility, it would be an ideal investment option. Mirae Asset Large & Midcap Fund can be utilized by investors that have plans to give their money time to grow over five years or even beyond.

If you seek an investment portfolio that is more balanced but can, however, prepare itself for fluctuations in stock prices, then this is what you need. The fund aims to offer good returns in the future through diversification between established companies and emerging firms, albeit it should only target individuals willing to take risks and hold onto their investments for an extended period.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.