SEBI in India is like your guardian angel. Wondering how?

Well, investing in the world of finance can be both thrilling and overwhelming, especially with all the information floating around. Have you ever wondered who makes sure your investment journey is safe and fair? That’s where SEBI–the Securities and Exchange Board of India–comes in. SEBI is like the guardian of the securities market, protecting investors from fraud and ensuring everything runs smoothly and transparently.

In this article, we’ll break down what SEBI is, how it works, and why it’s so important for investors like you. Let’s dive right in and see how SEBI keeps your investments secure and trustworthy.

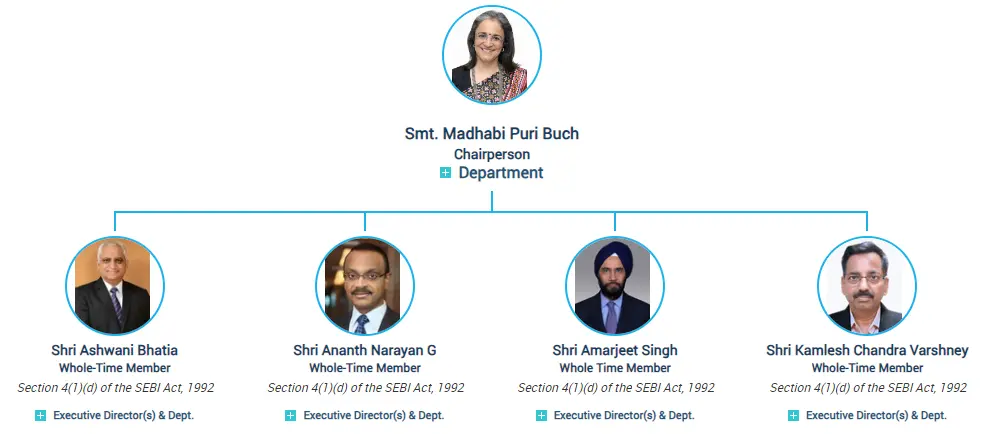

SEBI’s Organizational Structure and Hierarchy

SEBI has a well-defined structure to function smoothly.

Source of Image: https://www.sebi.gov.in/orgchart.html

Chairman

- The chairman is appointed by the Government of India.

Whole-time Members

- 4 whole-time Time Members are appointed by the Government of India.

- They look after different departments of SEBI.

Executive Directors

- Several Executive Directors report to Whole Time Members.

- They head different departments and divisions of SEBI.

Departments and Divisions

- SEBI is divided into different departments and divisions, which look after areas like:

- Corporate Finance

- Enforcement

- Investment Management

- Market Regulation

- These departments are headed by Executive Directors and staffed by other officers and employees.

Regional and Local Offices

- SEBI has regional offices in major cities like New Delhi, Kolkata, Chennai, and Ahmedabad.

- It has local offices all over India to promote investor education and to handle regional issues.

- These offices report to SEBI headquarters in Mumbai.

The hierarchy at SEBI starts with the Chairman and Whole Time Members at the top, then Executive Directors who head different departments, and regional and local offices report to the headquarters in Mumbai.

UNVEILING THE LEGACY OF SEBI in India

SEBI-SECURITIES EXCHANGE BOARD OF INDIA

The history of SEBI started in 1988, but what was the scenario before the establishment of SEBI? To know that we can divide the history of SEBI into two different phases:

PRE-SEBI

Before SEBI’s incorporation, the Controller of Capital Issues (CCI) used to supervise the securities market in India under the Capital Issues Control Act. Controlling capital issuances was the primary focus of the CCI, and it had limited powers to regulate the securities market.

SEBI ERA

Due to the limitations of CCI, the government of India took the next step by establishing the Securities Exchange Board of India in 1988. SEBI became more powerful with the introduction of the SEBI Act in 1992.

SEBI Headquarters: Bandra Kurla Complex, Mumbai.

Regional offices: New Delhi, Kolkata, Chennai, and Ahmedabad.

Objectives of SEBI

- To regulate the responsibilities of the Indian capital market.

- To preserve investors’ interests by governing the securities market.

- To provide a safe and secure environment for the investors by enforcing rules, regulations, and guidelines.

- To avoid unethical practices or malpractices in the Indian stock market.

- To guarantee that the securities market is fair and transparent to everyone.

- To foster awareness among investors and educate them.

- To aid in advancements of the Securities market, to uphold the economic improvement.

Role of SEBI in Investor Protection

SEBI’s Role in Regulating and Developing India’s Securities Market SEBI, therefore, has a significant role in giving a new face and protecting India’s securities market through its following significant functions:

Regulatory Role

- Formulates rules for stock exchanges and financial markets.

