Investors have a positive outlook on the Indian economy due to its growth initiatives, which makes small-cap funds a compelling choice. Investing in small-cap mutual funds allows investors to tap into this growth potential by offering a diversified selection of promising stocks.

However, given the large number of small-cap companies in the market, selecting the right ones can be challenging. Small-cap mutual funds provide investors with exposure to a diversified portfolio of stocks, helping them identify those with substantial growth potential.

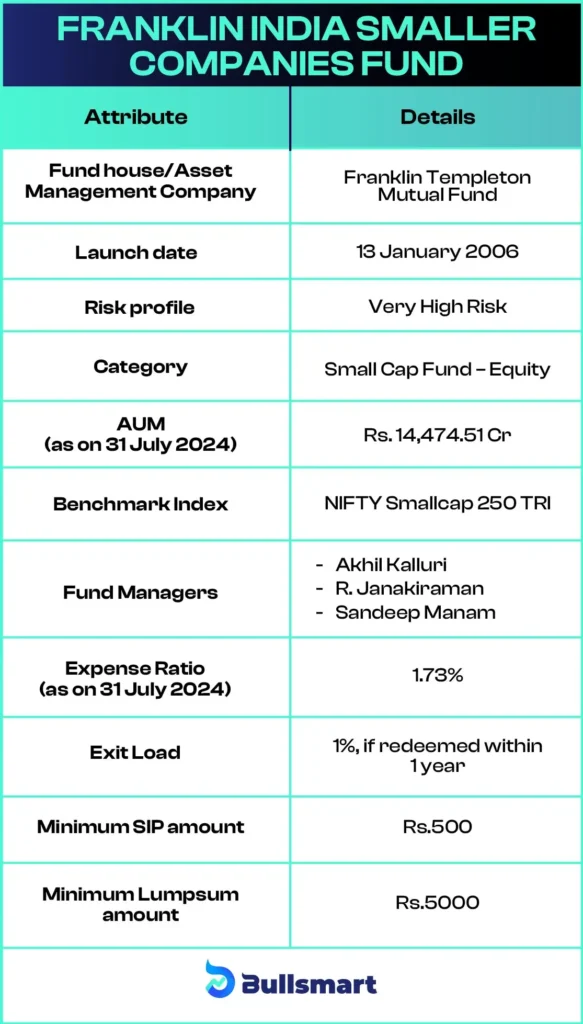

Franklin Templeton AMC introduced the Franklin India Smaller Companies Fund on January 13, 2006, aiming to leverage the growth momentum in the small-cap sector.

In this blog, we will explore whether the Franklin India Smaller Companies Fund could be a valuable addition to your investment portfolio.

Franklin India Smaller Companies Overview

The Franklin India Smaller Companies Fund is an open-ended equity scheme that predominantly invests in equity and equity-linked securities within the small-cap segment, and it aims to generate long-term capital appreciation.

This fund is launched by Franklin Templeton Asset Management, a globally renowned investment firm with a strong presence in India since 1996. The fund considers “Nifty Small Cap 250 TRI” as its benchmark index.

Let’s have a look at the basic details of the fund:

The expense ratio of the fund is 1.73%, which is lower than the category average of 1.85%, indicating that the fund is more affordable.

Portfolio Analysis

The fund allocates 94.98% of its investments to domestic equities, with 2.52% in large-cap stocks, 9.13% in mid-cap stocks, and 50.02% in small-cap stocks and 33.31% in others. The fund currently holds 91 stocks in its portfolio.

This fund features a dynamic portfolio with top stocks such as Brigade Enterprises Ltd, Deepak Nitrite Ltd, Kalyan Jewelers India Ltd, Equitas Small Finance Bank Ltd, Karur Vysya Bank Ltd, Crompton Greaves Consumer Electricals Ltd and Amara Raja Batteries Limited. These high-impact companies drive the fund’s potential for impressive growth.

Understanding the Risk-Return Profile of Fund

Franklin India Smaller Companies Fund is a high-risk fund as it invests entirely in equities and equity-related instruments, primarily focusing on small-cap companies. While small-cap companies have the potential for substantial returns due to their growth potential, they may also experience significant downturns during periods of market volatility.

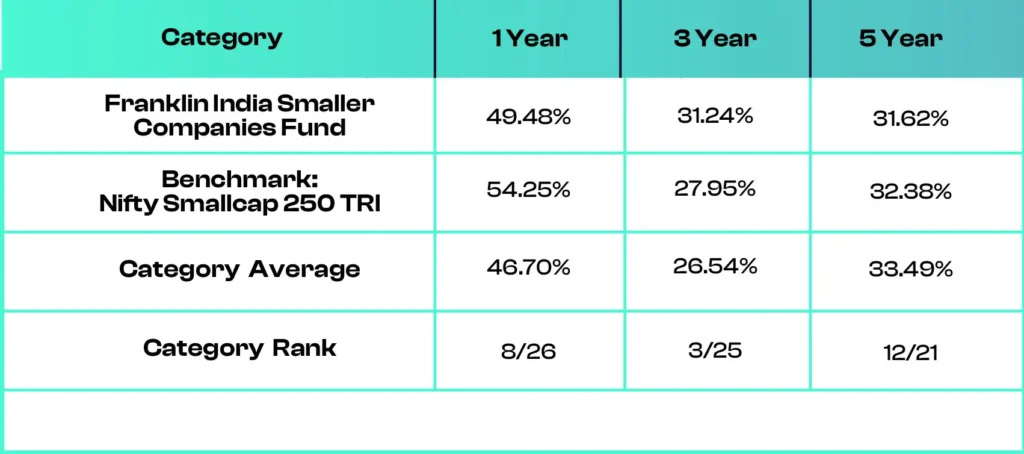

Let’s take a quick sneak peek at the returns of this fund and its benchmark index over the years:

Note: the returns mentioned above as of 29 August 2024.

This fund has consistently outperformed its category average demonstrates its superior performance and robust returns compared to its peers. However, past performance is not an indicator of future returns.

Suggested Read – Franklin India Ultra Short Duration Fund NFO

Meet the Fund Managers

The fund is managed by a team of experienced professionals, each bringing significant expertise to the table.

R. Janakiraman has over 27 years of experience and is the Senior Vice President and CIO for Emerging Markets at Franklin Templeton. Before joining Franklin Templeton Investments, he worked with Indian Syntans Investment Pvt. Ltd., Citicorp Information Technologies Ltd., and UTI Securities Exchange Ltd.

Akhil Kalluri has over 12 years of experience and is the AVP and Senior Research Analyst at Franklin Templeton. Prior to joining Franklin Templeton Mutual Fund, he worked with Credit Suisse and ICICI Securities.

Sandeep Manam holds a B.Tech and PGDM from IIM. He has over 12 years of experience and has been managing this fund since 2021.

Who should invest in the fund?

It is a high-risk, high-return fund. Hence, investors seeking high returns and willing to take very high risks can consider investing in Franklin India Smaller Companies Fund. It aims for long-term wealth creation, making it best suited for those looking to invest for more than five years.

It is always advisable to conduct thorough research on the fund or consult a financial advisor before investing.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.