India’s consumer market is growing rapidly, with experts predicting it will reach $4 trillion by 2030. The Axis Consumption Fund, recently launched by Axis Mutual Fund, aims to tap into this growth by investing in companies that benefit from India’s increasing consumption.

Let’s explore this fund to help you decide if it fits your investment goals.

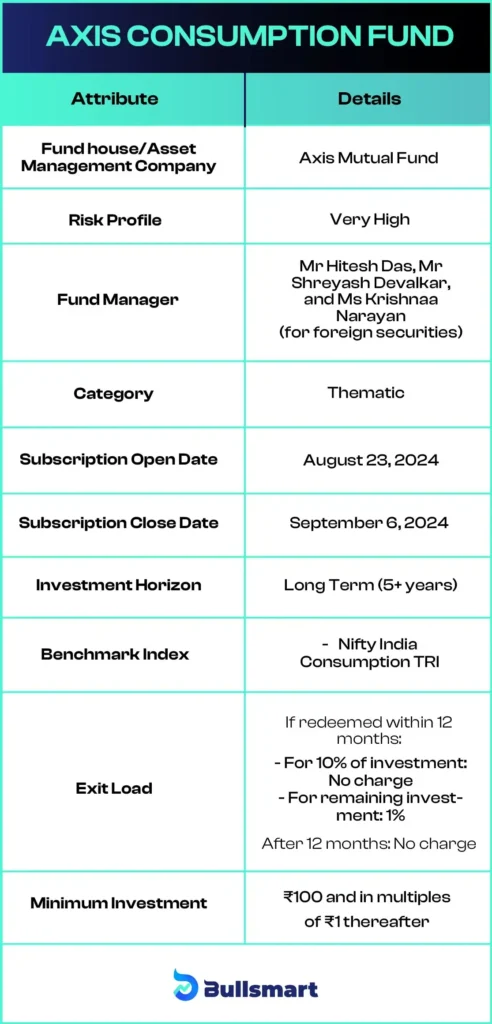

Details of Axis Consumption Fund

The Axis Consumption Fund is an open-ended equity scheme that follows the consumption theme. It invests in companies involved in or benefiting from India’s growing consumer market. This fund is designed for investors looking for long-term capital growth.

The fund considers the Nifty India Consumption TRI as the benchmark.

Investing Strategy of Axis Consumption fund NFO

The Scheme aims to provide long-term capital growth by investing in companies related to consumption and consumption-related sectors.

Let’s have a quick look at the key basic details of the fund:

Portfolio Analysis

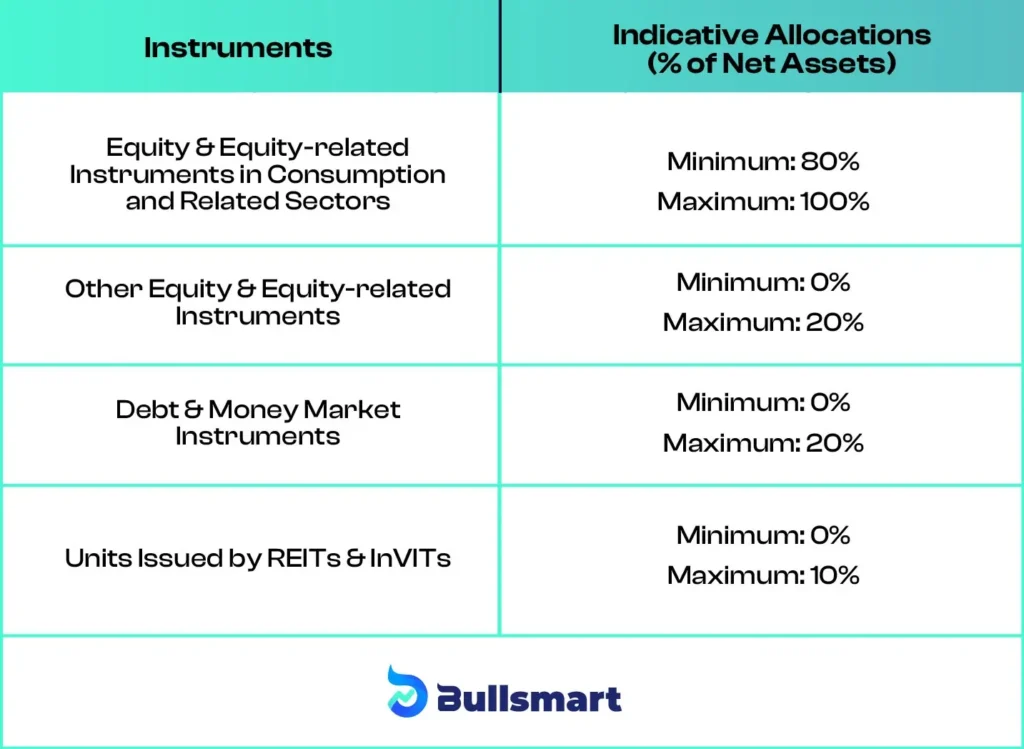

The asset allocation of the Axis Consumption Fund is as follows:

Understanding Risks and Returns

The Axis Consumption Fund NFO carries a very high-risk profile but is equally capable of generating high returns for its investors.

