Tata Tourism Fund, a trending NFO by Tata Mutual Fund, aims to encourage investments in the travel and tourism industry.

COVID–19, which confined us to our homes, has ignited a deep-seated wanderlust in many Indians post-pandemic. As the world opens up again, the tourism industry is witnessing higher growth than ever before. Raised disposable incomes, government spending on tourism, improvement of infrastructure quality, young population, increased internet penetration, and capital investments are the major factors boosting the growth of the tourism sector in India.

To leverage this trend, Tata AMC has put forward a new fund, the “Tata Nifty India Tourism Index fund.” Which solely concentrates on the travel and tourism industry.

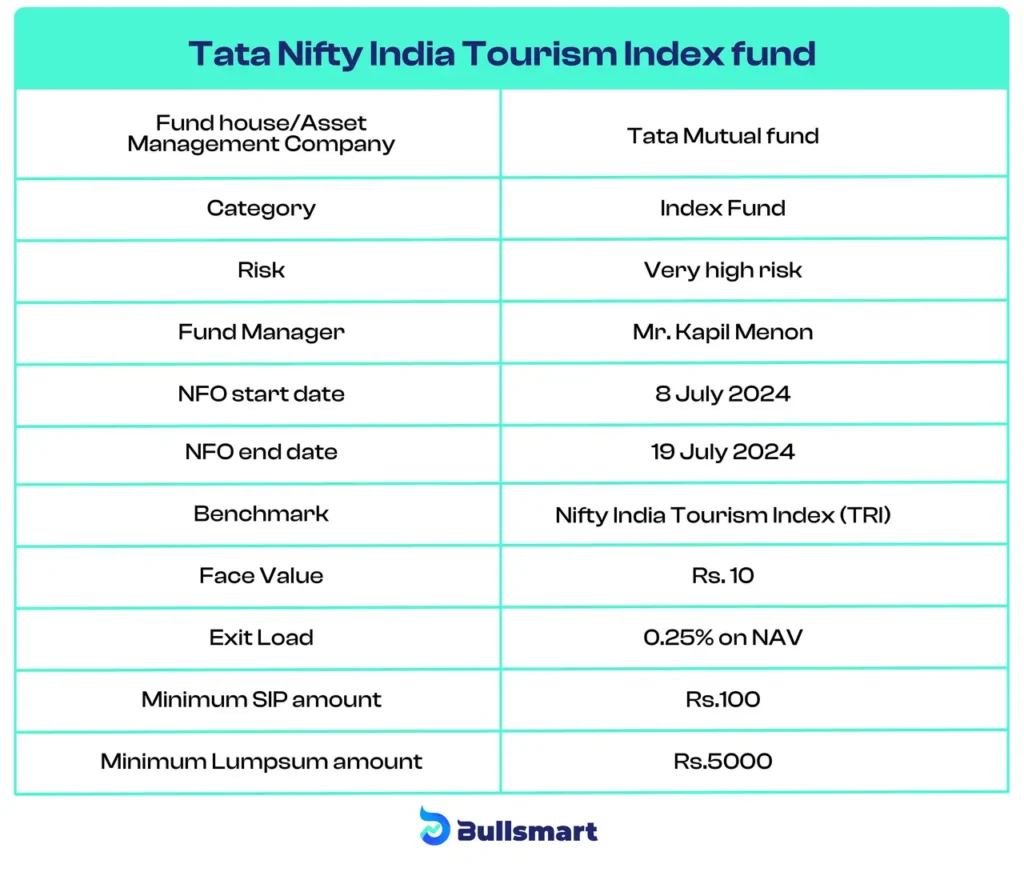

Details of Tata Tourism Fund

Tata Tourism Fund is India’s first “Tourism Fund”. Its NFO is offered at a face value of Rs. 10 per unit and is open for subscriptions from 8th July 2024 to 19th July 2024.

The Tata Tourism fund is an Index fund that aims to mirror its benchmark index, the “Nifty India Tourism Index (TRI)”. This means the fund invests in the companies that are listed on the Nifty tourism index in the same proportions as the index fund’s constituents. Within the Nifty 500, the Nifty India Tourism Index includes 30 companies related to travel and tourism.

Portfolio Construction

Tata Tourism fund invests in equity and equity-related funds within industries related to tourism and travel such as hospitality, hotels, resorts, tour & travel related services, restaurants, airlines, airport services, and other manufacturers of travel essentials like luggage, travel bags, etc.

Meet the Fund Manager: Mr Kapil Menon

The fund manager of Tata Tourism Fund is Mr. Kapil Menon, who has been associated with Tata mutual fund AMC since 2006.

The minimum investment amount for the fund is Rs. 5000 for lumpsum investments and Rs. 100 for SIP (Systematic Investment Plan). An exit load of 0.25% is applicable on NAV, if funds are redeemed on or before 15 days from the allotment date.

Returns and Risks

Tata Tourism Fund exhibits higher growth potential due to ongoing demand and trends in the tourism sector. However, it comes with a catch of higher risks due to its concentrated portfolio. This is a very highly risky fund with the potential of long-term capital appreciation.

Who Should Invest in this NFO?

As Tata Tourism Fund is a sector-specific fund, it is best suited for investors with a keen interest in the travel and tourism industry who believe in its growth. Investors seeking sector-specific exposure to diversify their portfolio and with higher risk tolerance. Hence, investors must analyze their risk appetite before investing. It is always advisable to consult with your financial advisor to check the suitability of the fund before investing.