As investors increasingly turn to Systematic Investment Plans (SIPs) for long-term wealth creation, a recent study by brokerage Geojit highlights the power of patience and consistency in mutual fund investing. The study revealed that 74% of 5-year SIP returns in the Sensex exceeded 10% CAGR, while an impressive 93.5% of 10-year SIP returns surpassed the same benchmark.

These findings underscore the potential of funds like JM Flexicap Fund to deliver substantial returns over time. The JM Flexicap has emerged as a top contender in the mutual fund space, delivering an impressive 80% return over the past year through SIPs.

This exceptional performance puts this fund at the forefront of the top 10 performing mutual fund SIPs, based on present value and XIRR (annualized returns).

Let’s explore more about this fund.

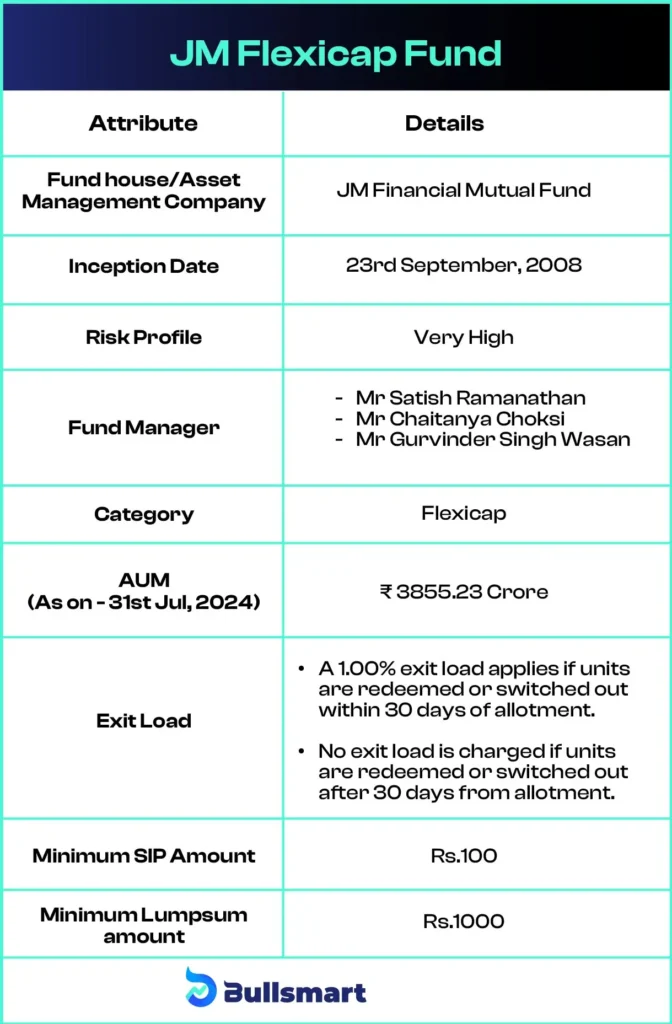

Details of JM Flexicap Fund

The JM Flexicap Fund is an open-ended diversified equity fund that aims to provide capital appreciation by investing in stocks across various market capitalisations. Launched on September 23, 2008, this fund has a track record of over 15 years in the Indian equity market.

The fund considers the BSE 500 TRI as the benchmark and the Nifty 50 TRI as an additional benchmark.

Investment strategy of fund

The JM Flexicap Fund is designed with a clear and focused goal in mind. As an open-ended diversified equity fund, its primary objective is to provide capital appreciation to investors. The fund aims to achieve this by investing primarily in equity and equity-related securities across various market capitalisations.

Let’s have a quick look at the key basic details of the fund:

