Tata Mutual Funds launched an index Fund, “Tata Nifty 200 Alpha 30 Index Fund” as a New Fund Offer (NFO) on 19th August 2024, which is open for subscription until 2nd September 2024. This fund is crafted to capture the essence of market leaders.

This fund targets top-performing stocks with attractive alpha within the Nifty 200 Index, focusing on companies that consistently stay ahead in the market and deliver strong returns to their investors.

Isn’t that interesting? Then let’s delve into the blog to find out more about Tata Nifty 200 Alpha 30 Index Fund.

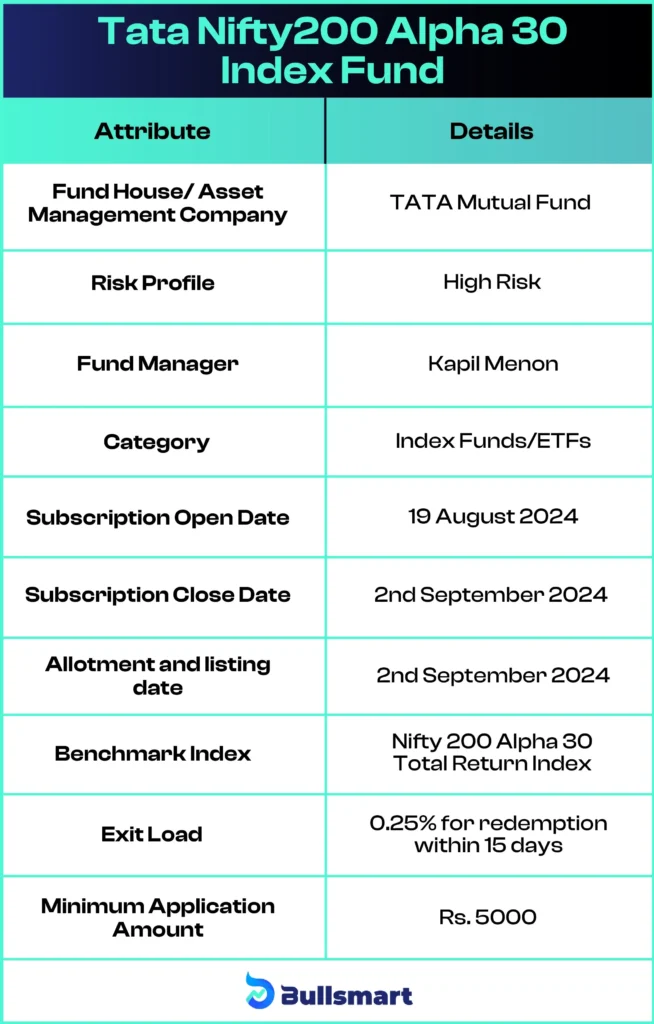

Details of Tata Nifty 200 Alpha 30 Index Fund

Tata Nifty 200 Alpha 30 Index Fund is an Open-ended Index fund that aims to track the performance of the top 30 high alpha companies within the Nifty200 Index.

The fund targets high-alpha stocks, that have the potential to outshine the market by generating returns above the broad market and risk-free rates to its investors. Hence, Investors can potentially benefit from the outperformance of high-alpha stocks within the Nifty 200 index.

This fund will outperform during market upturns due to its focus on excess returns per unit of risk. However, it may have chances to underperform during downturns.

Let’s have a quick sneak peek into the basic details of the fund:

The fund will re-open for subscriptions on or before September 11, 2024.

Investing Strategy of TATA Nifty Alpha Fund

As an index fund, this fund aims to mirror its benchmark, the “Nifty 200 Alpha 30 Index.” The index consists of 30 top stocks selected from its parent Nifty 200. These stocks are selected based on Jensen’s Alpha.

The index assigns weight to each stock according to its alpha score. This ensures that only the best-performing stocks are included, creating a focused and powerful portfolio.

What is Jensen’s Alpha?

Jensen’s alpha is the measure of excess returns earned on an investment, or a portfolio compared to the gains estimated by the capital asset pricing model. It allows investors to determine whether the average return on an asset is acceptable compared to the risks.

The Jensen Alpha formula for calculating Alpha is:

α = Rp – {Rf + β (Rm – Rf)}

Where,

- R = The returns generated by the portfolio

- Rf = The risk-free rate

- Β = The portfolio’s beta

- Rm = The expected market return

Navigating the Risk and Returns

The benchmark has generated returns of 78.52%, 34.19%, and 20.39% over 1 year, 5 years, and since inception respectively. As an index fund, Tata nifty 200 alpha 30 index fund is expected to produce similar returns. However, returns may vary depending on market conditions.

