India is at the epicenter of a technological revolution with AI, fintech, digital transformation, and innovation fueling its economic growth. It is not a trend that will fade away; it’s a movement that has great strength in the long run and makes India a leader in the tech space in forthcoming years.

As every industry changes and every sector gets molded into a technology-driven solution, the prospects for growth are limitless. Therefore, for investors looking for a route to this very transformative journey, sectoral mutual funds are one of the most strategic ways to have a ride in this very upward momentum.

These funds are channeled into industries directly riding on the tech boom, offering diversification while zeroing in on the most promising growth opportunities.

From AI-driven startups to fintech disruptors and companies forming India’s digital economy, the potential for exponential growth is undeniable. This is the ideal time to know about the best sectoral mutual funds that will take India’s tech wave into 2025, as the world shifts toward innovation and technological advancement.

Let’s look into the funds that will give your portfolio the competitive edge it deserves!

India’s Tech Industry Stats: A Brief Summary

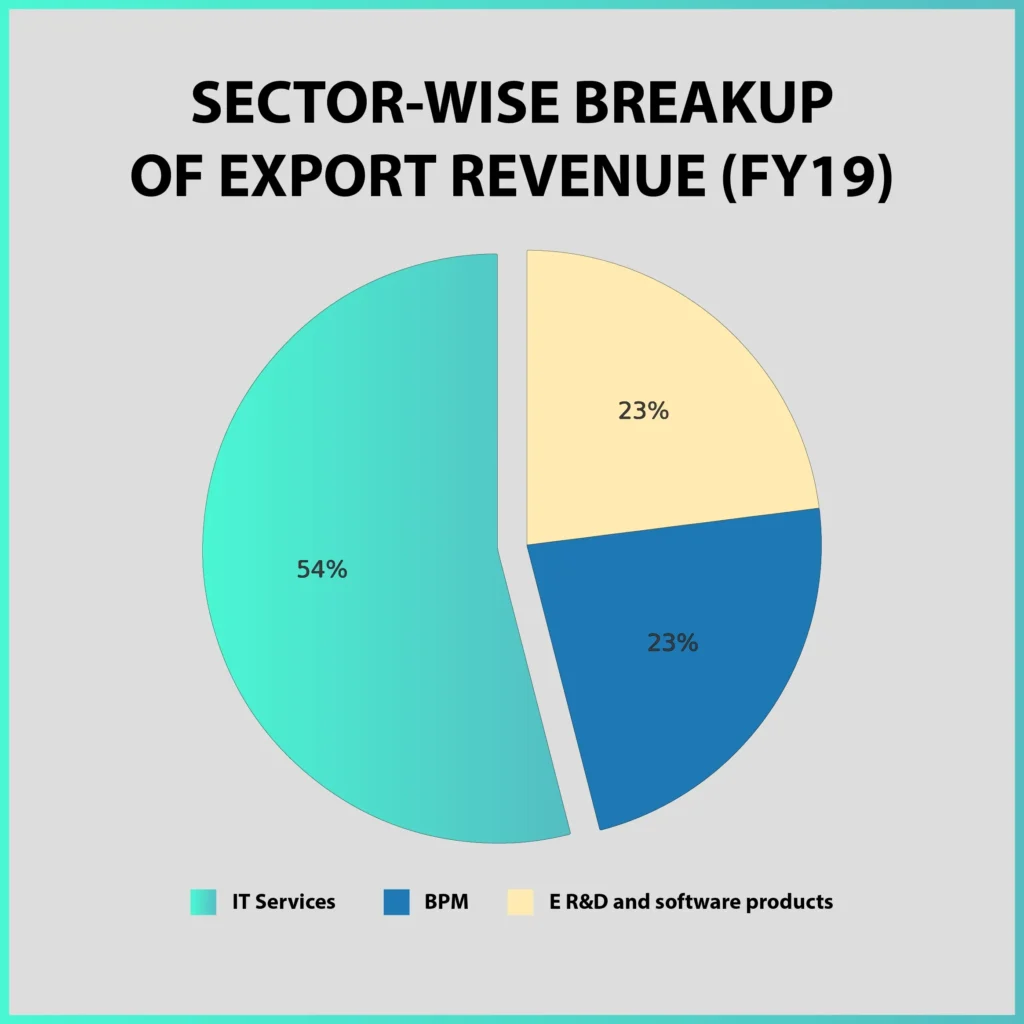

India has matured over the last ten years to become a global technology power. Its stature is marked in the two industries of IT and BPM. The technology sector in fiscal year 2024 firmly gained impetus, churning out revenue worth $254 billion, which marks a 3.8% YoY growth but also exceeds by $9 billion compared with the previous year.

While tech exports are expected to be $200 billion at a 3.3% increase in the previous year, the Indian market has beaten expectations close to $54 billion with a 5.9% growth. These are some of the factors why India shows such significant numbers in GDP growth.

Sector – Wise Breakup of Export Revenue (FY19)

What drives all this excitement? New technologies such as AI and GenAI would be brought up.

