Hello, future real estate moguls! Ever thought about jumping into the world of REITs? These investment vehicles let you invest in real estate just like stocks, minus the landlord headaches.

In this blog, we’ll dive into the world of REITs: their origins, how they work, the types available, and the upsides and downsides. Whether you’re new to investing or a seasoned pro, REITs provide a straightforward way to profit from real estate. Get ready to explore how they can simplify your investment journey and open doors for profitable real estate opportunities.

What is Real Estate Investment Trust (REIT)?

REIT stands for Real Estate Investment Trusts. They’re like investment tools for real estate that make money in different ways. Instead of owning property, one can invest in REITs to get a piece of the profits without the hassle.

They’re traded on stock exchanges, so you can spread out your investments and get into real estate without buying a whole property Cool, huh?

Think of it like this: REITs are the ultimate financial magicians, pulling resources from a diverse crowd to capitalize on the diverse revenue streams of real estate. Similar to pooling resources with your crew for something mind-blowing, except instead of the latest tech gadget, it’s real estate deals that are turning heads and making bank.

When was the REIT Launched?

This whole journey kicked off back in 2007 with some draft rules dropped by the Securities Exchange Board of India (SEBI). But those rules? Total flop. It wasn’t until September 2013 that SEBI rolled out some fresh REIT regulations, which finally got the thumbs-up on September 26, 2014.

When the Real Estate Investment Trust Regulations, 2014 hit the scene, they totally flipped the script on India’s real estate investment scene. This set the stage for 3 different companies to officially launch their REIT after 2016. Then, in 2016, the big moment arrived with the debut of India’s first-ever REIT, Embassy Office Parks REIT, making major waves in the country’s REIT market.

What are the Advantages and Disadvantages of REITs?

Pros of Putting Money into REITs

- Budget-Friendly Investment: REIT shares are pocket-friendly, making them doable for many investors.

- Great for Smaller Investors: No hassle of dealing directly with builders, making it simpler for small investors to jump in.

- Less Liquidity Risk: Compared to directly investing in property, REITs offer lower liquidity risk.

- Guaranteed Dividend Payouts: Count on a steady income stream from rental earnings.

- SEBI Keeps Watch: SEBI’s regulations keep shady dealings at bay, adding a layer of security.

Cons of Going the REIT Route

- Growth Capped: Big payouts to investors might limit potential growth.

- Heftier Taxes on Dividends: Brace for higher taxes on dividends compared to other investment avenues.

- Possibly Pricy Fees: Watch out for potentially steep fees and increased risk.

- Riding Market Waves: REITs are susceptible to ups and downs in the real estate market.

- Hands Tied: Investors have a limited say in performance and management decisions.

- Selling Shares Might Be a Hassle: Selling shares could be restricted for a certain period.

Types of REITs

Absolutely, here’s the expanded response with additional types of REITs and examples:

Equity REITs

Investing in REITs means buying stocks of companies that are involved in the real estate business.

In other words, equity REITs are the most prevalent-type in the industry. They acquire, manage, develop, renovate, and sell real estate properties that generate income. Their primary source of revenue comes from renting out these properties. Depending on their strategy, an equity REIT can either invest broadly across different property types or concentrate on specific market segments.

- Example: DLF Limited (DLF) in India is a prime example of an equity REIT. They own and manage various commercial properties, such as office spaces, shopping malls, and retail centers across the country. Tenants pay rent to DLF, generating income for the company and its shareholders.

- Also, if you buy stocks of DLF, that will be considered as an investment made in equity REIT.

Mortgage REITs

These REITs take a different route. Instead of owning buildings, they’re the ones funding the real estate game. They dish out cash to real estate companies or buy mortgage-backed securities, basically playing the role of the money lender in the property world.

- Example: PNB Housing Finance Limited (PNB Housing) serves as a mortgage REIT in India. Instead of owning physical properties, PNB Housing provides financing to real estate developers and homebuyers. They generate income through interest payments on mortgages and loans, as well as investments in mortgage-backed securities.

Hybrid REITs

These REITs are like the jack of all trades. They’re not satisfied with sticking to just one game. They dabble in both the landlord business and the money-lending game. So, you’ll find them investing in both properties and mortgage-backed assets, trying to get the best of both worlds.

- Example: Indiabulls Real Estate Limited (Indiabulls RE) operates as a Hybrid REIT in India. They have a diversified portfolio that includes both income-generating properties like office buildings and residential complexes, as well as investments in mortgage securities. Indiabulls RE leverages this dual approach to maximize returns and mitigate risk across different sectors of the real estate market.

Retail REITs

Retail REITs focus exclusively on retail properties, such as shopping malls, strip malls, and standalone retail stores.

- Example: Phoenix Mills Limited in India is a leading Retail REIT. They own and operate a portfolio of retail properties, including malls and entertainment complexes, across various cities in India.

Industrial REITs

Industrial REITs specialize in industrial properties such as warehouses, distribution centers, and manufacturing facilities.

