Investing in companies with economic moats is like betting on castles with unbreachable defenses. An Economic Moat is a strategy that provides companies with competitive advantages that make it difficult for competitors to challenge their market position, making them the ultimate picks for investors.

One such fund that adopts economic moat-based investing is the “Bajaj FinServ Large and Mid Cap Fund.” Let’s delve into the blog to understand more about this fund and its unique investment strategies.

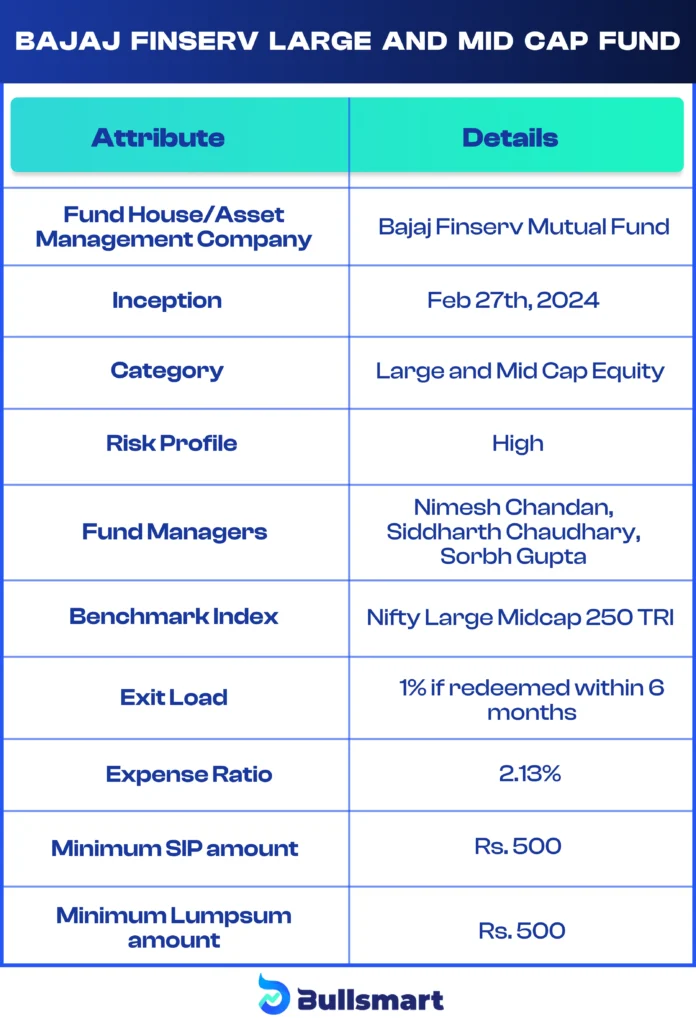

Details of Bajaj FinServ Large and Mid-Cap Funds

Bajaj FinServ Large and Mid-Cap Fund is an open-ended equity fund that holds an AUM of Rs.1,144 crore as on 30 June 2024. The fund considers “Nifty Large Midcap 250 TRI” as its benchmark index.

Launched on 27 February 2024 by Bajaj FinServ Mutual Fund house, one of the successful AMCs in India. Currently this fund holds an AUM of Rs.1,144 Cr.

The fund has an expense ratio of 2.13%, which is slightly higher than the category average of 1.91%, which indicates that the fund is bit more expensive than other funds in the category.

Alright! Let us have a quick glance at the details of the fund:

Bajaj FinServ fund’s investment strategy

There are certain features of the fund that make it unique, such as its stock selection based on Moat Investment strategy, Diversified Portfolio and INQUBE philosophy.

What exactly is Moat Investment Strategy?

Moat Investment Strategy is popularized by “Warren Buffet”. This strategy filters the companies with strong, sustainable and defensive competitive advantage over their market rivals. These companies enjoy a dominant market position and are business leaders in their industry and can maintain & shield their market position through their unique strengths and effective leadership. With this, Moat Investment Strategy, the fund aims to invest in such dominant market leaders with competitive advantage to achieve long term financial success.

Bajaj FinServ adopts Moat Investment Strategy for this fund, to maintain a portfolio that prefers companies with dominant market standing.

The fund follows the INQUBE investment philosophy, which enhances the portfolio with informational, quantitative, and behavioral insights. This approach focuses on key factors like business fundamentals, management quality, and valuation.

Portfolio construction

The fund allocates 93.81% of its corpus to domestic equities of which 38.77% to large cap stocks, 26.98% to midcap stocks.

Meet the Fund Management Team

Bajaj FinServ Large and Mid Cap Fund is managed by a team of seasoned professionals who expertly curate the portfolio according to market fluctuations.

Through moat investing strategy, they invest in companies with a competitive advantage over their competitors, thus capturing growth opportunities in both large cap and mid-cap companies that can defend their leadership positions.

Mr. Nimesh Chandan, Mr. Siddharth Chaudhary, Mr. Sorbh Gupta are the fund managers who bring significant experience to the table.

Nimesh Chandan and Sorbh Gupta manage equity investments and Siddharth Chaudhary manage investment in debt instruments.

Risks and Returns Analysis

Bajaj FinServ Large and Mid Cap Fund aims for long term growth with relative stability by striking a better balance between risk and reward through investments in large and mid-sized companies.

However, as the fund invests a higher percentage in equity markets indicate that it is highly risker and potential to give high returns.

The fund has been performing consistently since its inception, generating returns higher than its category average.

The return of the fund is as follows:

| Attribute | 1M Return | 3M Return |

| Bajaj FinServ Large and Mid Cap | 2.43% | 14.05% |

| Category average | 1.86% | 12.83% |

Who should invest?

The scheme is suitable for investors seeking long term wealth creation. Investors willing to invest for 3-4 years and looking for high returns at the cost of high risk can go for this fund.

It is always necessary to do thorough analysis before investing in any fund.