The Franklin India Ultra Short Duration Fund falls under the Debt Fund category and is typically designed for investment horizons of 3 to 6 months. These funds are considered low-risk due to their shorter lending durations and offer slightly higher returns compared to liquid funds.

At present, there are 25 schemes under this category giving an average return of 6.87% over a 1 year duration. Among these, Franklin Templeton has recently launched the Franklin India Ultra Short Duration Fund.

This blog will help you understand the investment objective of the fund and whether this fund is worth a try or not.

Details of Franklin India Ultra Short Duration Fund

The Franklin India Ultra Short Duration Fund is an open-ended ultra-short term debt scheme that invests in instruments with a Macaulay Duration between 3 to 6 months. This fund is designed for investors looking for short-term regular income.

The fund considers the Nifty Ultra Short Duration Debt Index A-I as the benchmark.

Investment Objective of the NFO

The Scheme aims to provide regular income and liquidity by investing in a portfolio of debt and money market instruments.

Let’s have a quick look at the key basic details of the fund:

Portfolio Allocation

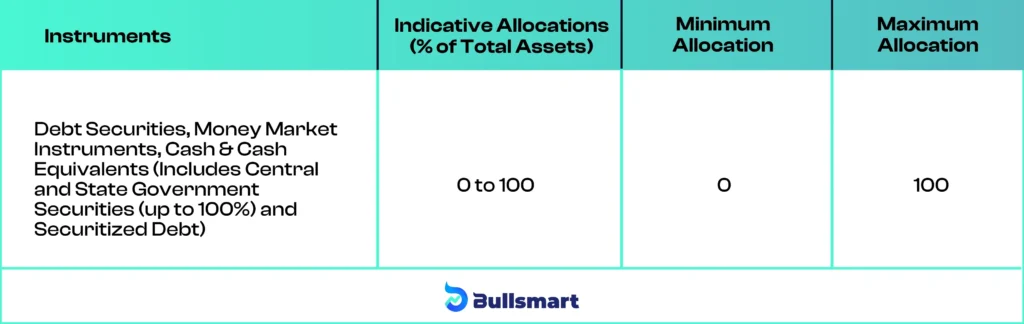

The asset allocation of the Franklin India Ultra Short Duration Fund is as follows:

Understanding Risks and Returns

The Franklin India Ultra Short Duration Fund carries a relatively low interest rate risk and moderate credit risk profile. This risk profile suggests that the fund aims to provide stable returns while managing the potential for default risk.

Nifty Ultra Short Duration Debt Index A-I has delivered returns of 7.55%, 6.10%, and 5.74% over the past 1 year, 3 years, and 5 years respectively.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Franklin Templeton Mutual Fund

Franklin Templeton is a global investment management organization with a rich history dating back to 1947. In India, Franklin Templeton started its operations in 1996 and has since become one of the leading fund houses in the country.

Franklin Templeton Asset Management (India) Pvt. Ltd. manages Franklin Templeton Mutual Fund. The company offers a wide range of investment solutions across equity, hybrid, and fixed-income categories.

As of 30 June 2024, Franklin Templeton Mutual Fund manages assets worth ₹ 103,943.77 crore.

Meet the Fund Managers

The fund is managed by Mr Pallab Roy and Mr Rahul Goswami.

Pallab Roy

With an MBA in Finance, M.Com., and DBF, Pallab Roy is an Assistant Vice President and Portfolio Manager for Fixed Income at Franklin Templeton Asset Management, based in Mumbai. He has 22 years of experience, having managed liquidity and portfolio MIS for various fixed-income funds at Franklin Templeton since June 2001.

Rahul Goswami

Rahul Goswami, holding a BSc in Mathematics and an MBA in Finance, is the Chief Investment Officer and Managing Director for Fixed Income at ICICI Prudential Asset Management, based in Mumbai. With 27 years of experience, he previously led fixed-income fund management at ICICI Prudential and Standard Chartered Bank.

Who should invest in this NFO?

The Franklin India Ultra Short Duration Fund may be suitable for investors with specific goals and risk tolerance. This fund is designed for those who are looking for:

- Short-term regular income

- Investment in debt & money market securities

- A relatively low interest rate risk and moderate credit risk profile

It’s best suited for investors who prefer stability in their short-term investments but are comfortable with a moderate level of credit risk. If you’re interested in earning regular income while maintaining liquidity, this fund could align with your investment objectives.

However, it’s important to remember that all investments carry some level of risk, and investors should carefully consider their financial goals and risk tolerance before investing. As always, consulting with a financial advisor is recommended to determine if this fund fits well within your overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.