- Example: Embassy Industrial Parks in India is an industrial REIT. They own and manage a network of industrial and logistics parks catering to the warehousing needs of various industries.

Residential REITs

Residential REITs invest in residential properties, including apartment complexes, single-friendly homes, and student housing.

- Example: HDFC Property Fund in India focuses on Residential REIT investments. They invest in a range of residential properties, providing rental income and capital appreciation opportunities.

Healthcare REITs

Healthcare REITs focus on healthcare-related properties such as hospitals, medical office buildings, and senior living facilities.

- Example: Fortis Healthcare REIT is a prominent Healthcare REIT in India. They own and operate a portfolio of healthcare facilities, including hospitals and diagnostic centers, catering to the healthcare needs of the population.

Hospitality REITs

Hospitality REITs own and operate hotels, resorts, and other lodging properties.

- Examples: Indian Hotels Company Limited (Taj Hotels) in India could potentially operate as a Hospitality REIT. They own and manage a chain of luxury hotels and resorts India and internationally, providing accommodation services to travelers and tourists.

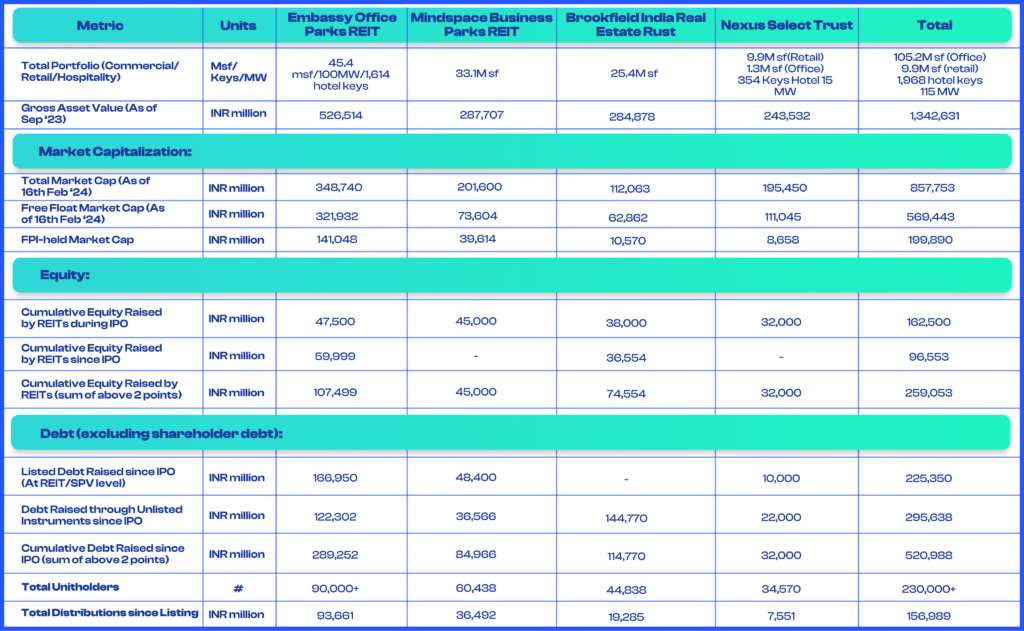

Top 4 REITs in India

As of now, there are only 4 REITs in India:

| Name of the REIT | LTP (as of 02.07.24) |

| Embassy Office Parks REIT | Rs. 355.11 |

| Mindspace Business Parks REIT | Rs 335.8 |

| Brookfield India Real Estate Trust | Rs 266.11 |

| Nexus Select Trust REIT | 144.19 |

More Insights

Data updated as of 02.07.24

Who should invest in REIT?

Buckle up, because REITs offer a ticket to the real estate rollercoaster for a diverse world:

The Newbies

If you’re just dipping your toes into the investment world, REITs are a fantastic starting point. They’re more accessible than buying physical properties, and they offer a slice of the real estate pie without the hassle of being a landlord.

The Diversifiers

Looking to spice up your investment portfolio? REITs bring a whole new flavor. They provide diversification by spreading risk across various real estate sectors, like commercial, residential, and industrial, giving your portfolio an extra layer of stability. The real estate market has less correlation with other capital markets and can create good diversification in the portfolio.

The Hands-Off Investors

Hate dealing with tenants, repairs, and all that jazz? REITs got your back. They handle all the nitty-gritty stuff, leaving you free to sit back, relax, and watch your money grow.

The Income Seekers

Need a reliable source of passive income? REITs are your go-to pals. They dish out juicy dividends from rental income, offering a steady stream of cash flow to fuel your financial goals.

The Risk Takers

Ready to ride the waves of the real estate market? REITs offer a rollercoaster of opportunities. From high-growth potential to market fluctuations, they’re perfect for those who thrive on a bit of risk and reward.