Nifty India Consumption TRI has delivered returns of 26.9% and 19.3% over the past 1-year and 3-years respectively.

Considering a broader perspective, over the past 17 years, the Nifty India Consumption Index has outperformed broader market indices, such as the Nifty 500, in 12 instances. Additionally, during market downturns, the consumption index generally experienced smaller declines.

Since this is the fund’s benchmark, the goal of this fund is to meet or exceed these benchmark returns.

Axis Asset Management Company

Axis Mutual Fund is the investment arm of Axis Bank, one of India’s largest private banks. Established in 2009, Axis Asset Management Company Ltd. (Axis AMC) is a joint venture between Axis Bank, which holds a 74.99% stake, and Schroder Singapore Holdings Private Limited (SSHPL), which owns 24%.

Axis Bank, the third-largest private sector bank in India, serves various customer segments, including large and mid-sized corporates, SMEs, agriculture, and retail businesses.

Schroder Singapore Holdings, founded in 1804 and based in London, manages £731.6 billion globally across equities, fixed income, multi-asset, and alternative investments.

As of 30 June 2024, Axis Mutual Fund manages assets worth ₹ 293,150.56 crore, with over 1.26 crore active investor accounts and operations in more than 100 cities.

Suggested Read – Axis Small Cap Fund Review

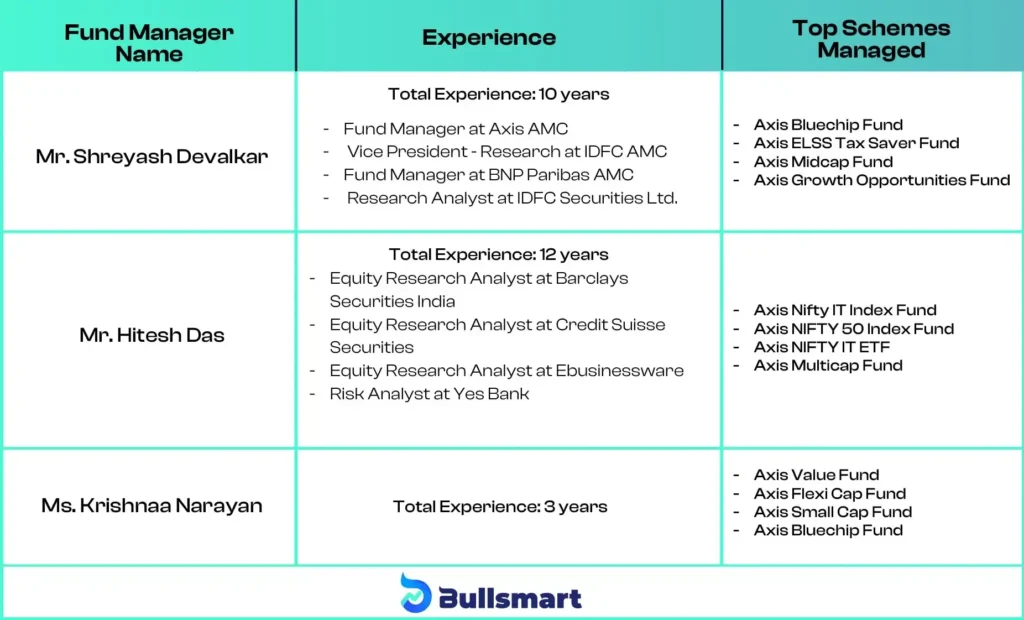

Meet the Fund Managers

The fund is managed by experienced fund managers. Their qualifications and previously managed schemes have been listed below:

Who should invest in Axis Consumption NFO?

The Axis Consumption Fund NFO may be a good fit for investors with specific goals and risk tolerance. This fund is designed for those who are comfortable with a long-term investment approach, typically looking at a horizon of 5 years or more.

It’s best suited for investors who can handle high risk, as the fund’s focus on equity investments in the consumer sector can lead to volatility. If you’re interested in capitalising on India’s expanding consumer market and seeking potential capital appreciation over an extended period, this fund could align with your investment objectives.

However, it’s important to remember that this fund is for those who understand and are comfortable with the risks associated with thematic equity investments.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.