When it comes to investing in equity mutual funds, large-cap funds are often a preferred choice for many investors. These funds focus on investing in well-established, financially sound companies with a proven track record of performance.

Large-cap companies tend to be market leaders, providing investors with a mix of stability and the potential for steady returns. The Baroda BNP Paribas Large Cap Fund is one such fund that aims to capitalize on the strengths of large-cap companies, offering a balanced approach to long-term investment. The fund has generated a return of 20.53% on an annualized basis in the last 5 years.

The fund’s asset allocation is predominantly focused on equity investments, which account for 96.25% of the total assets. A smaller portion, 4.71%, is allocated to debt instruments, providing a slight cushion against the market.

Overview of Baroda BNP Paribas Large Cap Fund

The Baroda BNP Paribas Large Cap Fund is an open-ended equity scheme that predominantly invests in large-cap stocks. This category of funds typically focuses on established and financially robust companies, which are often leaders in their respective industries.

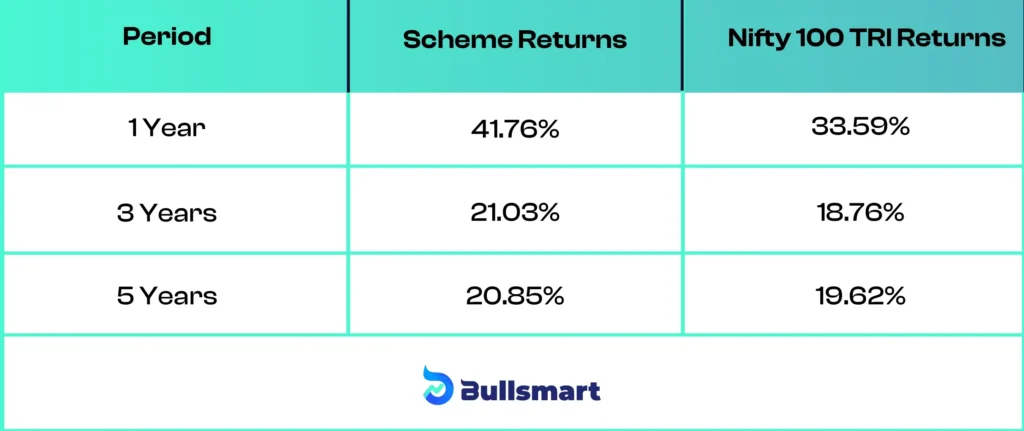

The fund considers the Nifty 100 TRI as its benchmark.

Investment Objective of the fund

The fund aims to provide long-term capital appreciation by investing in large-cap companies with proven growth records and strong market positions.

Let’s have a quick look at the key basic details of the fund:

Portfolio Allocation

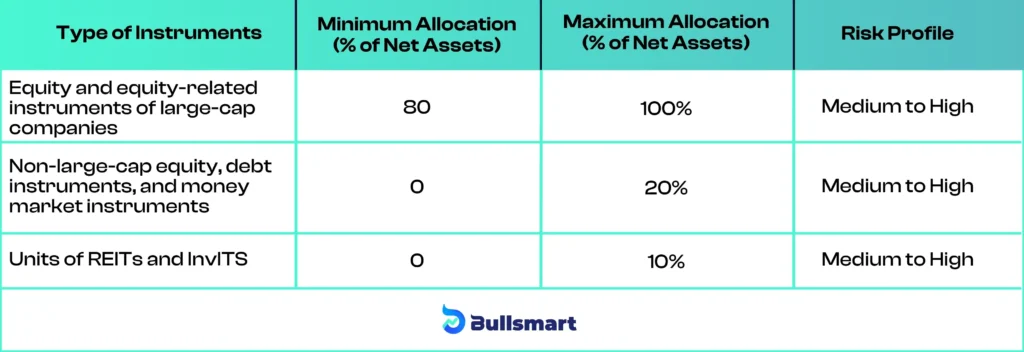

The fund aims to allocate its assets as follows:

Maximizing Returns While Managing Risk

The Baroda BNP Paribas Large Cap Fund offers investors exposure to well-established companies that are better equipped to handle market volatility.

These companies are usually leaders in their respective industries and have a history of providing stable returns over the long term.

The scheme has consistently given better returns as compared to the benchmark.

Baroda BNP Paribas Mutual Fund

Baroda BNP Paribas Mutual Fund is one of the leading mutual fund companies in India, offering a wide range of investment options. The company is known for its disciplined investment approach and its Growth-at-Reasonable Price (GARP) strategy.

Baroda BNP Paribas Mutual Fund is a part of BNP Paribas Asset Management, which oversees nearly ₹42 trillion in assets worldwide.

With a presence in India for over 150 years, the company provides 35 different schemes, including equity, hybrid, and debt funds. As of June 30, 2024, it manages assets worth ₹ 39,957.24 crore.

Some of the popular funds offered by the AMC include the Baroda BNP Paribas Midcap Fund, which has generated a consistent return amongst Mid Cap funds in the last 5 years.

Baroda BNP Paribas India Consumption Fund is one of the best in protecting against volatility within its category, and Baroda BNP Paribas ELSS Tax Saver has maintained a track record among the ELSS funds category in the last 2 years.

Meet the Fund Managers

Baroda BNP Paribas Large Cap Fund is managed by Mr. Jitendra Sriram

He brings 25 years of experience in the financial industry. Most recently, he served as Senior Vice President – Equity Fund Manager at Prabhudas Lilladher Portfolio Management Services. Before that, he held positions at several other organizations, including Max Life Insurance Company Private Limited, HSBC Securities & Capital Markets (India) Private Limited, and HSBC Asset Management (India) Private Limited.

Mr. Sriram holds an MBA with a specialization in Finance and a Bachelor of Engineering degree in Electrical & Electronics Engineering.

Suggested Read – Baroda BNP Paribas Dividend Yield Fund NFO

Who should invest in Baroda BNP Paribas Large Cap Fund?

The Baroda BNP Paribas Large Cap Fund is suitable for investors looking for long-term capital appreciation with moderate risk.

This fund is ideal for investors with a long-term investment horizon who prefer stability and consistent returns over higher-risk investments.

If you are a new investor or a seasoned one looking to diversify your portfolio with a focus on blue-chip companies, this fund could be a good fit for your investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.