AI investments have jumped the highest in 2.7x this year alone while GenAI is expected to grow at a CAGR of 24.4% until 2030, thus possibly adding $438 billion to India’s GDP. Besides that, spatial computing itself received a juggernaut-investment of $2.1 billion that projects a 40% annual growth rate.

In India alone, there are over 1,600 global tech centers which want to scale to a $100 billion valuation by 2030 and are projected to generate close to 4.5 million new jobs. Having a PE ratio of 36.5%, India’s IT sector is indefatigably aspirational on its upward course.

What are Sectoral Mutual Funds?

According to the Association of Mutual Funds in India (AMFI), sectoral mutual funds are equity mutual funds that primarily invest in a specific sector or industry of the economy. Such funds focus on allocating the majority of their assets to companies operating within a particular sector, such as banking, IT, pharmaceuticals, or energy.

Example: If you invest in a Banking & Financial Services Fund, most of your investments will be directed toward banking stocks and financial companies.

Key Features

- Sector-Specific Exposure: A fund that concentrates on firms operated in a certain sector will be very sector-specific in exposure.

- High Risk, High Reward: As a consequence of less diversification, sector funds are more vulnerable than diversified equity funds. Their fortunes are more in line with the market cycles and potential growth prospects of the chosen sector.

- Expert Knowledge Needed: They are ideal for investors with strong knowledge about the sector that has been chosen and its growth opportunities.

Global Tech Boom: Where does India Fit-In?

Countries like U.S., China, EU and India have shown their own growth momentum over the last decade in different ways, particularly in the field of technology. In the research and artificial intelligence, U.S. seems to lead the way, while in hardware and telecommunications, China has a significant edge over other countries. The EU focuses on innovation and digital infrastructure but still falls short of matching the scale of the other tech giants.

India has become a major player in IT services and has focused on bringing ideas to AI and fintech. India’s talent pool is massive, with the burgeoning and strong tech investments of India helping make it the world’s third-largest market for fintech startups. By the year 2030, experts think that the fintech market in India is going to cross $ 1 trillion.

Foreign Direct Investment (FDI) and global partnerships are aiding in speeding up growth for the IT sector of India, like Infosys working with NVIDIA or investment coming from foreign sources in fintech.

While not having the same footing as the U.S. and China in many areas, India has focused itself on technology, converted talent, innovation, and collaboration, and has, therefore, carved its importance into the present global tech boom.

Top Performing Sectoral Funds in 2024

| Fund Name | 1 Year Returns | Expense Ratio | AUM (INR) | Category |

| LIC MF Infrastructure Fund | 59.22% | 2.34% | 852 Cr | Sectoral-Infrastructure |

| HDFC Pharma And Healthcare Fund | 52.44% | 2.17% | 1,383 Cr | Sectoral-Pharma |

| Bandhan Infrastructure Fund | 50.58% | 2.07% | 1,777 Cr | Sectoral-Infrastructure |

| Canara Robeco Infrastructure Fund | 48.66% | 2.30% | 867 Cr | Sectoral-Infrastructure |

| LIC MF Healthcare Fund | 48.55% | 2.44% | 84 Cr | Sectoral-Pharma |

| UTI Healthcare Fund | 46.50% | 2.25% | 1,203 Cr | Sectoral-Pharma |

Data as of 09.12.24

Comparison of Top Funds Performance with Category Average

Mutual funds belonging to different sectors performed far better than the category average of 2.08% in 2024. Infrastructure and healthcare here pointed out the fact that these returned between 46% and 59% on investments. Significant growth potential has been found in infrastructure and pharma/healthcare. All funds proved to be outperformers of their respective categories, which is a testimony to the power of the sector strategies.

High returns accompany higher risks, which entail an informed choice. Although the expense ratios were on the higher end (2.07%-2.44%), these funds were attractive options for aggressive investors because of the strong net returns. Sector funds have huge potential returns, but they are highly cyclical with sectors, requiring exploration for investment.

Taxation in Sectoral Funds

Sectoral mutual funds are equity-focused funds that invest in specific industries or sectors like technology, healthcare, or finance. Their tax treatment follows the same rules as other equity mutual funds in India. Here’s how their taxation works:

Capital Gains Tax

Selling units of a sectoral mutual fund can lead to profit capital gains. The tax is determined by the holding period of the investment:

Short-Term Capital Gains (STCG)

- Holding Period: If sold within 12 months of purchase.

- Tax Rate: 15% (plus applicable surcharge and cess).

Long-Term Capital Gains (LTCG)

Holding Period: If sold after 12 months from the purchase date.

Tax Rate:

- Up to ₹1 lakh in a financial year: No tax.

- Above ₹1 lakh: 10% (plus applicable surcharge and cess).

Note: LTCG shall not be indexed.

Tax on Dividends

Sectoral mutual funds may distribute dividends to their investors. The following is the mode of their taxation:

- Dividend Tax: Included in the individual’s income and taxed according to the personal income tax slab.