- Registers and regulates stockbrokers, merchant bankers, or any intermediary connected with the securities market.

- Enforces compliance with listing and other regulatory provisions by listed companies.

Supervisory Role

- Keeps watch over the activities of market participants to ensure that they remain within the ambit of regulations.

- Inspections of markets and investigations are conducted to detect malpractices and violations.

Developmental Role

- Promotes market growth by introducing new products and instruments.

- Facilitates foreign investment and promotes investor education.

- Enhances market infrastructure and technology.

Investor Protection

- Ensures companies provide accurate and timely information to investors.

- Prevents insider trading and fraudulent practices.

- It provides investors with mechanisms for grievance redress.

Enforcement Role

- It imposes fines and sues regulatory violators.

- It has the power to suspend or cancel the registration of intermediaries for breaching rules.

- It investigates cases of insider trading and other financial frauds and prosecutes them.

All these functions are intended to promote an efficient, transparent, and secure securities market in India.

Check out this video by NSE for a quick insight:

SEBI Protection Measures for Various Investment Vehicles

For Stock Market

- Prohibition of Insider Trading Regulations Act, 2015: This act restrains insider trading, which is to prevent undisclosed price-sensitive information.

- LODR: Listing Obligations and Disclosure Requirements Regulations, 2015: These specific regulations ensure that all the listed companies adhere to norms of disclosure and to the standards of corporate governance.

- Under Section 11(2) of the SEBI Act, 1992, several measures have been implemented to protect investors from unfair trade practices and frauds in the stock market, including fostering and governing self-regulatory organizations, encouraging investor’s education and training with stockbrokers, regulating the funds of venture capital, and many more schemes for the sake of investors safety.

For Bonds

- Issue and listing of the Debt Securities Regulations Act, 2008, by SEBI. These regulations affirm investor’s protection and transparency by offering configurations for debt securities to be issued and listed.

- Credit Rating Agencies Regulations, 1999: Risks associated with bonds can be assessed by investors based on the ratings provided by credit rating agencies. SEBI steps in to make sure that these agencies’ ratings are accurate and reliable.

For Commodities

- SEBI Commodity Regulations, 2015: The motto of these regulations is to minimize volatility and avoid market abuse in the commodity derivatives market.

For Mutual funds

- SEBI issued regulations in 1993 for mutual funds, allowing private entities to enter the market and offer mutual funds to investors. A fully revised version of guidelines for mutual funds was issued in 1996, and they have been amended from time to time.

- Scheme Categorization and Rationalization: In 2017, to prevent confusion among investors, SEBI took the initiative to categorize all the available mutual fund schemes in the market.

For Others

- Alternative Investment Funds Regulations by SEBI in 2012 helped set standards and govern all alternate investments, such as venture capital, angel investment, cryptocurrency, etc.

If anyone in the securities market fails to follow the regulations set by SEBI, they will face severe consequences imposed by the organization based on its legal framework and proceedings.

Investors Education and Awareness

In this, SEBI educates investors and the market through:

- Investor Awareness Campaigns: 700+ ads in 48 newspapers and magazines in 111 cities, in 9 languages, and in English and Hindi.

- Educational Material: SEBI has published booklets, presentations, and FAQs on various securities market topics.

- Multi-Media Outreach: Radio and TV warnings in 40-second spots.

- Investor Education Workshops: Conducted by SEBI and through investor groups and other market entities.

- Grievance Redressal Mechanism: A system to handle complaints against intermediaries and listed companies.

- IEPF Initiatives: Professional institutes and CSC e-Governance Services will partner with IAP to educate financial literacy in rural areas.

SEBI is harmonizing regulations to increase transparency and investor confidence. This is for investments in India’s growing financial space.

Legal Framework

SEBI has developed a strong statutory and legal framework through years of amendments and acts. Following is the brief overview that clearly indicates the main laws under which SEBI derives its powers:

SEBI Act, 1992

- Origin: SEBI was established in 1988 as a non-statutory body.

- Statutory Powers: It got legal powers under the SEBI Act, 1992, w.e.f. January 30, 1992.

- Purpose: It empowered SEBI to be in a position to protect investors and regulate the securities market.

Depositories Act, 1996

- Book Entry Form: Permits the establishment of depositories to maintain records of securities electronically.

- Regulation: Provided for the powers to SEBI to regulate depositories, participants, etc.

Securities Contracts (Regulation) Act, 1956 SCRA

- Market Control: Controls virtually all aspects of trading in securities and stock exchanges.

- Enforcement: It is administered and enforced by SEBI.