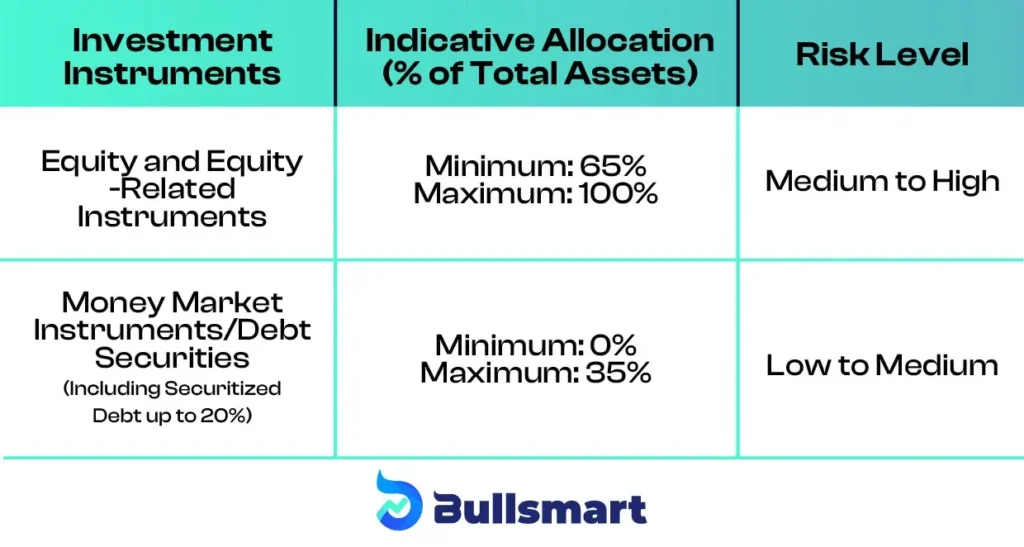

Portfolio Construction of JM Flexicap Fund

The asset allocation of the JM Flexicap Fund is as follows:

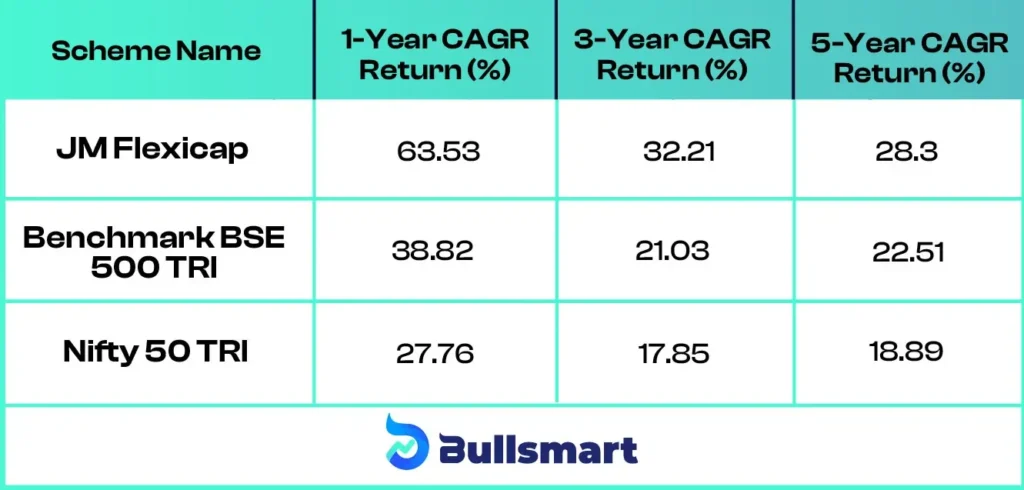

Understanding Risks and Returns

The JM Flexicap Fund carries a very high-risk profile but is equally capable of generating high returns for its investors.

The Fund has significantly outperformed its benchmarks, BSE 500 TRI and Nifty 50 TRI, across the 1-year, 3-year, and 5-year periods.

JM Asset Management Company

JM Financial Mutual Fund was set up in 1994 with strong backing from JM Financial Ltd. The company was created to become a trusted partner for all its stakeholders. JM Financial Asset Management Ltd. was officially registered under the Companies Act of 1956 on June 9, 1994.

JM Financial Ltd. started its journey in the capital markets by launching three funds: JM Equity Fund, JM Liquid Fund (now called JM Income Fund), and JM Balanced Fund. Over time, the company expanded its offerings to include a wide variety of schemes to cater to its customers’ needs. As of June 30, 2024, JM Financial Asset Management Ltd. managed assets totaling ₹ 9,468.76 crore.

Fund Managers of JM Flexi Cap Fund

The fund is managed by Mr Satish Ramanathan, Mr Chaitanya Choksi, and Mr Gurvinder Singh Wasan.

Mr Satish Ramanathan has nearly 30 years of experience in finance, having worked with companies like TATA Economic Consultancy, ICICI Securities, and Franklin Templeton. He currently manages JM Large Cap Fund, JM Midcap Fund, and JM Value Fund.

Mr Chaitanya Choksi brings over 21 years of experience in equity research and capital markets, with a background at UTI and Lotus India AMC. He manages JM Tax Gain Fund and supports several other funds at JM Financial.

Mr Gurvinder Singh Wasan has over 20 years of expertise in fixed-income markets, with experience at ICICI Bank, CRISIL, and Principal AMC. He oversees JM Short Duration Fund, and JM Dynamic Bond Fund, and manages the debt portion for all equity schemes.

Who Should Invest in this Fund?

The JM Flexicap Fund is ideal for long-term investors, particularly those with financial goals such as retirement, a child’s education, or wealth creation. It’s suited for risk-tolerant individuals who are comfortable with market volatility in pursuit of long-term gains.

This fund is also a good option for those seeking diversification across market capitalisations and focusing on capital appreciation over regular income.

Additionally, it’s best for investors who have financial flexibility and do not need immediate access to their invested funds.

It’s best to consider with a financial advisor to determine if this fund fits well within your overall investment strategy.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.