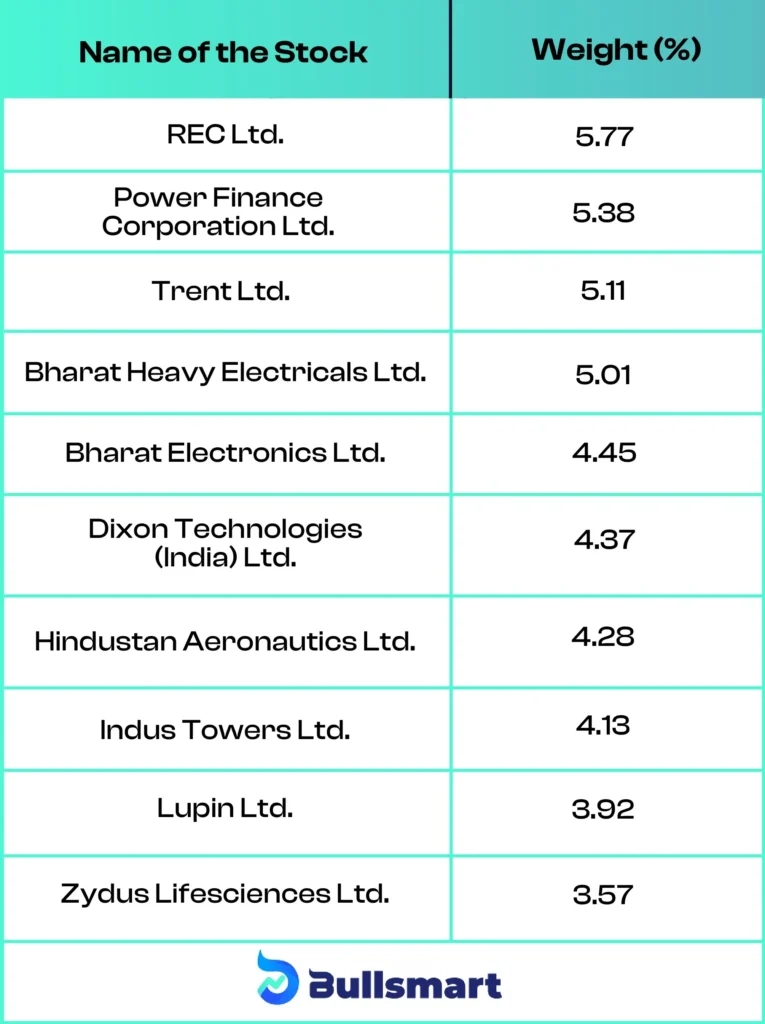

The top holdings of the Benchmark is as follows:

Note: The returns and holdings mentioned above are as of July 31, 2024.

Tata AMC

Tata Asset Management is a part of the Tata Group which has been helping investors since 1994. The company focuses on trust, performance, and service, offering a range of investment options tailored to different financial goals.

It provides solutions to investors with various risk appetites. Tata AMC emphasizes expertise and disciplined risk management to provide its investors with consistent, long-term growth. Tata Asset Management is dedicated to enhancing lives by delivering financial security and wealth creation opportunities.

Following the success of their previous NFO, Tata AMC has launched a new index fund to tap into broader markets. In July, they introduced an NFO, “Tata Tourism Fund,” which focuses on the growth potential of India’s growing tourism industry.

Meet the Fund manager – Kapil Menon

Kapil Menon has a B. Com degree and currently manages an AUM of ₹5,817 crores across 29 schemes. He has been associated with Tata Mutual Fund since 2006.

From June 2021 to the present: He has been with Tata Asset Management Pvt. Ltd. as a Dealer, currently reporting to the Chief Investment Officer – Equities.

From September 2006 to May 2021: He was with Tata Asset Management Pvt. Ltd. as Senior Manager – Investments, reporting to the Chief Investment Officer – Equities.

Who should Invest in the fund?

This NFO of the Tata Nifty 200 Alpha 30 Index Fund is suitable for investors who are seeking long-term capital appreciation and want to invest in equity and equity-related instruments comprising of top performing stocks.

It is always advisable to conduct thorough research on the fund or consult a financial advisor before investing.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.