SEBI (Amendment) Act, 2002

- Enhanced Powers: Enhanced the power of SEBI to impose penalties and pass orders.

- New Regulations: Made provisions relating to insider trading and fraudulent practices.

SEBI (Amendment) Act, 2014

- Search and Seizure: Arm SEBI with search, access to telephone records, and seizure of assets for recovery of penalties.

- Settlement Mechanism: Provides for the concept of settlement.

SEBI Amendment Act, 2021

- Strengthened framework: Enhanced the investigating powers of SEBI, access to information, and execution of enforcement actions.

- Special Court: Made provisions for a Special Court to try offenses under the SEBI Act.

In other words, changes in SEBI legislation have been on par with the transformation in India’s securities market. Such Acts have expanded the powers of SEBI, which has immensely helped in the protection of investors by enabling a properly regulated market.

SEBI’s 2024 Updates: Simplifying Rules and Boosting Transparency

New Market Cap Category for Listed Companies

What’s New? SEBI has introduced a new market cap category for companies with a market capitalization of less than Rs. 10,000 crore (about $1.2 billion).

Why it Matters: These companies will have easier compliance rules, allowing them to focus more on growth and development.

Changes to Disclosure Requirements for Foreign Portfolio Investors

What’s New? Foreign Portfolio Investors (FPIs) must now disclose their holdings in Indian companies more frequently.

Why it Matters: This will help keep SEBI a closer eye on FPIs and ensure they follow the rules, increasing market transparency. FPIs must now report their holdings within 15 days after each quarter.

SEBI (Prohibition of Insider Trading) (Second Amendment) Regulations, 2024

Reduction in Cool-Off Period for Trading Plans

What’s New? The cool-off period for starting a trading plan has been reduced from 6 months to 120 days.

Why it Matters: This gives insiders more flexibility while ensuring trading plans are put into action in a reasonable time. There are exceptions for not following the trading plan in cases like incapacity, bankruptcy, or death of the insider.

Introduction of Price Limits for Trading Plans

What’s New? SEBI has set price limits for trades under a trading plan. Trades can only be executed within 20% of the previous day’s closing price.

Why it Matters: This helps protect insiders from unexpected price swings and ensures trades happen within a reasonable price range.

Removal of Minimum Trading Plan Period Requirement

What’s New? The previous rule requiring a minimum 12-month period for trading plans has been removed.

Why it Matters: This gives insiders more freedom to design their trading plans.

SEBI (Listing Obligations and Disclosure Requirements) (Amendment) Regulations, 2024

Enhanced Disclosure Requirements for Listed Companies

What’s New? Listed companies now need to disclose more details, including information about their subsidiaries, related party transactions, and significant events.

Why it Matters: These changes aim to boost compliance and transparency in the market, ensuring that companies provide more regular updates.

These amendments are designed to streamline the regulatory framework, give more flexibility to market participants, and enhance transparency in the Indian securities market.

Conclusion

SEBI is the resilient protector of the financial markets of India. Each investor’s journey is safeguarded and made transparent. From the process of corporate disclosure to the stock exchanges, there is a definite role played by SEBI. With a well-structured leadership under the Chairperson and Whole-Time Members at the helm, regional offices in major cities launch themselves into action. That is the very essence of SEBI, set up to dynamically change with changing phases of markets. Insistent on zero tolerance for insider trading, it is keen on enforcement of regulations that level the playing field and create a fair marketplace.

Beyond the regulatory functions, SEBI fuels market growth with advanced products and infrastructure augmentation. Their extensive investor education programs colormap the face of the country, ensuring that the people are equipped to handle the rigors of investment. Changes of this associative nature, like easier compliance rules and enhanced disclosures, reflect the commitment of SEBI to transparency and stability in the economy, further underpinning India’s securities market as a vibrant hub for growth and prosperity.

Invest with a sense of safety under the guardianship of SEBI.

Start your investment journey today ?

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing.

FAQs

What is SEBI?

SEBI is an acronym of the Securities Exchange Board of India. It is an entity or organization exclusively for safeguarding investors in the world of capital markets.

What is the role of SEBI investor protection?

SEBI’s role is to make sure that your journey into financial markets is safe and secure.

What is the role of SEBI in investor protection and redressal of grievances?

If you have any issues with fraud in the capital markets, you can report them. For example, if you need to complain about a stockbroker, you can contact SCORE. SEBI will then take the necessary steps to resolve your complaint.

What are the campaigns of SEBI for investor protection?

SEBI has launched various awareness and educational programs through print media, All India Radio (AIR), television, public meetings, standardized materials, and many more.