- TDS: 10% TDS on dividends is deducted by mutual funds if the payment exceeds ₹5,000 in a financial year.

Investor Mindset Towards Sectoral Funds

Investors consider the sectoral funds distinctly from the diversified ones as it comes with its unique risks and opportunities:

- High Risk, High Return

They deal with investments in a particular sector; hence, they are riskier and offer a higher potential return in the sector’s upturns. A diversified fund shuffles the various industry risks for steady growth over the long term.

- Sector-Dependent

The performance of sectoral funds is dependent on a specific economic/regulatory trend, such as Pharma in healthcare crises or IT in tech-bubbles, while diversified funds would ride the broad market trends and thus would be relatively stable.

- Role in the Portfolio

Sectoral funds are short- to medium-term tactical instruments; diversified funds are the core of long-term-pronged, steady investment strategies.

- Investment Horizon

Sectoral funds are intended for short- to medium-term investors with a market timing approach, while diversified funds are better suited to long-term wealth accumulators.

- Complexity & Knowledge

These involve specialized market knowledge, unlike diversified funds, which are generally simple and applicable to most retail investors.

- Return Potential

These can give phenomenal returns with higher risk but, in contrast, diversified funds aim for long-term, consistent balanced returns.

So, it just goes: Sectoral funds are higher-risk, opportunity-seeking investment types, and meanwhile, diversified funds are very stable and have a long-term growth projection.

Scholar’s Talk & Psychological Imprints

As per a study conducted by Ramanathan, Geetha, and Chalce Dony (2024) in Global Journal of Enterprise Information System, sectoral funds invite investors to target select opportunities but are associated with greater risks and volatility due to concentration.

Their study mentions that middle-income people are drawn to mutual funds as they seem to yield returns that are very stable and flexible; however, they also suffer from problems associated with market volatility and high charges.

Investors seek sectoral funds for short-term, tactical upswing opportunities, which require substantial sector knowledge and timing; diversified funds are preferred for long-term investment with stable returns at a lower risk (Ramanathan et al, 2024).

This shows that while sectoral mutual funds can be considered as niche, opportunity-based tools, diversified funds can potentially promise broad, stable growth over the long term.

Sectoral Funds: Pick or Drop?

Who Would Benefit from Sectoral Funds Investment?

- Risk-takers: These funds are meant for high-risk takers looking forward to big returns and the thrill in fields like tech.

- Sectoral Growth Seekers: These funds supplement the outlook of people who believe in the future of industries such as tech, pharma, or infrastructure.

- Veteran Investors: These funds are for experienced investors who have time and knowledge of the market to ride the highs and lows.

Who Should Avoid Sectoral Funds?

- Conservative Investors: These funds are not for investors looking for stable low risk returns. Do not think in terms of “don’t sell until stocks hit zero.”

- Newbie Investors: Stick with diversified funds-safe and lower-risk-you are inexperienced or untutored in market experience.

- Short-Term Planners: Sectoral funds are not the tool for short-term goals. For money you wish to access nearly immediately or profits in a short space of time, better go elsewhere on the options.

Top Investment Strategies for Beginner Investors in Sectoral Funds

Investing in sectoral mutual funds can be a smart move, but it’s all about having the right strategy–especially if you’re just starting out. Here’s how beginners can approach sectoral fund investments effectively:

Know your sector

- Know growth drivers and threats such as IT by digitizing, Pharma by innovation, and Banking linked with interest rates.

- Study past performance and trends.

Diversify Your Portfolio

- Mix sector funds with diversified ones to reduce risk.

- Invest in various sectors; such as IT + Pharma Spread

Timing with SIPs

- Invest when the market is at its lowest stage, and exit near its peaks.

- Use SIPs for averaging qualitative costs and reducing risks.

Trust Professional Guidance

Go for experienced fund managers and credible research. Align with Your Goals & Risk

Sector funds are generally short to medium term.

Align with Your Goals & Risks

- Different funds imply different risks, as with small-cap for high risk and large-cap for stability.

- Keep track of the news and markets and review your strategy at regular intervals.

Bonus Tip: Patience is a virtue.

- Stamp your strategy be a long-term thinker-results take time.

Conclusion

India’s tech boom isn’t just a trend but a systematic movement put into a big force with AI, fintech, innovation, and digital change. It is estimated that in a few years, India will be on the front lines of the global tech scene. The simplest way to invest in this growth story is via sectoral mutual funds. These funds invest in industries namely AI, fintech, health care, and infrastructure—big promises at big-risk levels.

These funds offer the investor the option to invest in the sectors that would most likely determine the future shape of the economy. Unfortunately, this high-return potential won’t appeal to everyone. It does require research, strategy, and belief that the long game will pay off.

The question, then, is: Are you ready to take the plunge? Sectoral mutual funds can take your portfolio up another notch, but only through wise maneuvers.

Will you stay on the sidelines or venture ahead into the tech wave?

Suggested Read – Top 5 Hybrid Mutual Funds to invest in 2025