So, whether you’re a rookie investor or a seasoned pro, a cautious planner, or a daring risk-taker, there’s a seat reserved for you on the REIT train. Jump aboard and let the real estate adventure begin!

REITs in Comparison to Mutual Funds

| Aspect | REITs | Mutual Funds |

| Investment Focus | Primarily real estate properties like office buildings, malls, and apartments. | Diverse portfolio, including stocks, bonds, and commodities. |

| Income Source | price appreciation of real estate, lease income, and rental payments from tenants | From dividends, interests, and capital gains. |

| Liquidity | Traded on stock exchanges, providing liquidity. | Governed by specific regulations, including the requirement to distribute income to shareholders. |

| Management | Managed by a team of real estate specialists. | Fund managers make investment decisions based on the fund’s objectives. |

| Diversification | Exposure to the real estate market without owning physical properties | Offers diversification across various asset classes, not just one. |

| Reputation | Governed by specific regulations, including requirement to distribute income to shareholders. | Regulated by authorities like SEBI, ensuring transparency and investor protection. |

Future of REITs in India

Branching Out into New Territories: Experts believe that REITs in India are gearing up for a major expansion beyond the usual real estate game. We’re talking about diving into industrial spaces, data centers, hotels, healthcare facilities, and even opportunities for individuals like us.

Room for Mega Growth: Even though India’s REIT market is just starting out compared to big players like the US and Singapore, it’s still got a long way to go. Right now, our market capitalization is less than 10% of theirs. This means there’s tons of potential for growth, with more REITs likely to pop up in the Indian scene soon.

Expanding the REIT Empire: Big players like Embassy Office Parks REIT are bullish on the office space market. They’re not sitting around twiddling their thumbs; they’re actively scouting for new office spots in cities like Chennai and beefing up their business park portfolio. Talk about going big or going home!

New Kids on the REIT Block: The rise of REIT has paved the way for some exciting new asset classes. Case in point: India’s first retail-focused Nexus Select Trust REIT hit the scene in May 2023. This signals a cool trend towards diversification within the REIT world, opening up fresh avenues for investors like us.

Bottom Line

According to Colliers India, about 380 million square feet of Grade A office space in India is ripe for REIT picking, out of a total of 667 million square feet. Currently, the three listed office REITs hold around 74.4 million square feet of office space, with Bengaluru and Hyderabad taking the lion’s share.

Stories of Triumph

The success stories of Embassy Office Parks REIT and Mindspace Business Parks REIT are the stuff of legends. These bad boys raised serious cash through Initial Public Offerings (IPOs), showing that investors are all in on the Indian REIT scene. Their victories have set the stage for even bigger moves and investments in REIT down the line.

In a nutshell, the future of REITs in India is looking hella bright. With doors opening to new asset classes, massive potential for market growth, existing REIT giants in expansion mode, and some killer examples of IPO triumphs, it’s safe to say that investing in REITs is shaping up to be a major game-changer in India’s real estate scene.

But wait…there’s a twist in the tale—a secret lurking in the shadows, waiting to be uncovered. What could it be?

Stay tuned as we delve deeper into the untold mysteries of the REIT revolution, in the future, where every investment tells a story, and every story holds a clue to the future.

Disclaimer: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities are quoted as an example and not as a recommendation.

FAQs

Is it good to invest in REIT stocks in India?

Investing in REITs in India can diversify your portfolio, offer exposure to commercial real estate, and provide professional asset management. However, consider the limitations like limited equity and few options. It’s best to keep REITs to no more than 10% of your portfolio. Make sure your asset allocation is optimized across different investment classes before adding real estate.

Which REIT is best in India?

The best REITs in India, based on factors like dividend yield, occupancy rate, and loan-to-value ratio, are:

Brookefield REIT: Offers an 8.5% dividend yield, 92% occupancy rate, and a tax-free distribution of 75%.

Mindspace REIT: Provides a 7.4% dividend yield, 87.3% occupancy rate, and an LTV of 16.8% with 92% tax-free distribution.

Embassy REIT: With a 6.9% dividend yield, 88.9% occupancy rate, and 77% tax-free distribution, Embassy REIT is another strong option.

Nexus Select Trust REIT: Offers a dividend yield of 3.57%, occupancy rate of 96.2%, LTV of 14% along with 92% percentage of tax-free distribution.

(Data as of 02.07.24)

How can I buy REITs in India?

To invest in REITs in India, follow these steps:

1. Open a Demat Account.

2. Choose a trading platform like ICICI Direct.

3. Buy REIT units listed on stock exchanges.

4. Monitor investments.

5. Consider REIT-focused mutual funds or ETFs for diversification.

What is the average return on REITs in India?

The average return on REITs in India can vary based on factors like market conditions, economic trends, and the performance of specific REITs. Returns from REITs are typically generated in the form of dividends, interest payouts, and capital appreciation for investors. It’s important to note that past performance is not indicative of future results, and individual REITs may offer different returns based on their specific portfolios and strategies.