Global manufacturing sector is changing rapidly, and due to India’s strategic location, conducive economic environment, and government targets for local production makes it an emerging manufacturing hub.

Geopolitics shifts have led firms to diversify their supply chain. India’s advantage here lies primarily in its low manufacturing wage costs and remarkable increase in labor productivity relative to other Southeast Asian countries.

This environment provides an encouraging atmosphere for large scale international investment, supporting the country’s economic trajectory.

To grab the momentum and benefit from this growing sector, Motilal Oswal mutual fund released a new fund, the “Motilal Oswal Manufacturing Fund” that exclusively focuses on manufacturing sector.

Let’s delve into the blog to gain insights on the fund.

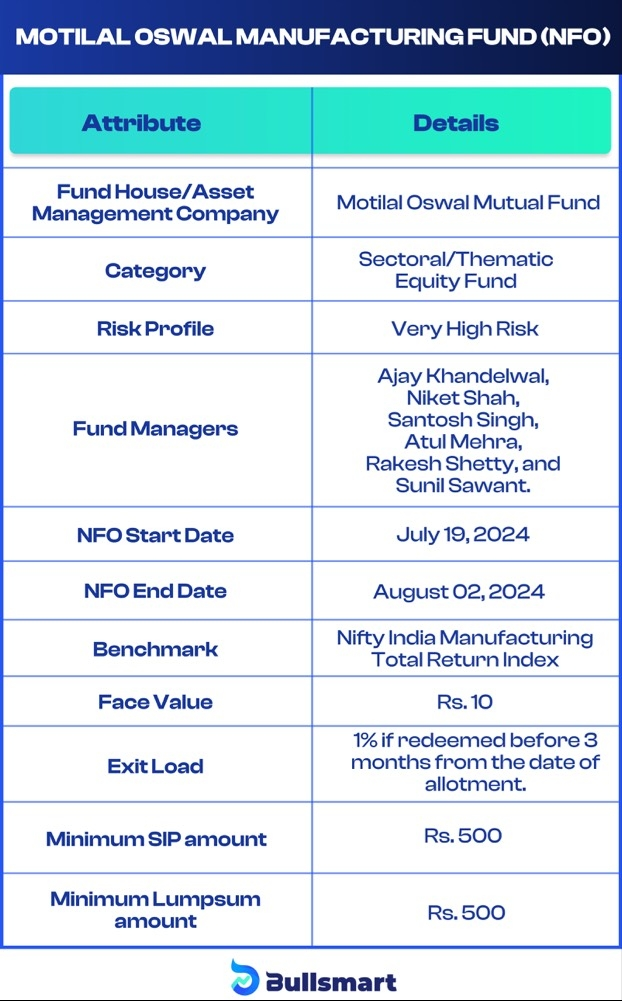

Details of Motilal Oswal Manufacturing Fund

Motilal Oswal Manufacturing Fund is currently being offered as NFO (New Fund Offering) at a face value of Rs.10 per unit. It is open for subscription from July 19, 2024, to August 02, 2024.

The fund is launched by one of the India’s largest AMC, Motilal Oswal Mutual Fund house that manages an AUM (Asset Under Management) of Rs. 66,452.27 Cr.

Investment Objective of fund

“To achieve long term capital appreciation by predominantly investing in equity and equity related instruments of companies engaged in manufacturing activity.”

Let’s have a quick glance at the details of the Fund

Investment strategy and portfolio construction

Motilal Oswal Manufacturing fund will allocate 80 to 100% of its assets to equities within the manufacturing sector, while 0 to 20% allocation to equities other than manufacturing sector or debt instruments.

The fund evaluates diverse sub sectors within the manufacturing industry to uncover growth trends and opportunities.

Hence, the fund offers diversification of portfolio by exposing the fund to various stocks within the manufacturing sector, such as Electronics Manufacturing Services, chemicals, and defense.

It aims to maintain a focused portfolio of up to 35 stocks, that are picked based on high-growth potential and could benefit from the current capital expenditure cycle.

Meet the Fund Management Team

The fund is managed by a team of 6 expert professionals: Ajay Khandelwal, Niket Shah, Santosh Singh, Atul Mehra, Rakesh Shetty, and Sunil Sawant. Each of them brings significant experience and perspective to the table.

The fund managers aim to strategically invest funds in a variety of manufacturing stocks to generate substantial profits for investors.

Navigating the risks and returns of fund

Motilal Oswal Manufacturing Fund offers benefits such as focused exposure, diversification within a segment, and professional management.

However, it also comes with potential risks, such as sector concentration risk, regulatory risk including changes in government policies etc.

As the fund aims to invest a minimum of 80% of its assets in equity markets signifies that the Motilal Oswal Manufacturing Fund is a highly risky fund with the potential for higher returns due to emerging manufacturing landscape, especially with India’s emergence as a manufacturing hub.

Who should invest in Motilal Oswal NFO fund?

Investors willing to take higher risk and aiming for long-term capital appreciation can invest in this fund. It is best suited for investors who are optimistic about the growth of the manufacturing sector because the fund’s major focus is on manufacturing stocks.