Recently, Franklin Templeton, a well-known name in the investment world, launched its own multi-cap offering – the Franklin India Multi Cap Fund. The New Fund Offer (NFO) opened on July 8, 2024, and closed on July 22, 2024. The fund has now reopened for ongoing investments from July 31, 2024.

Multi-cap funds are equity-oriented funds that invest in a variety of market caps and sectors, providing investors with a broad portfolio and exposure to key sectors of the Indian economy. These funds offer a unique blend of stability from large caps, growth potential from mid-caps, and the possibility of discovering hidden gems in small caps.

As investors consider whether to add this fund to their portfolio, it’s important to understand its features, potential benefits, and risks.

This blog will help you decide if the funds align with your financial goals or not.

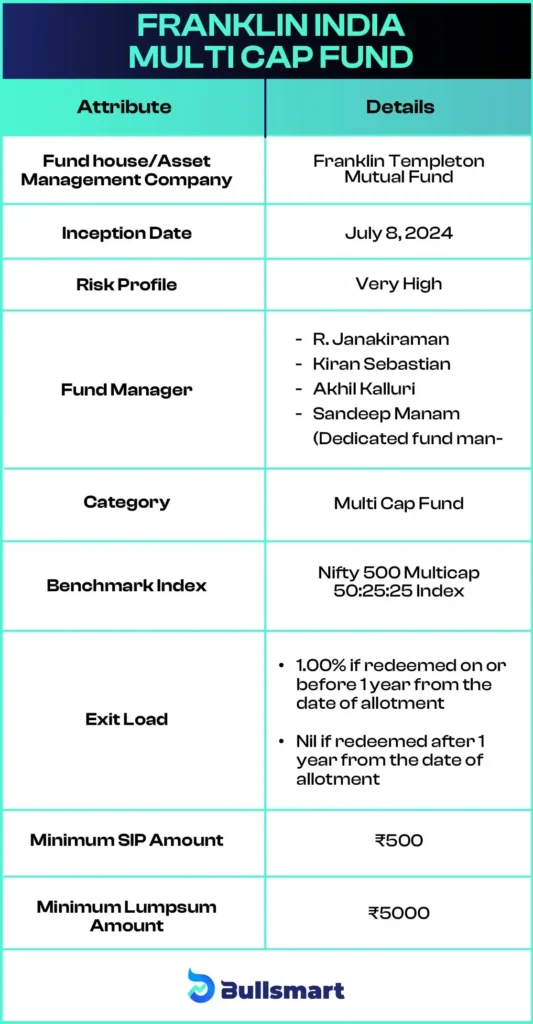

Details of Franklin India Multi Cap Fund

The Franklin India Multi Cap Fund is an open-ended equity scheme that invests across large cap, midcap, and small cap stocks. This fund is designed for investors looking for long-term capital appreciation through a diversified equity portfolio.

The fund considers the Nifty 500 Multicap 50:25:25 Index as its benchmark.

Investment Objective of the fund

The Scheme aims to generate long-term capital appreciation by investing predominantly in equity and equity-related securities across large cap, midcap, and small cap stocks.

Let’s have a quick look at the key basic details of the Franklin India Multi Cap Fund:

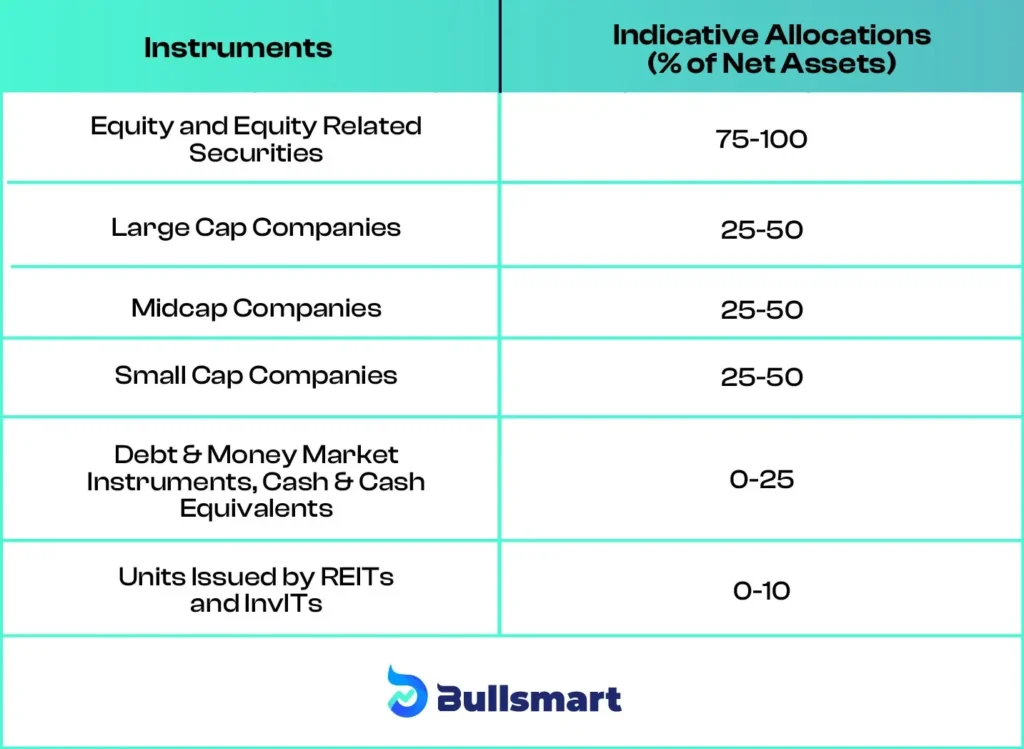

Portfolio Analysis of the Fund

The fund will invest across large cap, midcap, and small cap stocks, following a blend of ‘growth’ and ‘value’ investment styles.

Understanding Risks and Returns

As a newly launched fund, the Franklin India Multi Cap Fund doesn’t have a performance track record yet. However, its multi-cap nature aims to balance the stability of large caps with the growth potential of mid and small caps.

The fund carries a “High Risk”, reflecting the inherent volatility in equity markets.

Nifty 500 Multicap 50:25:25 TRI has delivered appreciable returns of 44.83%, 23.37%, and 26.90% over the past 1 year, 3 years, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Suggested Read – Franklin India Ultra Short Duration Fund NFO

Franklin India Mutual Fund

Franklin Templeton has been a globally renowned investment firm with a strong presence in India since 1996. The Franklin India Mutual Fund offers a wide range of mutual fund schemes across various categories.

The AMC currently manages an AUM of ₹ 103,943.77 crore as of 30 June 2024.

Meet the Fund Managers

The fund is managed by a team of experienced professionals:

R. Janakiraman

Age 52, with 27 years of experience, R. Janakiraman is the Senior Vice President and CIO for Emerging Markets at Franklin Templeton in Chennai. He has previously managed investments at Indian Syntans and provided domain knowledge at Citicorp Information Tech Ltd.

Kiran Sebastian

Age 43, Kiran Sebastian is an AVP & Senior Research Analyst based in Chennai with 19 years of experience. He focuses on global equities research and portfolio recommendations, previously working at ARGA Investment Management.

Akhil Kalluri

Age 35, Akhil Kalluri is an AVP & Senior Research Analyst in Chennai with 12 years of experience. He specializes in stock research, particularly in small and midcap stocks, and has previously worked with Credit Suisse and ICICI Securities.

Sandeep Manam

Age 36, Sandeep Manam is an AVP/Senior Research Analyst with 13 years of experience, specializing in automotive and airline sectors. He previously managed foreign securities investments and was involved in Franklin India Feeder funds.

Who should invest in this fund?

The Franklin India Multi Cap Fund may be suitable for investors who:

- Have a long-term investment horizon

- Seek capital appreciation through equity investments

- Are comfortable with high-risk

- Want exposure to stocks across market capitalisations

The Franklin India Multi Cap Fund offers a way to invest across different market segments through a single fund. Its diversified approach aims to capture opportunities across large, mid, and small-cap stocks. However, as with all equity investments, it carries high risk and is best suited for long-term investors.

Remember, this is a new fund without a performance history. It’s crucial to align any investment with your financial goals and risk tolerance. Consider consulting a financial advisor to determine if this fund fits well within your overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.