The global defense landscape is undergoing significant changes due to increased geopolitical tensions. This has created a need to develop defense sector in many countries, including India. Consequently, India has emerged as a key player, not only in enhancing its defense budget but also focusing on self-reliance through a series of strategic initiatives.

To capture the growing momentum of the defense sector, ABSL AMC Ltd. has released a new fund, the Aditya Birla Sun Life India Nifty Defense Index Fund, as an NFO from August 9th to August 23rd.

Let’s review India’s defense budget and initiatives before diving into the fund.

Union Budget

For FY 2024-25, the Indian government has allocated a substantial ₹6,21,940.85 crore to the Ministry of Defense (MoD), which constitutes 12.9% of the total Union Budget for the year. This allocation reflects India’s significant investment in its defense sector, which is crucial to give the global defense spending landscape.

Government Initiatives

Atmanirbhar Bharat focuses on self-reliance in defense through domestic procurement and tech development via public-private partnerships.

Make in India has indigenized 2,920 out of 4,666 defense items. The government is also boosting foreign investments and restructuring the Ordinance Factory Board into seven entities for better efficiency.

Indian defense exports are projected to grow at a CAGR of 19% per annum, reaching ₹500 billion by FY 2029. Consequently, Indian defense sector companies are expected to benefit from rising global and domestic demand.

Given these promising advancements, Let’s delve into the fund to find out if this Aditya Birla Sun Life India Defense Index Fund could be the perfect option for you to enter India’s prestigious defense sector.

Details of ABSL Nifty India Defence Index Fund

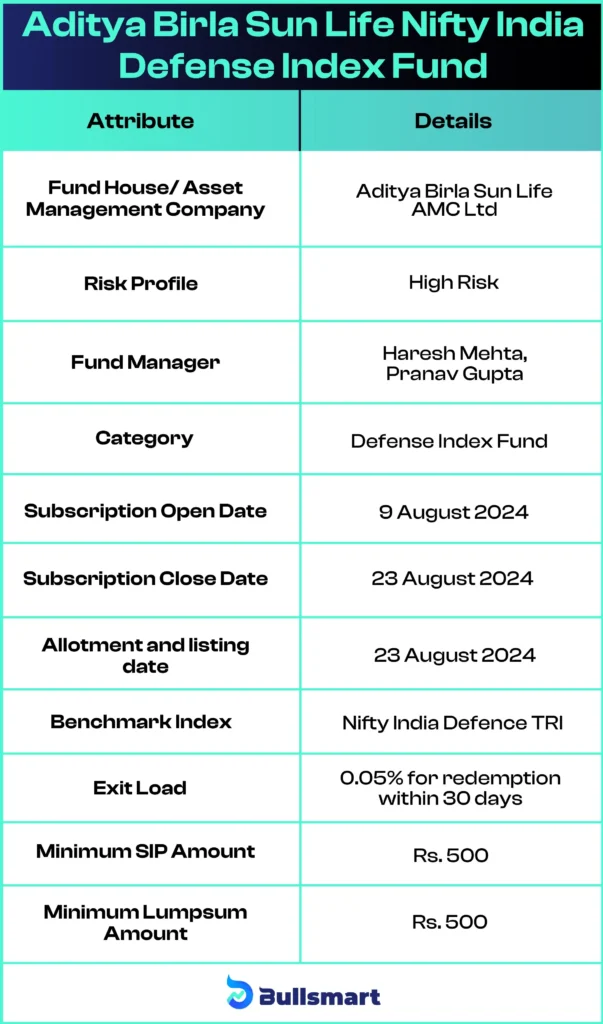

The Aditya Birla Sun Life Nifty India Defence Index Fund is an open-ended, passive index fund strategically designed to track the performance of the “Nifty India Defense TRI”.

As India strengthens its defense capabilities, this fund offers investors a compelling opportunity to fortify their portfolios by tapping into the dynamic growth of the country’s defense sector.

The fund’s strategy supports the goal of enhancing national security and economic strength, making it a solid option for those interested in investing in India’s growing defence industry.

Key Feature of the fund

A passive investing strategy that tracks defense stocks through a market cap-based Defense index, aiming to generate long-term capital gains from the high-potential defense sector.

Portfolio construction

Investors in the Aditya Birla Sun Life Nifty India Defense Index Fund gain exposure to a variety of companies in the defense sector, similar to its index fund. These companies are involved in areas like aerospace, shipbuilding, manufacturing, and defense electronics.

Let’s have a look at the top holdings of NIFTY Defense TRI are as follows:

ABSL AMC

Aditya Birla Sun Life AMC Limited (ABSLAMC) is incorporated in the year 1994 with Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc. as major shareholders.

ABSL AMC manages Aditya Birla Sun Life Mutual Fund and offers Portfolio Management Services, Real Estate Investments, and Alternative Investment Funds. It serves approximately 9.4 million investor folios across over 300 locations, with an AUM of Rs.3,60,520.88 crore as of June 30, 2024.

Meet the fund management teams

The fund will be managed by two seasoned professionals, Mr. Gupta and Mr. Mehta, each bringing extensive experience to the table.

Mr. Gupta holds a B. Com and a Master of Management Studies in Finance. Before joining Aditya Birla Sun Life Mutual Fund, he gained valuable experience working with Centrum India and Ohm Stockbroker Pvt. Ltd.

Mr. Mehta has an MBA and CFA. Prior to his role at Aditya Birla Sun Life AMC Ltd, he was associated with Baroda BNP Paribas Asset Management India Pvt. Ltd and First Global Stockbroking Pvt. Ltd.

Returns as on 12.08.2024.

As the fund aims to mimic its index, it is expected to deliver results similar to its benchmark. However, past performance is not a guarantee of future returns.

Suggested read: HDFC defence fund review

Who should Invest in this NFO?

Investing in Aditya Birla Sun Life Nifty India Defense Index Fund is more than just a financial move; it’s an opportunity to be part of India’s growing defense sector.

It is most suitable for investors with a keen interest in the defense sector who believe in its growth. This fund is ideal for those seeking sector-specific exposure for long-term capital appreciation and who have a higher risk tolerance. Investors should assess their risk appetite before investing.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.